In recent years, the Bermuda insurance market has witnessed a significant increase in Japanese ownership and affiliations, reflecting a broader trend of Japanese insurers expanding their global footprint.

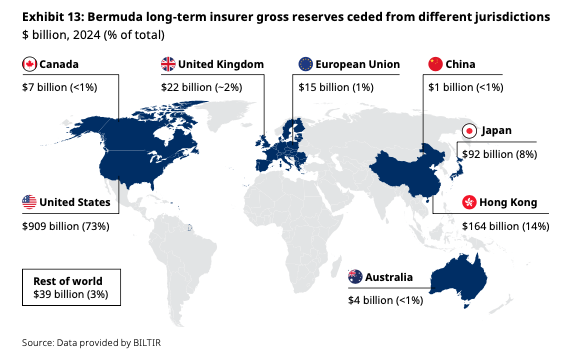

A sense of the extent to which Japanese insurance is ceded to Bermuda can be garnered from a number of reports published in 2025.

For the life market, analysis published by Oliver Wyman on the systemic risk in the Bermuda long-term insurance sector, places long-term insurer gross reserves ceded from Japan to Bermuda in 2024 at USD 92 billion (see chart).

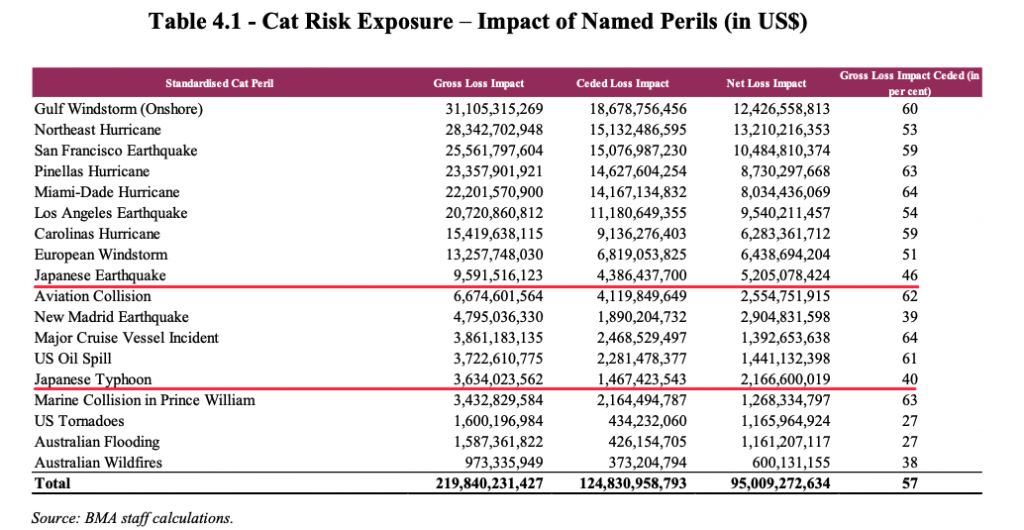

BMA analysis of the property and casualty market, published at the end of 2025 estimates that gross loss impact of Japanese earthquake and typhoon cat-risk assumed by Bermuda insurers was USD 9.6 billion and USD 3.6 billion, respectively.

Analysis conducted by the Bermuda Insurance Database unpacks the forms and structures by which Japanese insurance risk is ceded to Bermuda.

Text analysis review of 181 Financial Condition Reports (FCRs) uncovered 56 firms that mentioned Japan, detailing a range of forms from direct ownership, acquisitions and co-insurance arrangements. The structures and some notable examples are outlined here.

Direct ownership and subsidiaries

Several major Bermuda-based insurers and reinsurers are now directly owned or controlled by Japanese entities. Notable examples include:

- HCC Reinsurance Company, a wholly-owned subsidiary of Tokio Marine Holdings (ultimate parent), a Japanese corporation.

- Endurance Specialty Insurance Ltd and Sompo International Group, both part of Sompo Holdings, a publicly-traded Japanese holding company regulated by the Japanese Financial Services Agency (JFSA).

- Dai-ichi Life Reinsurance Bermuda, a subsidiary of Dai-ichi Japan.

- Protective Life Reinsurance Bermuda, owned by Dai-ichi Life through its German subsidiary, Protective Life Corporation.

Acquisitions and partnerships

The trend of Japanese involvement is further evidenced by recent acquisitions and partnerships.

- Resolution Life Group announced that Nippon Life Insurance Company, Japan’s largest life insurer by revenue, has agreed to acquire 100% of Resolution Life shares.

- Aflac Re Bermuda, while not directly Japanese-owned, is 100% owned by American Family Life Assurance Company of Columbus (Aflac Columbus), which is part of Aflac Incorporated – a company with significant operations in Japan.

Japanese subsidiaries and branches

Many Bermuda-based insurers have established subsidiaries or branches in Japan, indicating a strategic focus on the Japanese market.

- Arch Capital Group has a Japanese subsidiary, MPM Japan Limited.

- AXA XL Reinsurance operates Japanese subsidiaries XL Catlin Japan KK and Global Asset Protection Services Co. Ltd.

- The Steamship Mutual Underwriting Association (Bermuda) Limited has a related entity, SMUA, with a branch regulated by the JFSA.

Business operations and reinsurance agreements

Beyond direct ownership, numerous Bermuda insurers have significant business operations or reinsurance agreements with Japanese entities, some have also reported details of the volume and scope of their Japanese exposure.

- Global Atlantic Re, Ivy Re II, and Kuvare Life Re all report substantial premium income from Japan.

- Resolution Life Group recently established an office in Singapore to support its first flow deal with a Japanese cedant, reinsuring $2 billion in premium income in 11 months.

- Prismic Life Reinsurance entered into a modified co-insurance agreement with an affiliate to reinsure $1.45 billion of reserves backing USD-denominated Japanese whole life insurance policies.

- Athene Annuity Re reported USD 204 million in gross written premium attributable to the Japan region in 2024. The figure represents a significant decrease in volume compared to 2023, when the company recorded USD 2,214 million in premiums from the region.

- RenaissanceRe Group allocated USD 106.5 million of Gross Premiums Written to coverage exposure in Japan within its Property Segment for 2024. This exposure accounted for 0.9% of the Property Segment’s total gross premiums, reflecting an increase in absolute value from the USD 85.8 million written in 2023.

Conclusion

The increasing Japanese presence in Bermuda’s insurance sector is driving enhanced capital flows between Japan and Bermuda, potentially leading to greater market stability and capacity. It also suggests increased expertise in Asian markets, particularly Japan, among Bermuda-based insurers. There is potential for new product innovations that blend Japanese and Western insurance practices, as well as greater regulatory cooperation between Bermuda and Japanese authorities.

Solvency II Wire Data – BLUE