Category: SFCR Archive (2016 – 2019)

Solvency II, Solvency and Financial Condition Reports 2016 – 2019

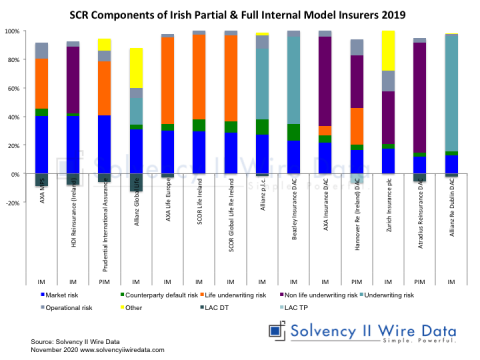

Solvency II SCR Sub Module Analysis

November 25, 2020

Shifts in the Dutch Insurance Market Structure 2016 – 2019

October 29, 2020

State of Solvency II reporting 2019 (part 3)

September 1, 2020

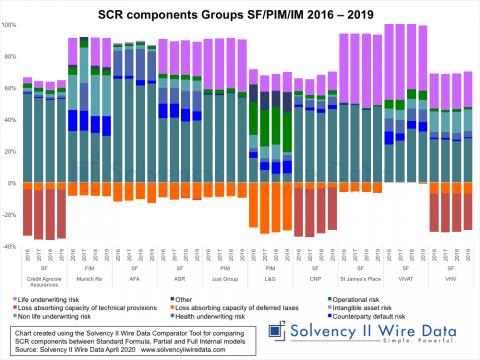

Comparing Solvency II SCR components

July 13, 2020

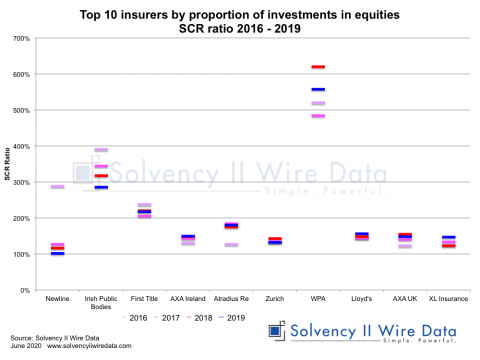

Emerging impacts of COVID-19 on insurers

June 18, 2020

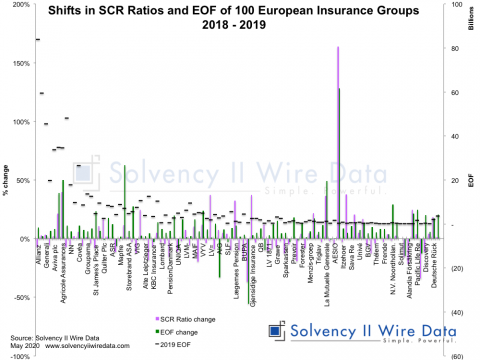

State of Solvency II reporting 2019 (part 2)

May 27, 2020

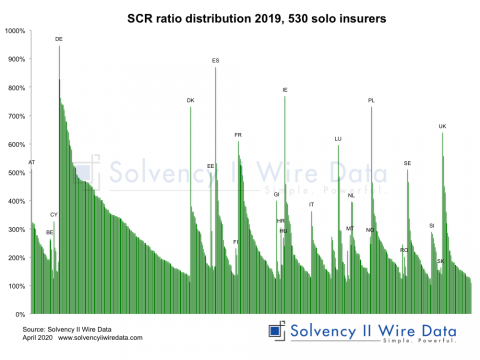

State of Solvency II reporting 2019 (part 1)

