Tag: eligible own funds

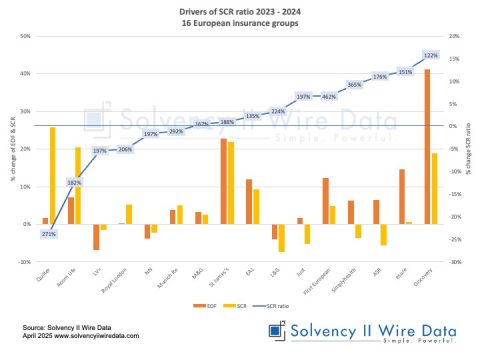

Early reporting of 2024 group SFCRs solvency ratios up

April 8, 2025

Dutch insurance market analysis 2023

September 25, 2024

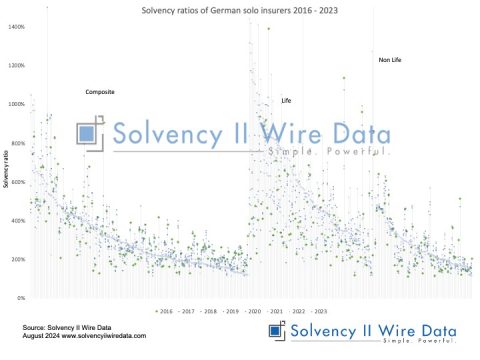

Analysis of the German insurance market 2016 – 2023

August 19, 2024

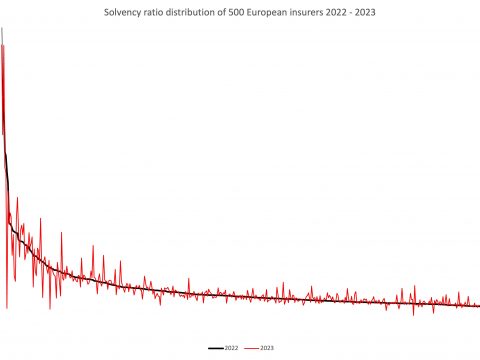

European insurance market insights 2023: 1st 500 QRTs

April 15, 2024

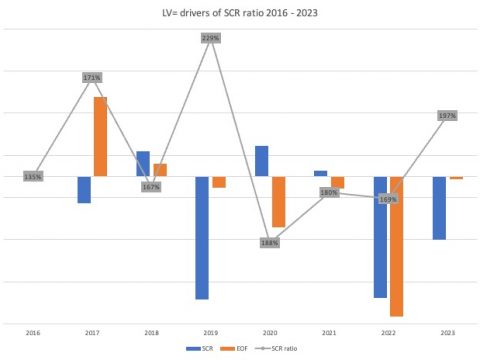

SFCR 2023: LV= returns to tier 3 capital

April 9, 2024

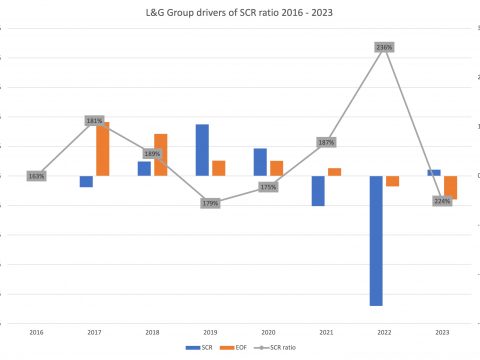

SFCR 2023: L&G solvency ratio down

April 4, 2024

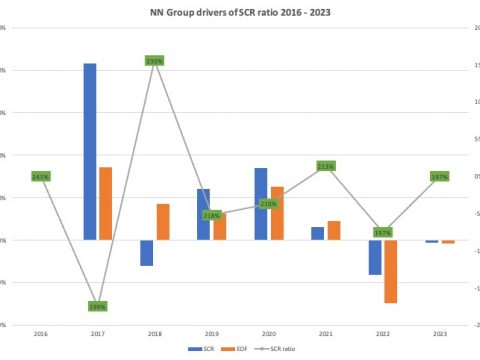

SFCR 2023: NN Group solvency ratio unchanged

April 1, 2024

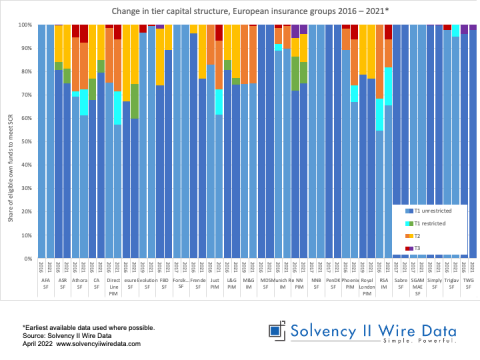

2021 SFCR group early analysis

May 24, 2022

European insurance market analysis 2021 (early insights)

April 28, 2022