Author: Gideon Benari

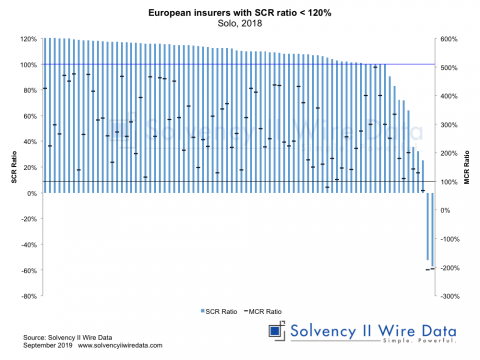

Insight into the lower end of the European insurance market

September 2, 2019

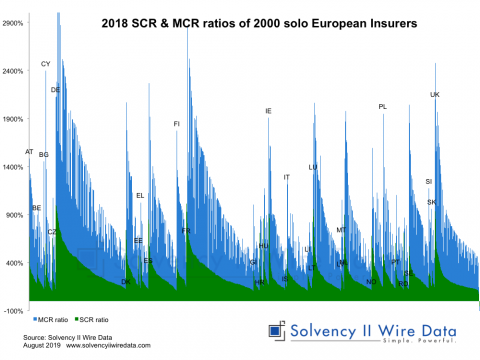

SFCRs 2018 – a market snapshot from early collection

April 24, 2019

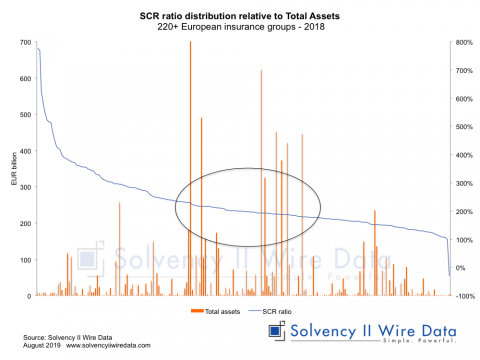

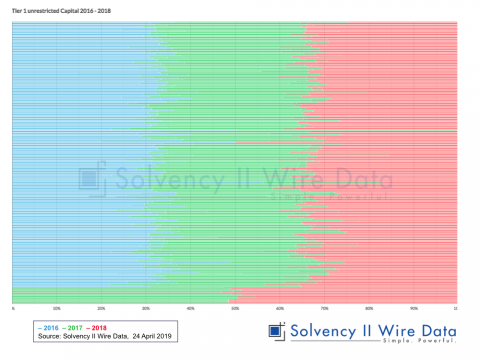

Trends in Solvency II ratio distributions

March 25, 2019

SFCR List upgrade

March 6, 2019

Solvency II News: first 2018 SFCRs

December 14, 2018

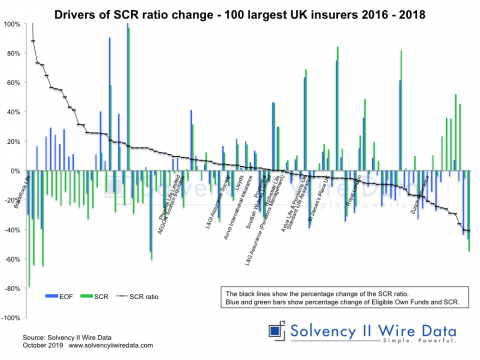

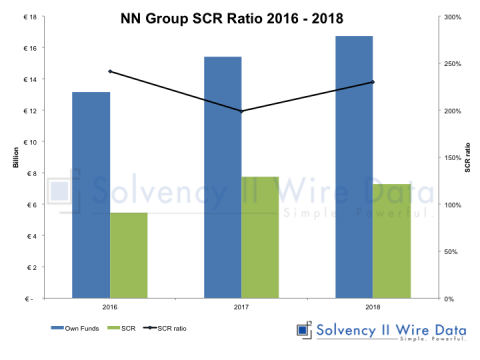

A deep-dive into the Solvency II SCR ratios

December 6, 2018

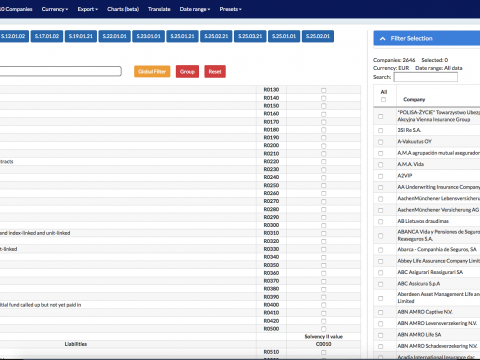

Putting the Solvency II QRTs to the test

November 16, 2018

A cross-border reinsurance spiral

November 6, 2018

Solvency II and equity price valuation

November 5, 2018

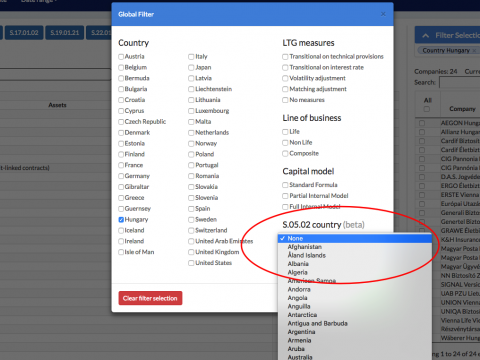

Market exposure based on S.05.02

October 12, 2018

#resist

October 8, 2018

Tracking shifts in counterparty default risk

September 25, 2018

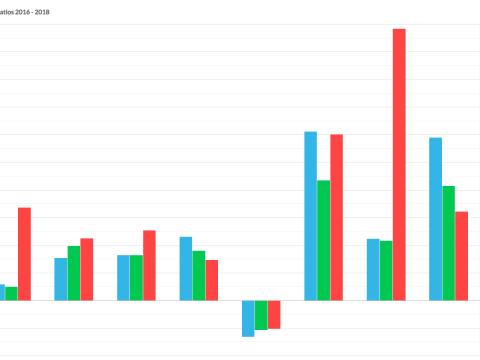

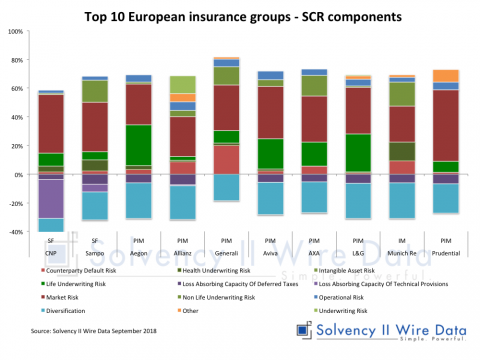

SCR components comparison of European insurance groups

September 11, 2018