Reinsurance and the Solvency II public disclosures

April 24, 2018

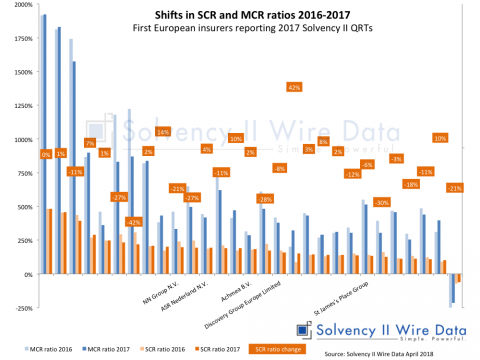

NN Group published SFCR and QRT for 2017

April 10, 2018

SFCR comparison tools – Solvency II Wire Data

April 3, 2018

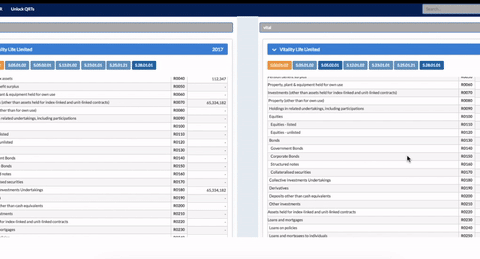

Side by Side View upgrade

March 27, 2018

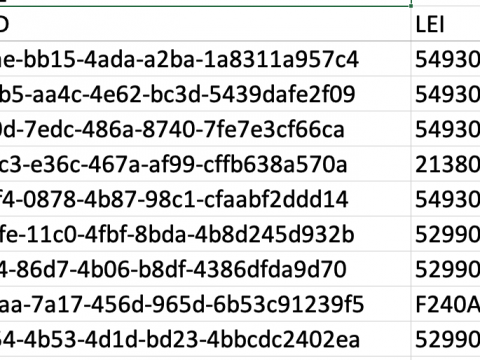

SIIWD_ID

March 13, 2018

Top 50 European insurers with highest exposure to structured notes

February 15, 2018

Top 50 European insurers with highest exposure to property

February 13, 2018

Top 50 European insurers with highest exposure to derivative

February 12, 2018

Deconstructing Internal Model SCR components

January 24, 2018

User interface upgrade

January 1, 2018

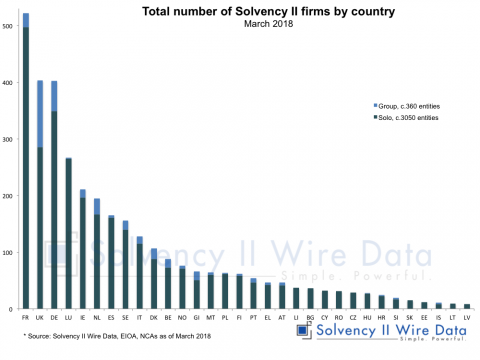

Solvency II, a data mine for asset managers

November 19, 2017

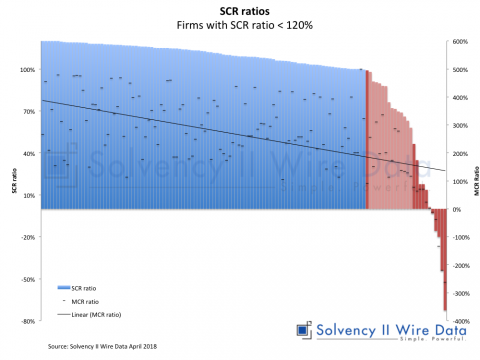

MCR shock – testing the strength of the SCR coverage ratio

October 30, 2017