Tag: Groups

Solvency II group reporting annual statistics 2024

June 2, 2025

SFCR 2024: Solvency UK groups capital ratios

May 27, 2025

Allianz 2024 SFCR: solvency ratio down, sub-debt up

May 22, 2025

2024 SFCR Groups Week

May 19, 2025

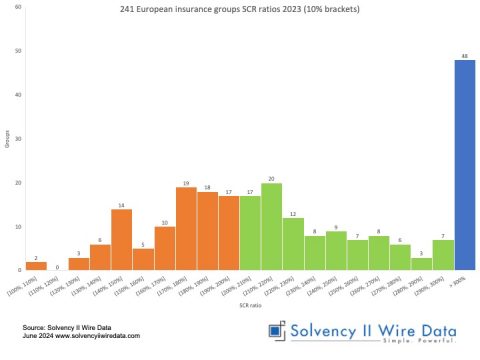

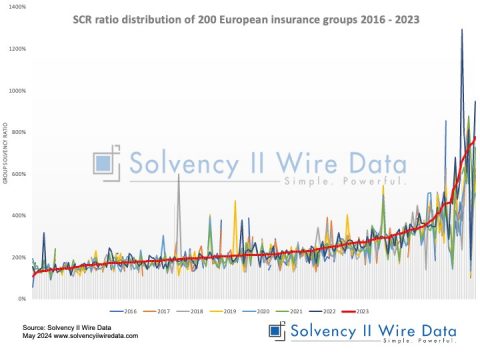

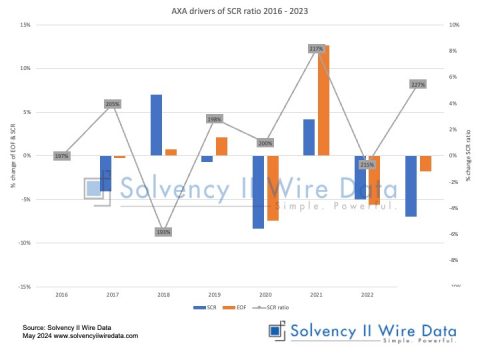

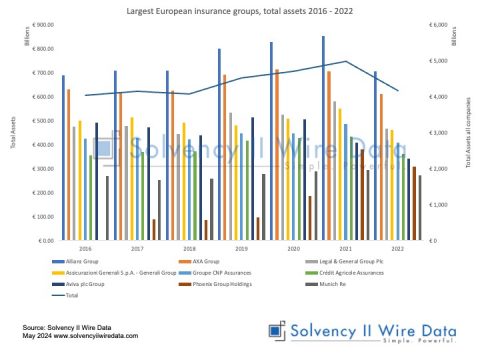

Group Solvency II ratios 2016 – 2023

May 27, 2024

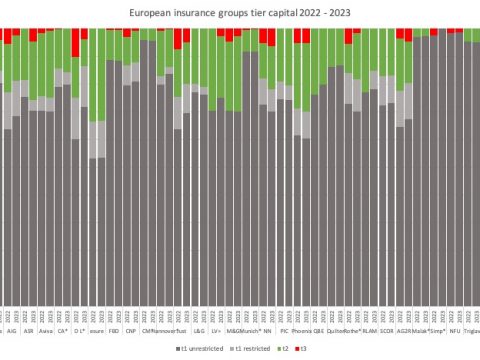

European insurance market insights 2023: group tier capital

April 19, 2024

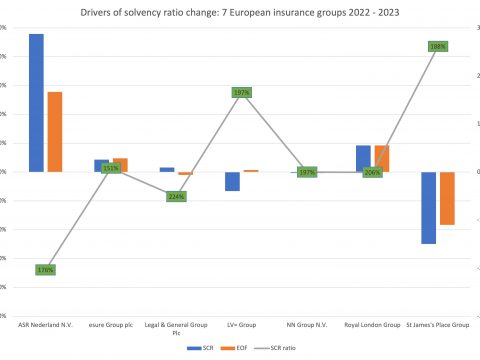

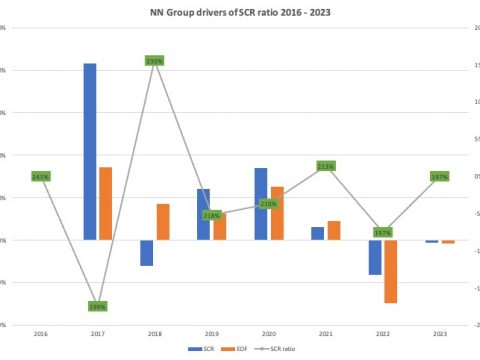

SFCR 2023: NN Group solvency ratio unchanged

April 1, 2024

Group structure in template S.32

February 29, 2024

IFRS 17 reporting lagging in Solvency II SFCRs

May 24, 2023

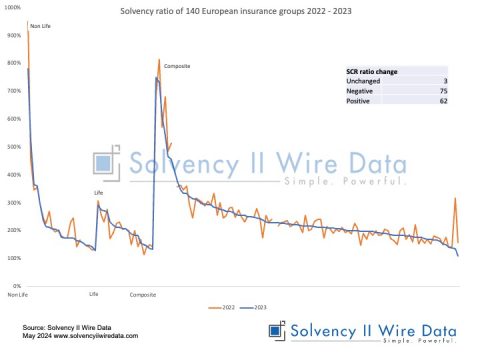

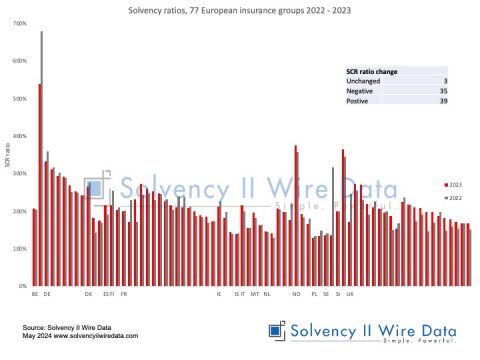

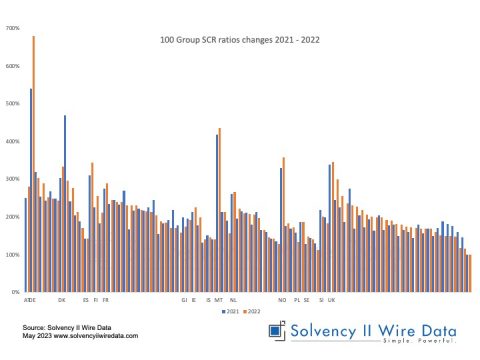

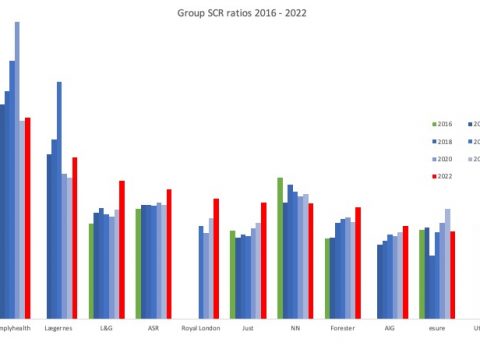

2022 Group SCR Ratios

May 19, 2023

2022 Group SFCRs

April 11, 2023