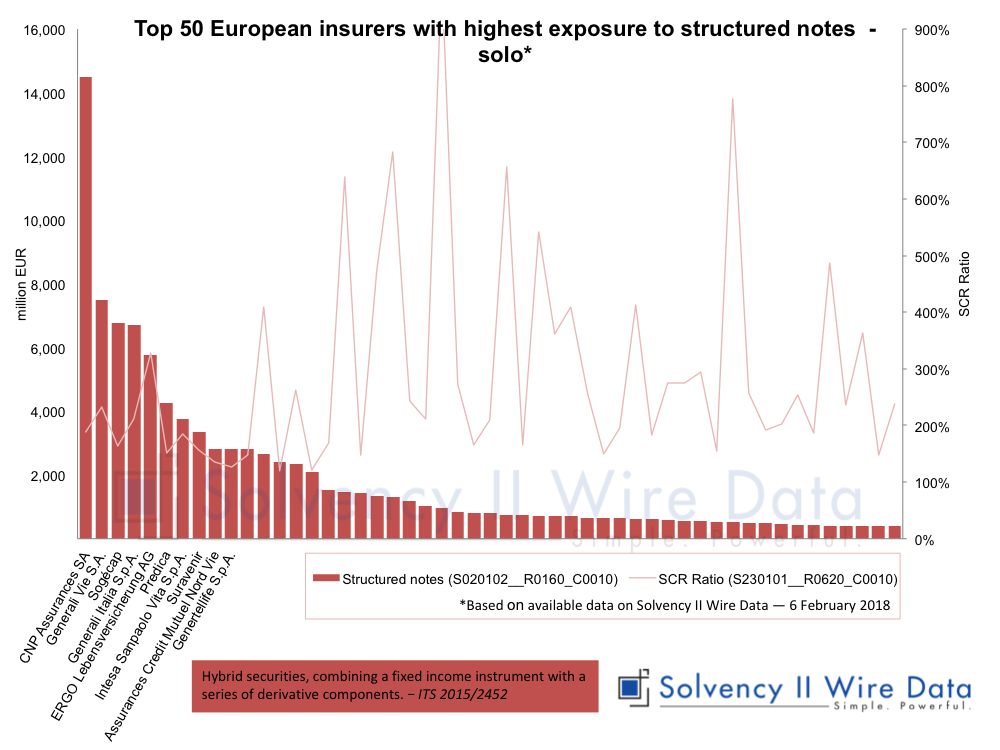

Chart title: Top 50 European insurers with highest exposure to structured notes – solo

Description: List of 50 solo European insures with highest exposure to structured notes on their balance sheet (Solvency II balance sheet).

Definition: Structured notes, ITS 2015/2452, page 53

Chart title: Top 50 European insurers with highest exposure to structured notes – solo

Description: List of 50 solo European insures with highest exposure to structured notes on their balance sheet (Solvency II balance sheet).

Definition: Structured notes, ITS 2015/2452, page 53

Top 50 European insurers with highest exposure to structured notes

Hybrid securities, combining a fixed income (return in a form of fixed pay ments) instrument with a series of derivative components. Excluded from this category are fixed income securities that are issued by sovereign gov ernments. Concerns securities that have embedded any categories of deriva tives, including Credit Default Swaps (‘CDS’), Constant Maturity Swaps (‘CMS’), Credit Default Options (‘CDOp’). Assets under this category are not subject to unbundling