Category: SFCR Analysis

Analysis of the Solvency II public disclosures

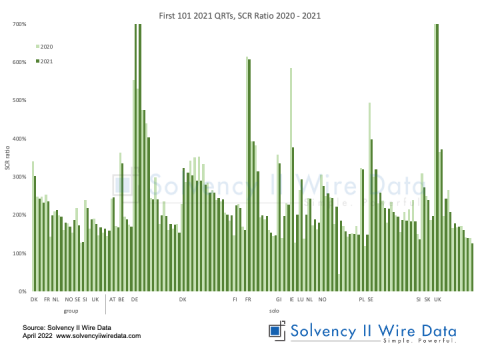

The First 101 2021 QRTs

April 7, 2022

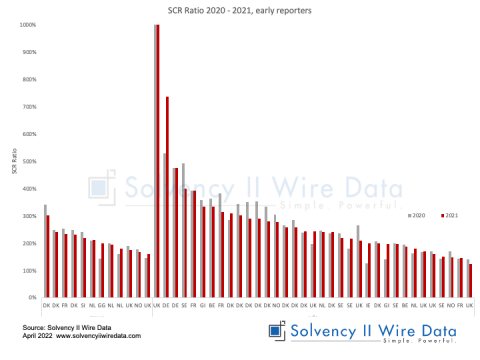

SFCR 2021 early publications

April 4, 2022

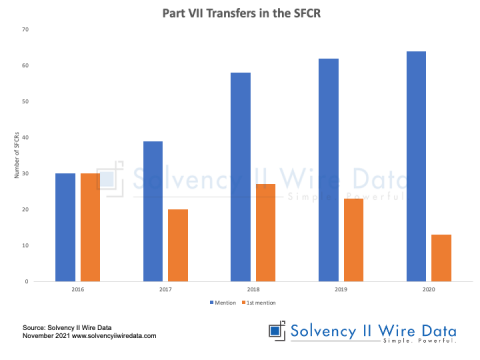

Insurance Part VII Transfer Market Activity

November 2, 2021

Failures and near misses in insurance

October 9, 2021

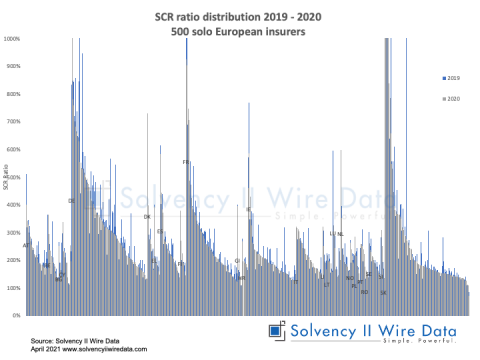

500 2020 QRTs packed with insurance data

April 19, 2021

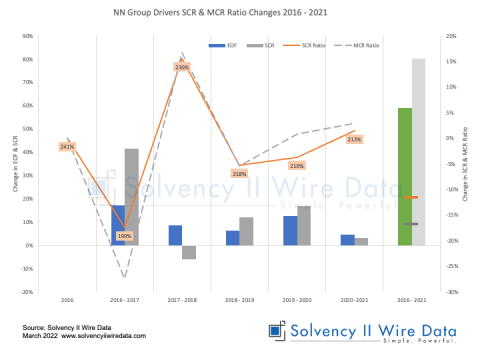

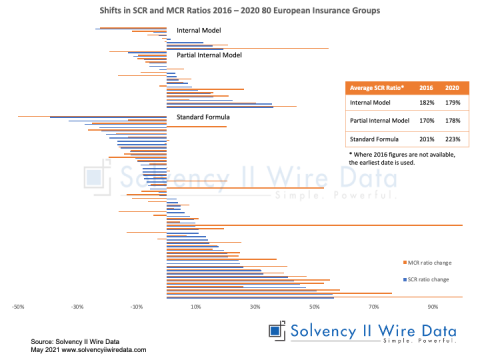

