Early reporting of 2024 group SFCRs solvency ratios up

April 8, 2025

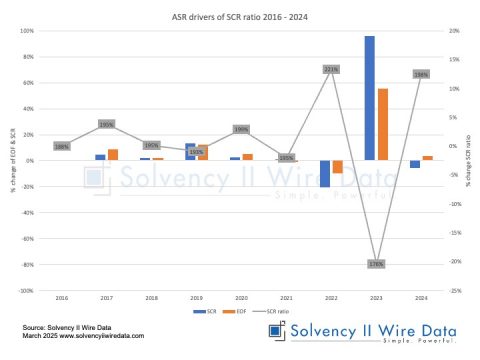

ASR 2024 SFCR: bouncing back and dropping tier 3 capital

March 31, 2025

Mapping the Solvency UK public QRTs to Solvency II – webinar

March 17, 2025

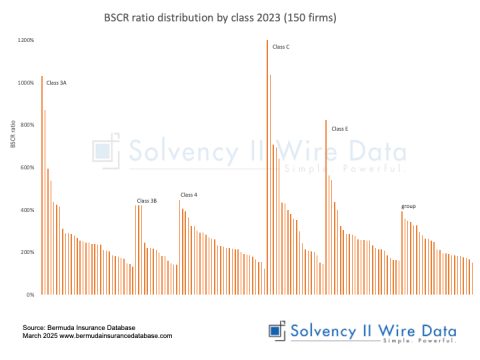

Bermuda insurance and reinsurance BSCR ratios in 2023

March 11, 2025

The ORSA beyond Solvency II

February 23, 2025

A guide to the Solvency UK public disclosures

February 17, 2025

Surviving a breach in the SCR ratio

February 10, 2025

Bermuda insurance capital ratio analysis

January 27, 2025

Analysis of the financial strength of Bermudan insurers

January 17, 2025

Solvency II data 2024 review

January 12, 2025

Lloyd’s syndicate total asset distribution 2022 – 2023

December 15, 2024

Captive Insurance Hub by Solvency II Wire

November 7, 2024

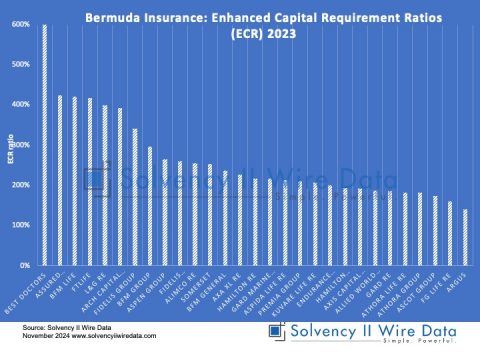

Bermuda Enhanced Capital Requirement ratios (ECR) 2023

November 1, 2024

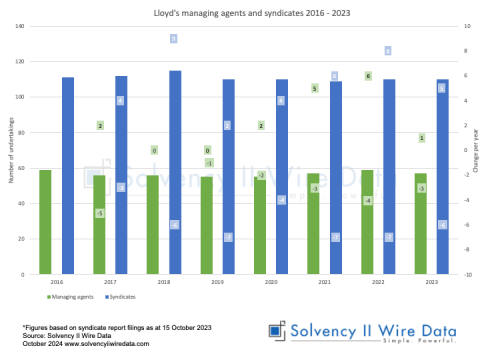

The number of Lloyd’s managing agencies and syndicates

October 15, 2024

8th annual Solvency II survey: balancing risk and opportunity

October 3, 2024

Dutch insurance market analysis 2023

September 25, 2024