Solvency II and equity price valuation

November 5, 2018

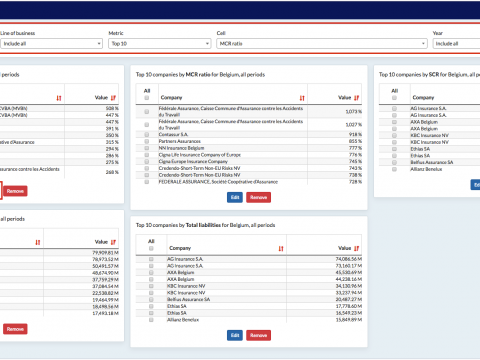

Top 10 Companies List

November 2, 2018

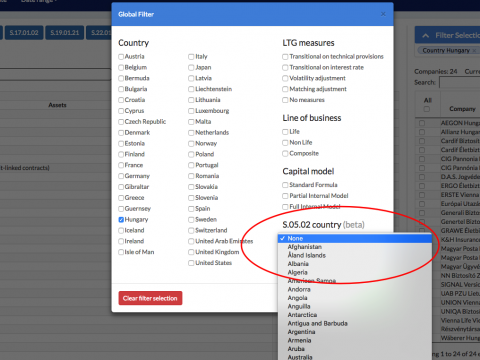

Market exposure based on S.05.02

October 12, 2018

#resist

October 8, 2018

Tracking shifts in counterparty default risk

September 25, 2018

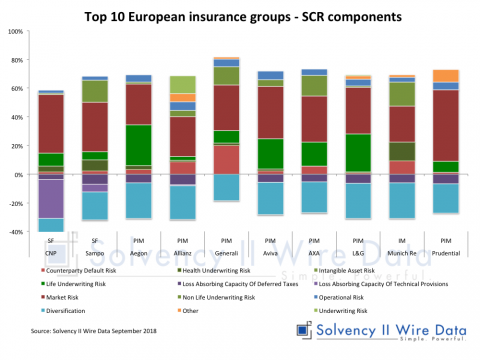

SCR components comparison of European insurance groups

September 11, 2018

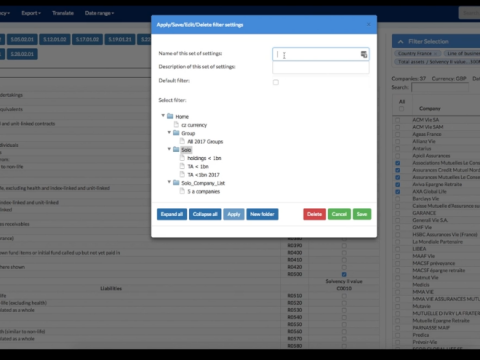

Filter Presets

May 25, 2018