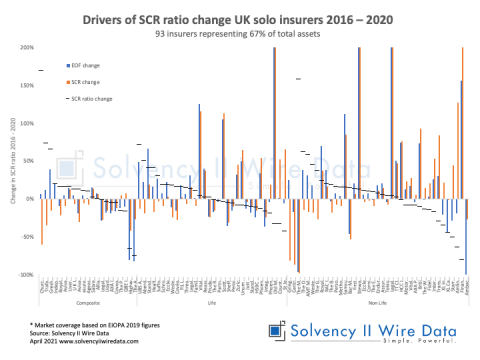

Drivers of insurance risk change in UK SCR ratios 2020

April 16, 2021

Distribution of Solvency II ratios by line of business 2020

April 13, 2021

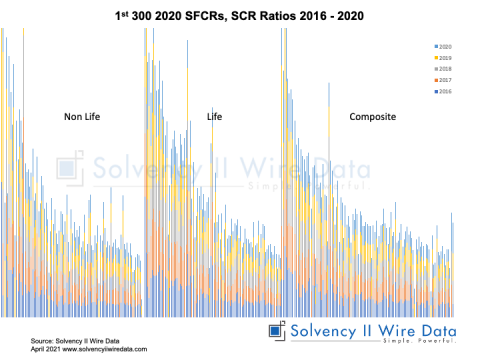

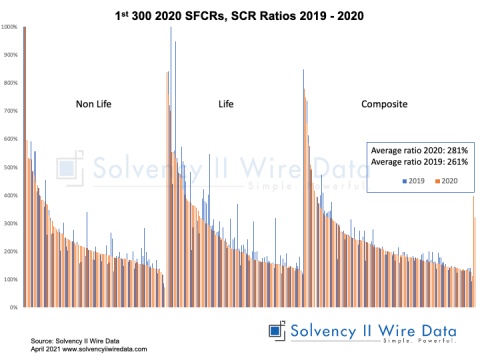

Solvency II ratios of 300 QRTs for 2020

April 13, 2021

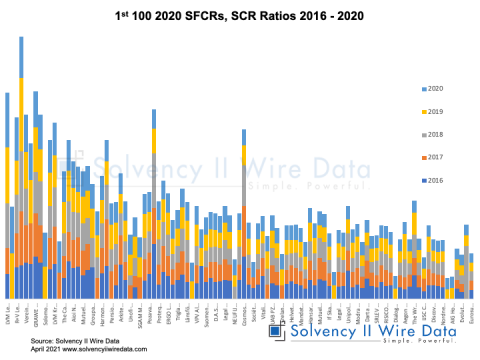

1st 100 2020 SFCRs

April 8, 2021

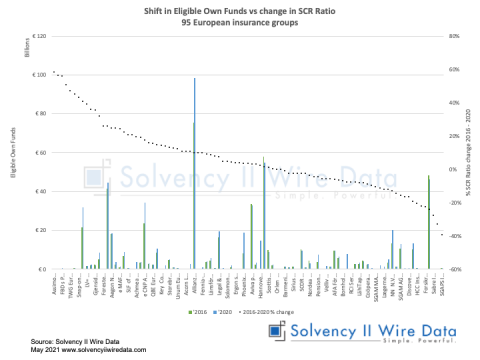

SCR ratios of 2016 – 2020 of early reporting groups

April 6, 2021

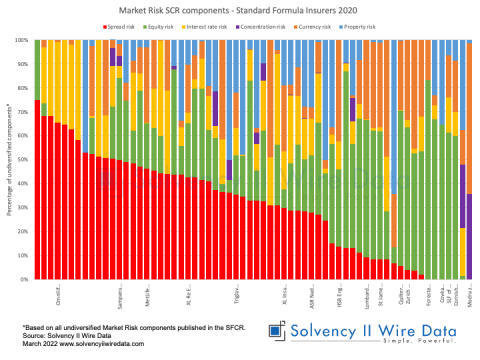

Market risk sensitivities data in the SFCR

March 14, 2021