European insurance groups subject to Solvency II have to report on all their solo entities that are subject to Solvency II, as well as provide details of the full group structure.

The data is published in template S.32.01 of the QRTs. All entities are categorised according to criteria specified in the regulation.

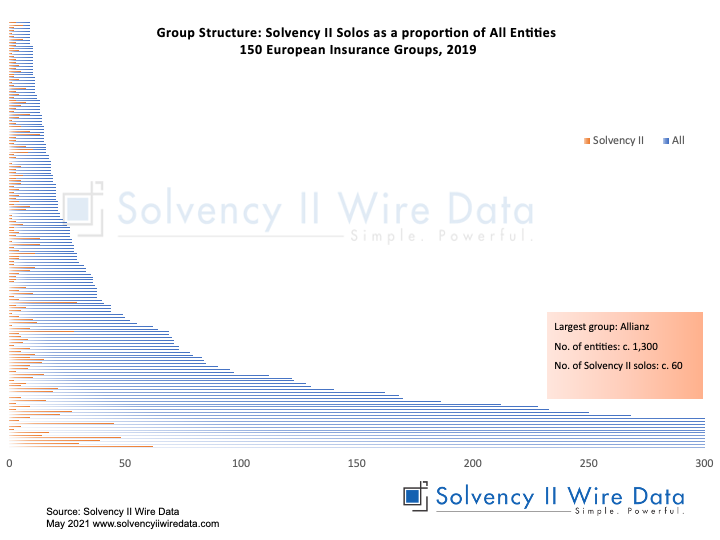

Allianz has reported the highest number of entitie in 2019, close to 1,300. Of these some 60 are subject to Solvency II.

The figures can at time fuctuate substantially. For example AXA, reported 978 entities in 2016, 996 in 2017, 1,134 in 2018 and 791 in 2019. The company did not provide information about the shift in the numbers. Despite these changes the number of Solvency II solo entities for the group remained stable at around 40.

The total number of entities as well as Solvency II solos may vary in a group for a number of reasons relating either to M&A and consolidation activity as well as changes in the way they report. In addition some groups have created consolidated entities for the purpose of Solvency II reporting.

The chart below shows the number of entities for 150 European groups as published in template S.32.01 in 2019.

It is striking that in some cases there can be little corrolation between the size of the group (in terms of number of total entities) and the number of Solvency II solo entities. The factors mentioned above, as well as the group’s insurance portfolio relative to the overall business makeup may be driving these diffrences.

Data extracted by Solvency II Wire Data shows that in 2019 a sample of about 300 European insurance groups reported a total of aproximately 13,600 entities.

Solvency II Wire Data collects all available public QRT templates for group and solo.