Weekly Lunchtime Webinar Series: 2024 SFCRs weekly reporting update

Wednesdays throughout May and June 2025, 12.00 UK / 13.00 CET

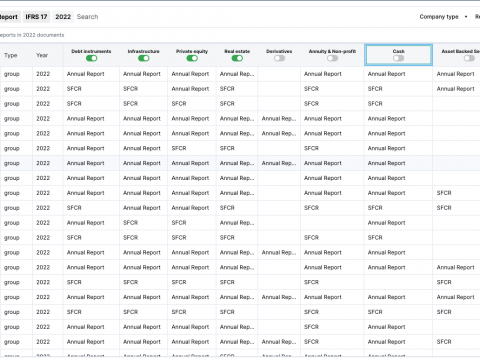

A weekly update on the state of the Solvency II and Solvency UK 2024 SFCR reports, including early market analysis from Solvency II Wire Data.