Survey of the European insurance audit market

February 22, 2022

The environmental investment challenge for insurers – what comes next?

February 12, 2022

Captive insurance and corporate risk management

February 6, 2022

Examples of climate risk disclosure in the SFCR

January 3, 2022

WACI – a blunt tool for climate disclosures

December 13, 2021

Solvency II News: Climate risk management for insurers

December 9, 2021

Webinar: Climate risk management for insurers

November 16, 2021

Insurance climate risk reporting

November 13, 2021

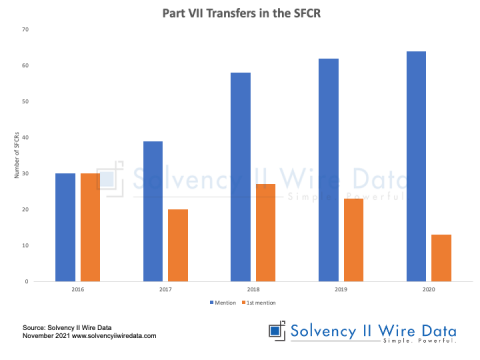

Insurance Part VII Transfer Market Activity

November 2, 2021

Failures and near misses in insurance

October 9, 2021

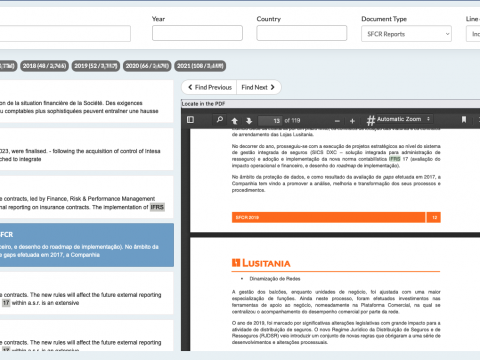

SFCR Text Search

May 11, 2021

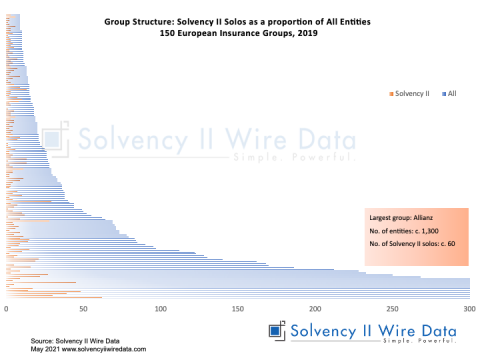

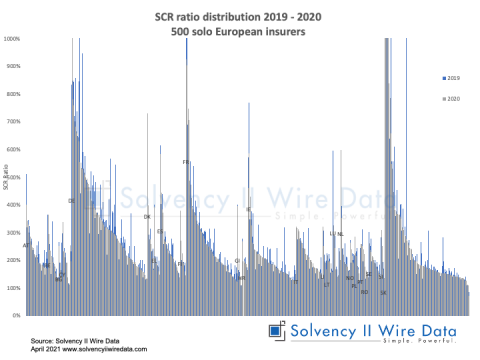

500 2020 QRTs packed with insurance data

April 19, 2021

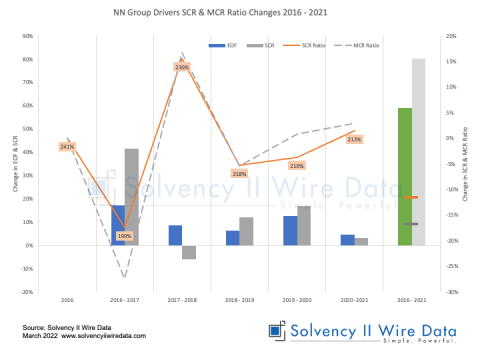

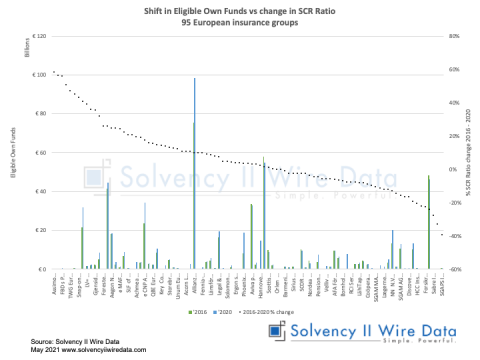

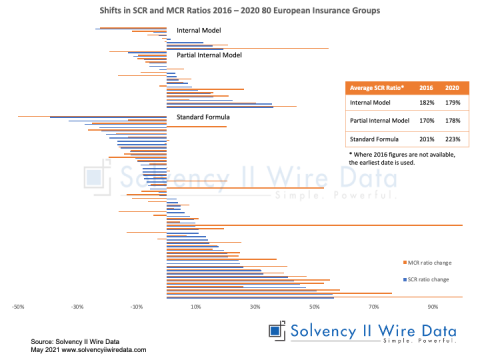

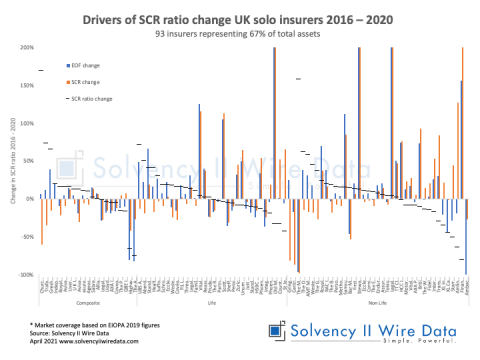

Drivers of insurance risk change in UK SCR ratios 2020

April 16, 2021

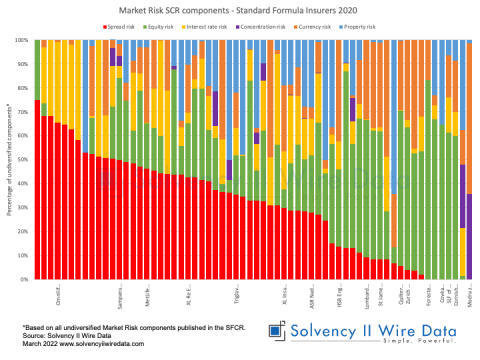

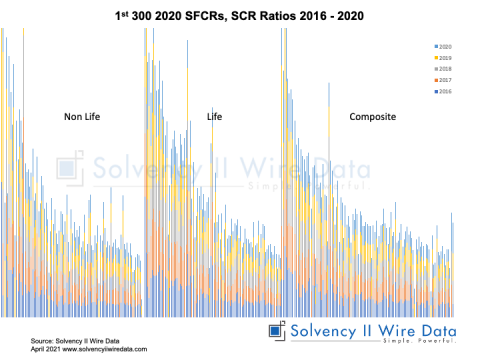

Distribution of Solvency II ratios by line of business 2020

April 13, 2021