Solvency II Wire Data reveals the state of the German insurance market and begins to shed light on the use of the Long Term Guarantees Measures.

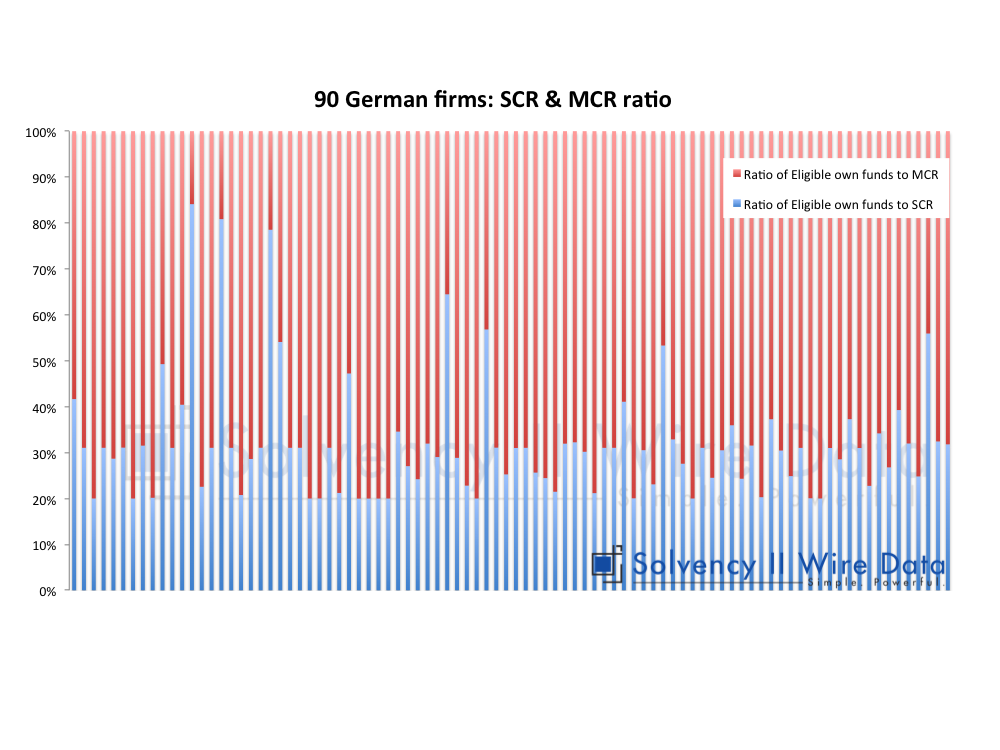

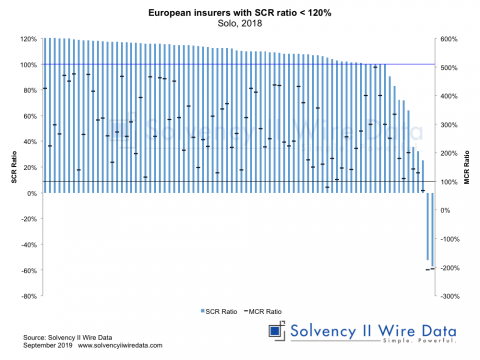

90 German firms: SCR & MCR ratio

A sample of 90 firms shows strong market coverage. The average SCR and MCR coverage ratios for the sample are 338% and 836% respectively. However, the range within the sample varies considerably. The SCR ratio varies from 127% to 962% while the MCR ratio ranges from 104% to 3,682%. By comparison, the results of the 2016 EIOPA stress test for a the German market showed an average SCR coverage ratio of 272% and MCR coverage ratio of 638%. Figures for the sample are higher for both.

