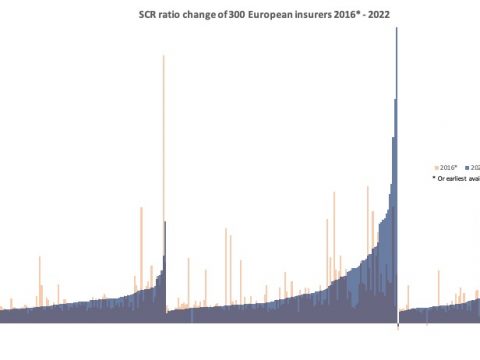

Solvency II Wire Data, reveals that the level of disclosure have remained consistent over the past month (Solvency II Wire 5/6/2017). Of the larger European markets surveyed disclosure rates have been highest in Germany and Spain (87% and 84% of market coverage). In the UK and France about half of firms have published the Solvency II disclosures. In the smaller markets surveyed, Slovakia, Greece and the Czech Republic had a near complete record of publication. Figures vary greatly across Europe. A few surprisingly low levels of publication were noted in Luxembourg (15% of the c.300 firms) where many firms do not have websites, Belgium and Malta (6% and 5% respectively). The average SCR coverage ratio for a sample of about 300 companies across these markets is 295%, ranging from -73% to 6,003% (see Solvency II Wire 5/6/2017). The MCR coverage ratio is 695%.

UK Market analysis

A sample of 130 UK firms shows that the transitional on technical provisions was is being used by 16 firms, Article continues on Solvency II Wire Data (free to access, registration required) The full data set is available on the premium Solvency II Wire Data service. A subset of the data is also available to free subscribers to the service (register here).

Working with SFCRs and QRTs on Solvency II Wire Data Filter to SFCR Analysis from Gideon Benari on Vimeo. SFCR Exposures Chart from Gideon Benari on Vimeo.]]>