ANALYSIS

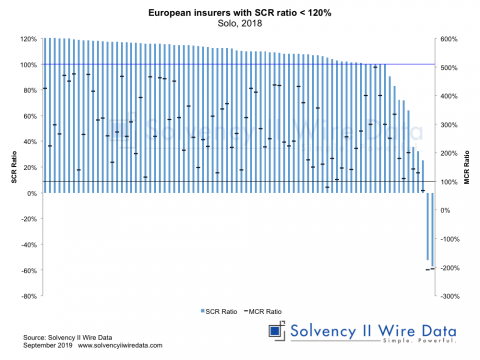

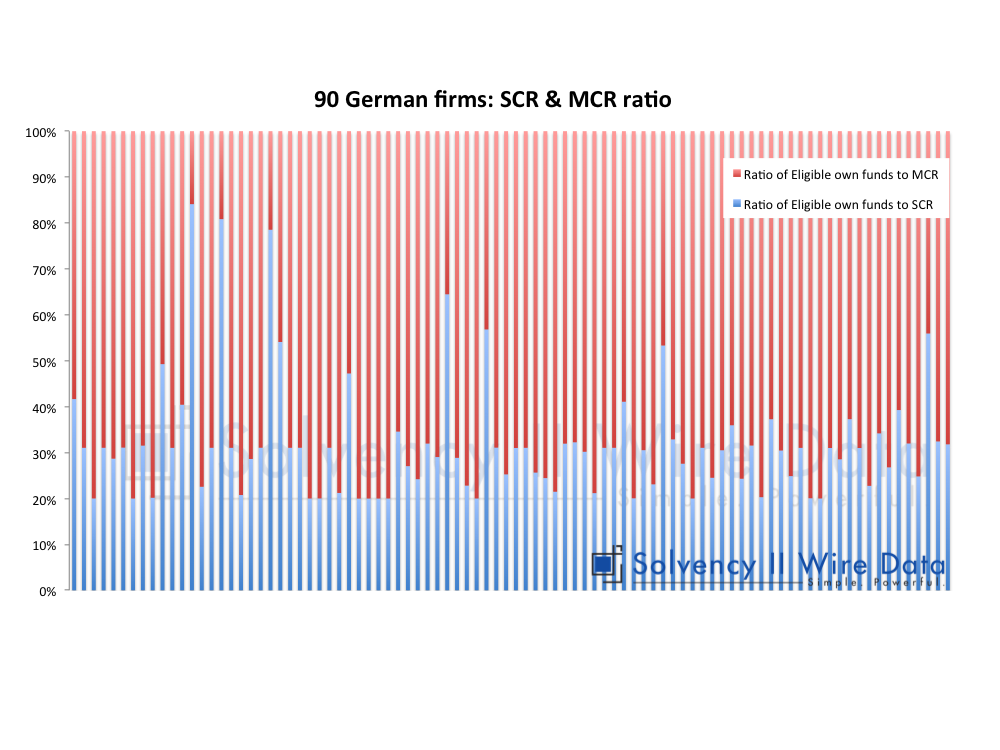

Daragh Clune, chief investment officer, IRC, on why the Solvency II SCR ratio can sometime be higher than the MCR ratio. Analysis of the Solvency II public disclosures in the German market (Solvency II Wire 14/6/2017) uncovered a number of firms with a lower MCR ratio (Minimum Capital Requirement) than SCR ratio (Solvency Capital Requirement).

This is surprising given that the MCR is the lower of the two capital requirements and it would be expected that the MCR ratio would be higher (see The SCR: early warning system or panic button?).

Smaller insurers whose MCR does not exceed an absolute minimum capital requirement under Solvency II, for the classes of businesses in which they operate (€3.2m for most non-life firms and €3.7m for life and some classes of motor) have a minimum level of MCR imposed by the regulator. Where the firm’s modelled SCR does not exceed this absolute level a situation arises where the MCR and SCR are the same.

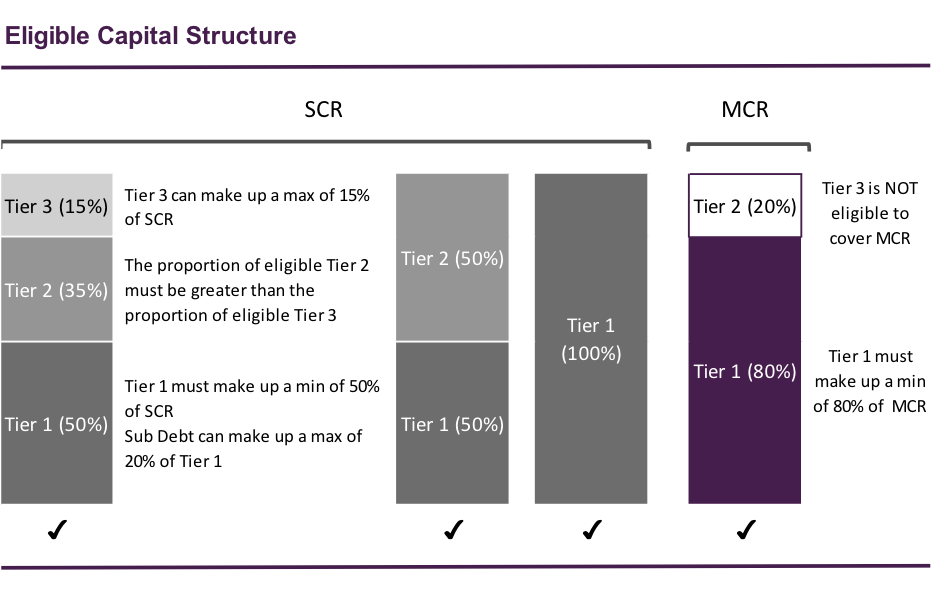

As can be seen from the Table on the right, the MCR must be funded with a minimum of 80% Tier 1 capital and may have up to a maximum of 20% Tier 2 capital.

Tier 3 capital is not eligible to cover the MCR. However, the SCR which must have a minimum of 50% Tier 1 capital can be funded by up to 50% with Tier 2 or a combination of Tier 2 and Tier 3 capital. In the case where a company is using its full allowance of Tier 2 and Tier 3 capital to cover its SCR, its eligible own funds to support their SCR will be higher than its eligible own funds to support their MCR.

With the MCR and SCR at the same level this results in a higher SCR ratio than MCR ratio.

—

The author is managing director and chief investment officer at Insurance Regulatory Capital. The views and analysis presented here are the author’s own.

—

20+ group SFCRs and QRTs are available to premium subscribers. A further 40+ are being processed and expected to be available later this week.

The full data set is available on the premium Solvency II Wire Data service.