European insurers have been asked by EIOPA to report on the impact of Corona virus / COVID-19 in their 2019 SFCR reports.

Text analysis conducted by Solvency II Wire Data on a number of 2019 SFCR reports that have already been published (including 4 groups and several solo entities from 7 countries) reveals the strengths and potential weaknesses of European insurers in the face of the pandemic.

Most companies surveyed said they were resilient to the initial shock of the virus, but commented that it was too early to assess its full impact.

Concerns range from rising market risk premiums, changes to mortality, operational risk, increases to outstanding balance of reinsurance counterparties and even bankruptcy.

Others, such as Direct Line Group, cited exposure to specific lines of business such as travel. The group also reported changes to its share buyback programme due to the potential impact of the pandemic.

“On 3 March 2020, the Board approved a share buyback of up to £150 million. On 19 March 2020, given the uncertainty as a result of Covid-19, the Group announced the suspension of the share buyback programme. The information in this SFCR, including the own funds and solvency capital ratios, has been presented to include the buyback as a foreseeable distribution.”(emphasis added).

The full data set is available to premium subscribers of Solvency II Wire Data.

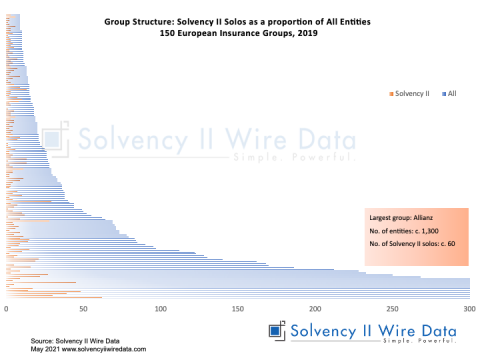

Solvency II Wire Data collects all available public QRT templates for group and solo.

QRT templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.12.01 Life and Health SLT Technical Provisions

S.17.01 Non-life Technical Provisions

S.19.01 Non-life Insurance Claims Information

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern Models

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group