Category: Data Analysis

Analysis of QRT data from Solvency II Wire Data

500 2020 QRTs packed with insurance data

April 19, 2021

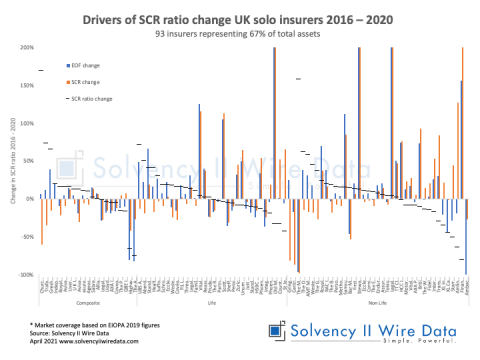

Drivers of insurance risk change in UK SCR ratios 2020

April 16, 2021

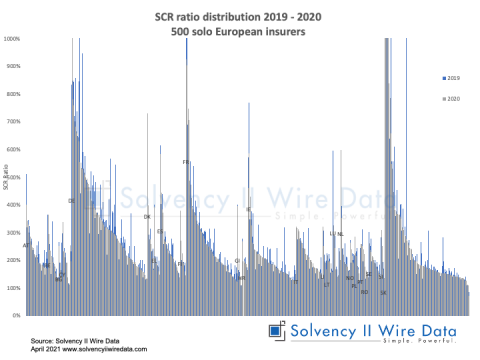

Distribution of Solvency II ratios by line of business 2020

April 13, 2021

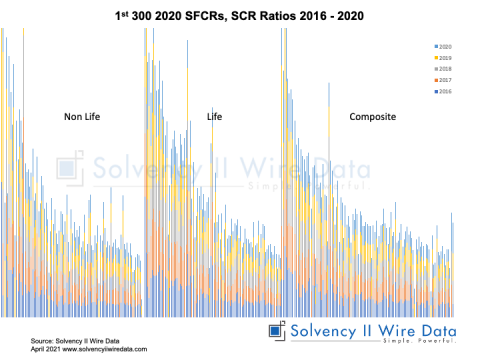

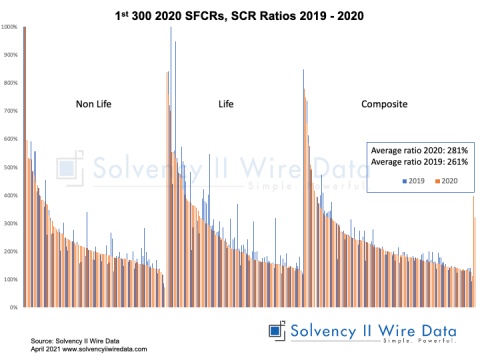

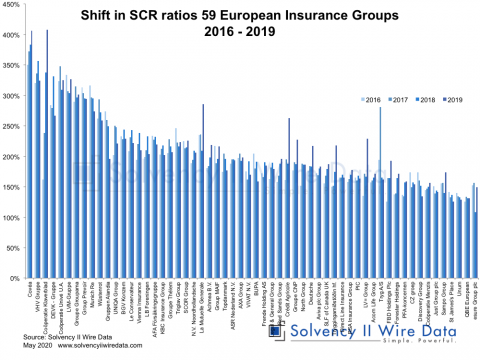

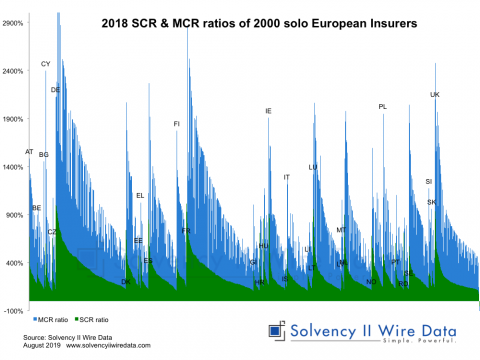

Solvency II ratios of 300 QRTs for 2020

April 13, 2021

Shifts in the Dutch Insurance Market Structure 2016 – 2019

October 29, 2020

