Category: SFCR Analysis

Analysis of the Solvency II public disclosures

A cross-border reinsurance spiral

November 6, 2018

Solvency II and equity price valuation

November 5, 2018

Tracking shifts in counterparty default risk

September 25, 2018

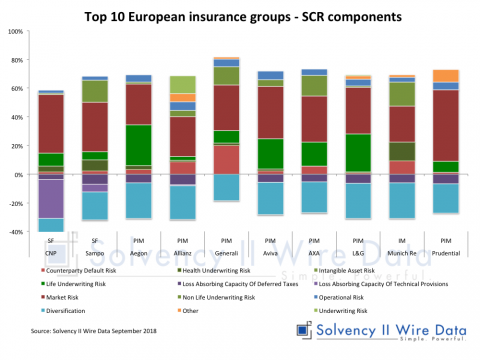

SCR components comparison of European insurance groups

September 11, 2018

Reinsurance and the Solvency II public disclosures

April 24, 2018

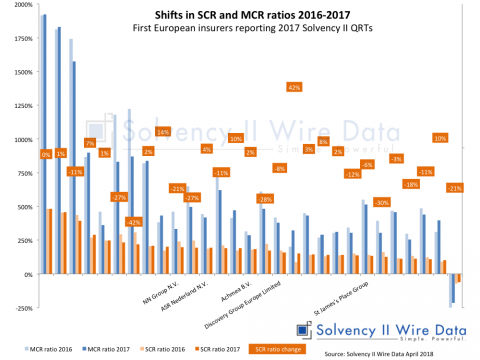

NN Group published SFCR and QRT for 2017

April 10, 2018

SFCR comparison tools – Solvency II Wire Data

April 3, 2018

Top 50 European insurers with highest exposure to structured notes

February 15, 2018

Top 50 European insurers with highest exposure to property

February 13, 2018

Top 50 European insurers with highest exposure to derivative

February 12, 2018

Deconstructing Internal Model SCR components

January 24, 2018