April 20, 2020

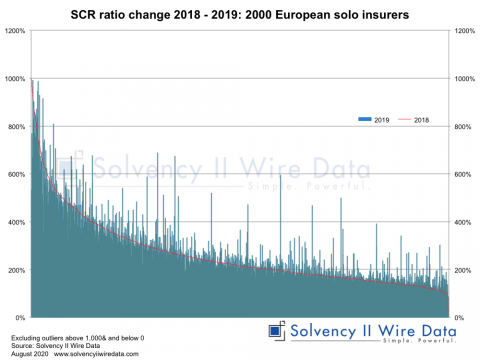

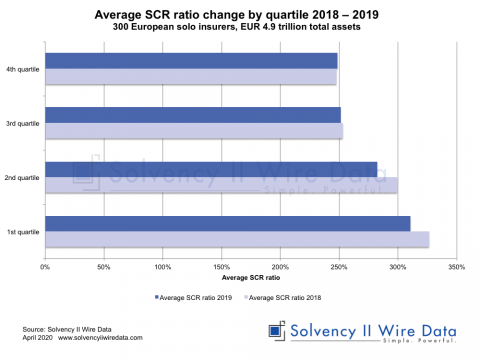

Solvency II News: SCR ratios lower in 2019

April 14, 2020

Insurers slow to publish 2019 Solvency II figures

April 8, 2020

Analysis of EEA Life Insurance Market 2018 SFCR & QRT data

January 22, 2020

Insights from the first 2019 Solvency II SFCRs and QRTs

January 1, 2020

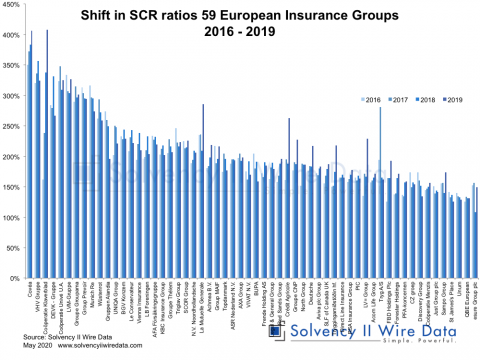

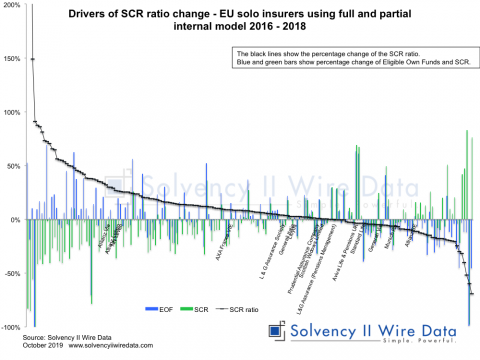

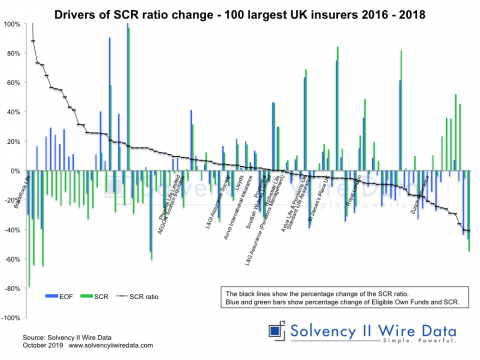

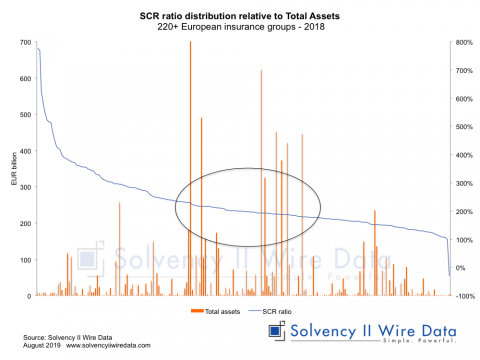

Drivers of Solvency II SCR ratio change across Europe 2016 – 2018

October 23, 2019

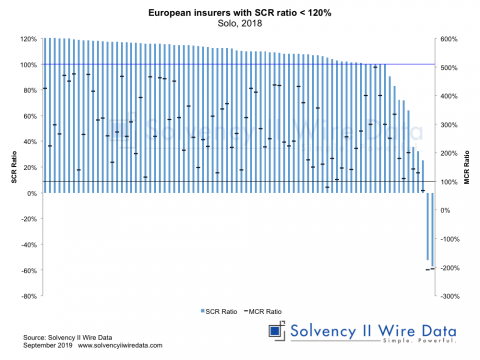

Insight into the lower end of the European insurance market

September 2, 2019