Analysis of EEA Life Insurance Market 2018 SFCR & QRT data

January 22, 2020

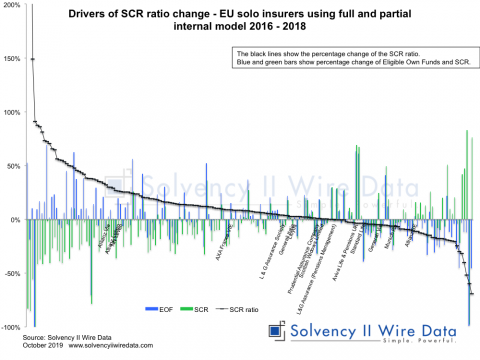

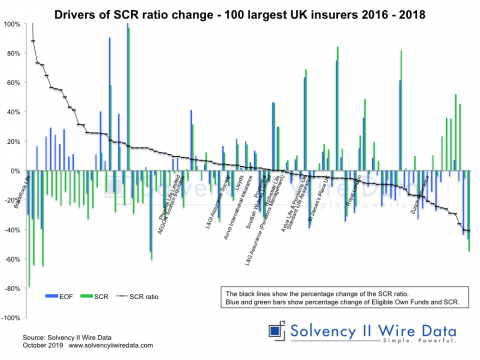

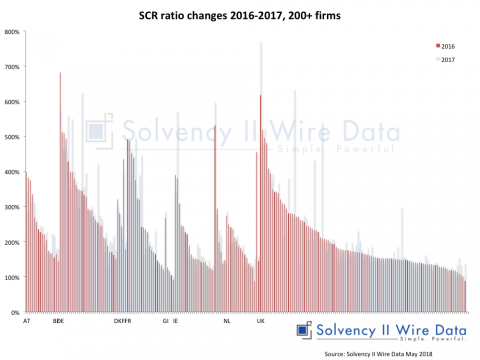

Drivers of Solvency II SCR ratio change across Europe 2016 – 2018

October 23, 2019

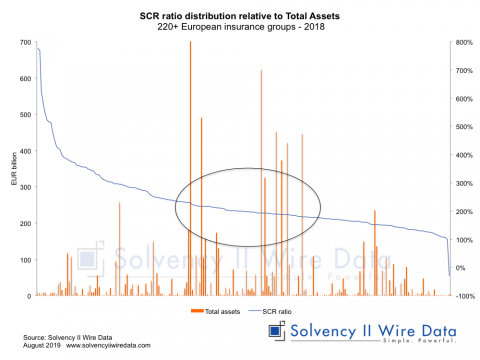

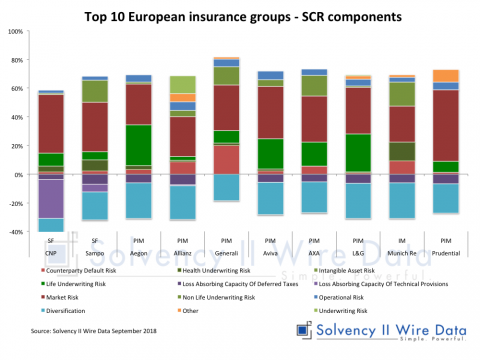

SCR components comparison of European insurance groups

September 11, 2018

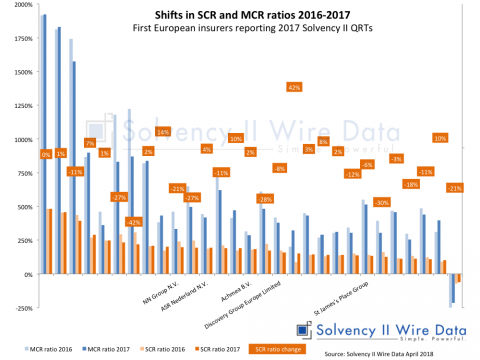

NN Group published SFCR and QRT for 2017

April 10, 2018

Top 50 European insurers with highest exposure to structured notes

February 15, 2018

Top 50 European insurers with highest exposure to property

February 13, 2018