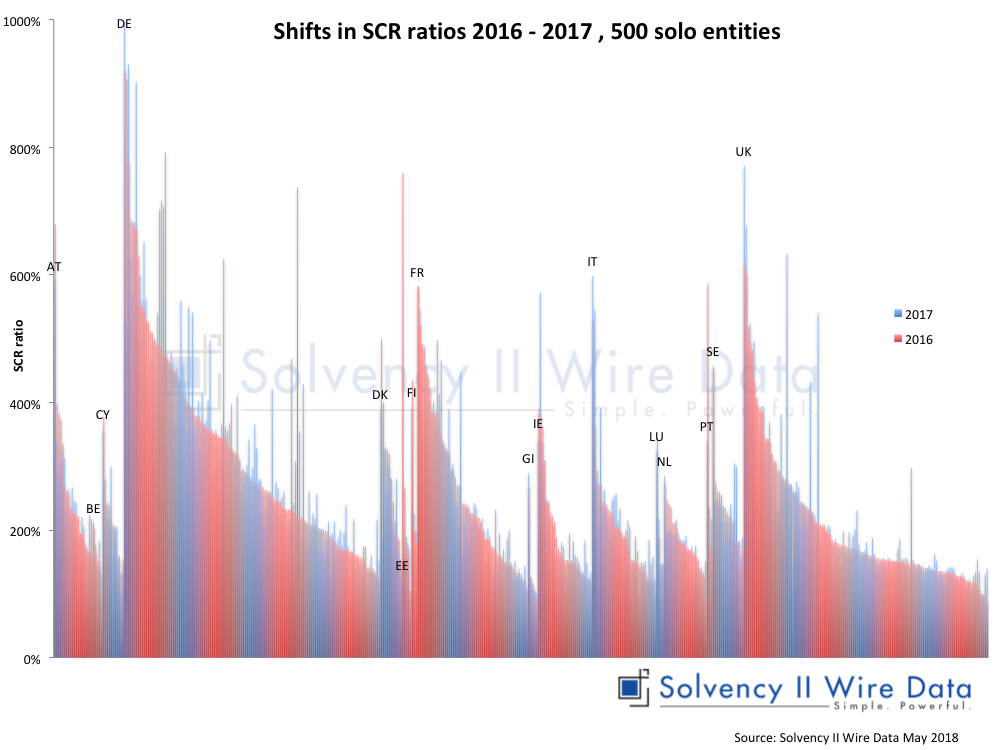

Analysis of SCR ratios of close to 500 solo European insurance entities subject to Solvency II shows a slight drop in SCR coverage ratio in 2017.

The sample covers around EUR 6 trillion in total assets, over half of the market, collected by Solvency II Wire Data. The average ratio for the sample (which excludes outliers above 10,000% and below 0%) was 247% in 2017 compared to 258% in 2016.

Quality of the Solvency II public disclosures

The data collection so far has shown that the overall quality of the disclosures has improved compared to 2016, although data quality issues persist including lack of uniformity in the unit amounts of the disclosures. Some instances of different unit amounts between templates for the same company have also been observed. The number of SFCRs published as scanned pdf images is lower this year. However, in markets such as Spain many firms still chose to publish scanned images.

One welcome improvement in the UK has been the introduction of template S.01.01 containing basic information about the company and the filing with the QRTs.

A substantially larger number of firms also published on time this year, this despite the deadline being shortened by two weeks.

To date Solvency II Wire Data has obtained over 1,000 SFCRs, which are available to search and download in the Solvency II Wire Data SFCR List.

The full set of data is available to premium subscribers of Solvency II Wire Data. Find out more here.

Solvency II Wire Data SFCR List

Related Articles:

Solvency II News: The number of Solvency II firms revisited, again