Category: Slider

2024 SFCR Groups Week

May 19, 2025

SFCR 2024: 30 days on, Solvency II ratios down

May 12, 2025

French life insurers’ solvency ratio down in 2024

May 12, 2025

Austrian insurance market analysis 2024

May 5, 2025

German insurance market analysis 2024

April 22, 2025

CNP Assurances Group 2024 SFCR: solvency ratio down

April 17, 2025

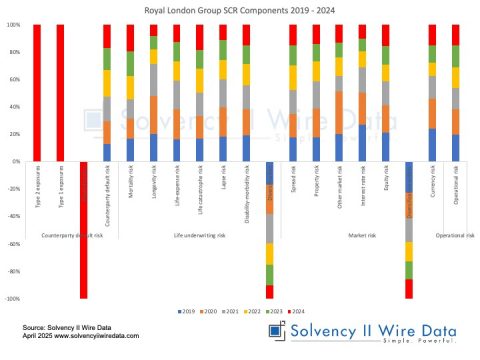

UK life insurance capital requirement 2024

April 16, 2025

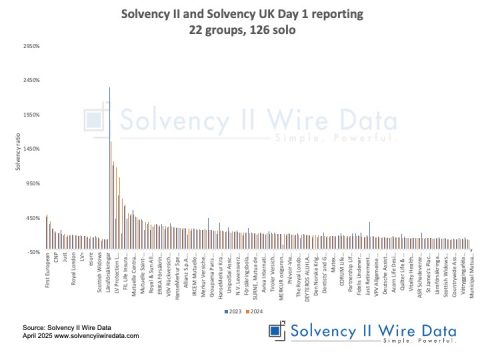

Solvency II and Solvency UK 2024 SFCR Day 1 reporting

April 9, 2025

Early reporting of 2024 group SFCRs solvency ratios up

April 8, 2025