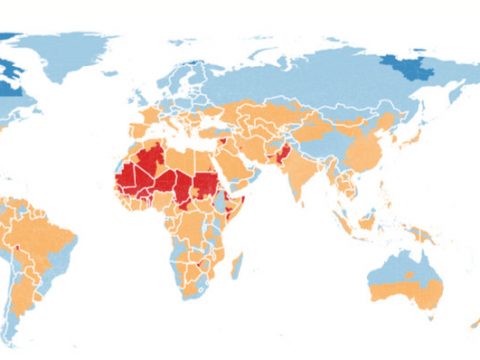

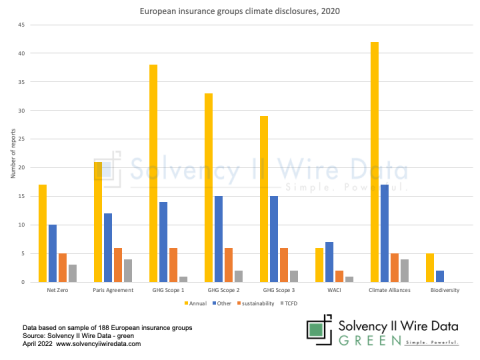

The Actuary and Climate Change

June 28, 2022

2021 SFCR group early analysis

May 24, 2022

Solvency II Wire Data 30 day report – 2021

May 11, 2022

Irish insurance market 2021

May 6, 2022

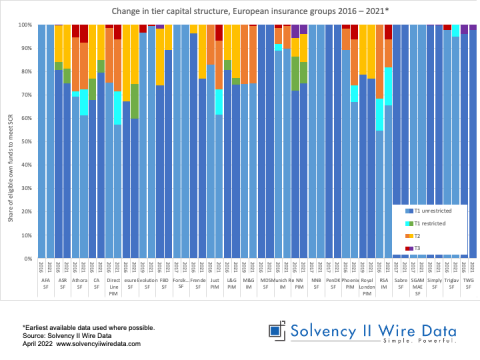

2021 Group SFCRs

May 1, 2022

European insurance market analysis 2021 (early insights)

April 28, 2022

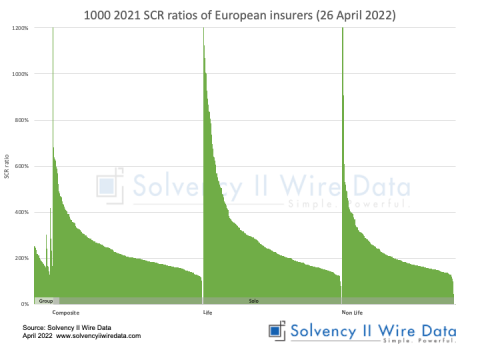

1000 2021 Solvency II ratios

April 26, 2022

Emerging trends in European insurance – 2021 SFCRs

April 19, 2022

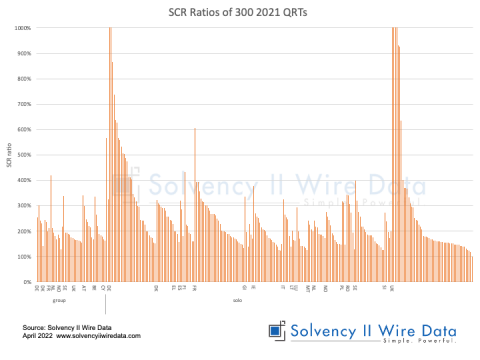

SCR ratio of 300 2021 European insurance SFCRs

April 12, 2022

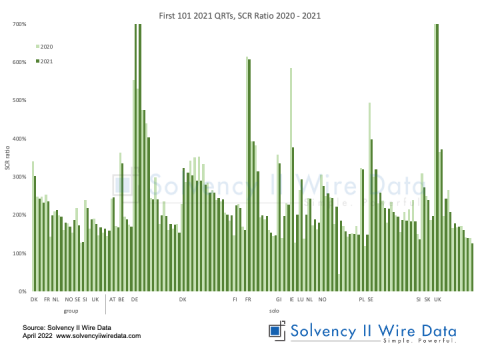

The First 101 2021 QRTs

April 7, 2022

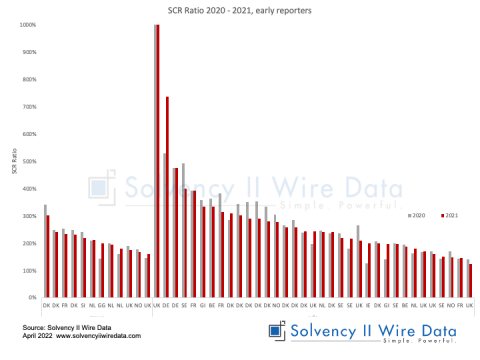

SFCR 2021 early publications

April 4, 2022

Survey of the European insurance audit market

February 22, 2022