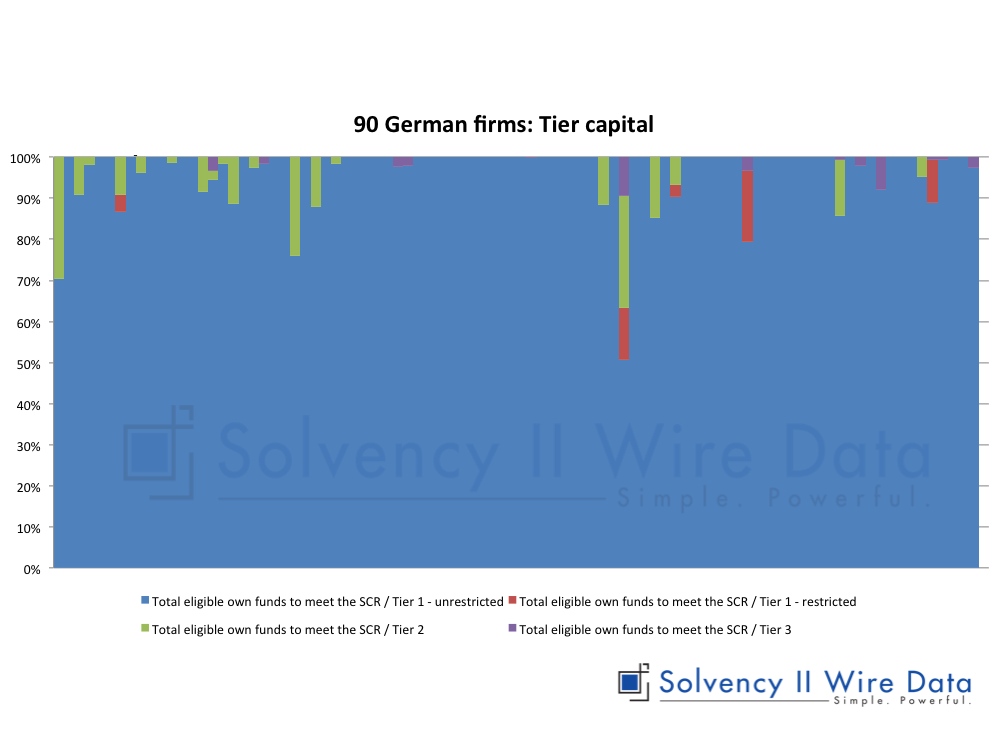

90 German firms: Tier capital

Analysis of the tier capital structure for the same sample (based on Total eligible own funds to meet the SCR, S23.01:R0540_C0020 to C0050) shows high levels of Tier 1 capital. Only one outlier has less than 50% tier 1 capital, Karlsruher Lebensversicherung AG. The company has an SCR coverage ratio of 231% and MCR coverage ratio of 512% both below the sample average. By comparison EUROP ASSISTANCE Versicherungs-AG has very similar SCR and MCR Ratios (234% and 521% respectively) but its capital consists of 100% tier 1 capital.

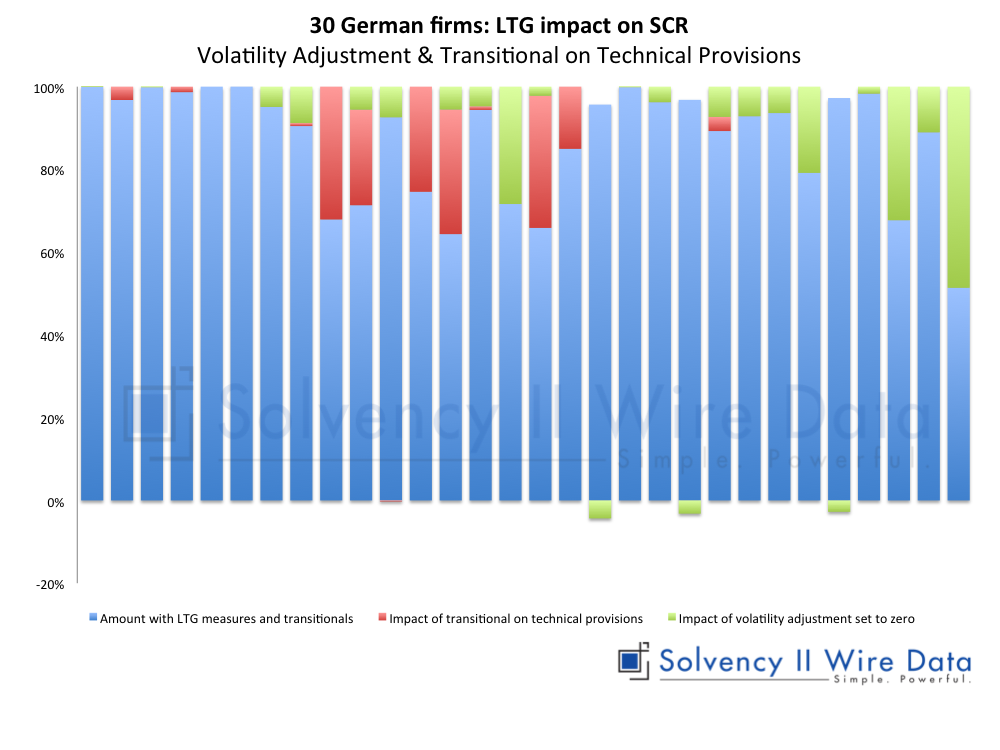

30 German firms: LTG impact on SCR

The third chart examines the impact of the Volatility Adjustment & Transitional on Technical Provisions on the SCR for 30 of the companies in the sample that used either measure. The chart shows the relationship between the SCR Amount with LTG measures and transitional (S22.01:R0090_C0010), the Impact of transitional on technical provisions on the SCR (S22.01:R0090_C0030) and the Impact of volatility adjustment set to zero on the SCR (S22.01:R0090_C0070). It is also interesting to note that only one third of firms have used any LTG measures. The full data set is available on the premium Solvency II Wire Data service. A subset of the data is also available to free subscribers to the service (register here).