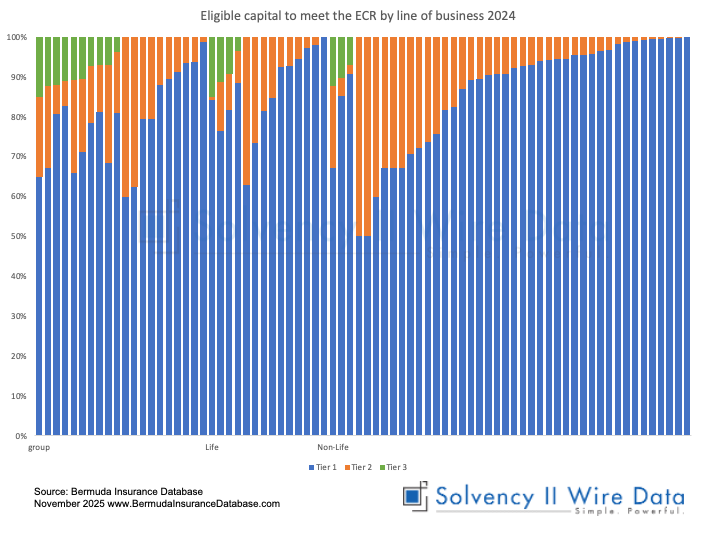

Bermudan insurers must hold sufficient capital to meet their Enhanced Capital Requirement (ECR), as specified under Bermuda’s solvency capital regime.

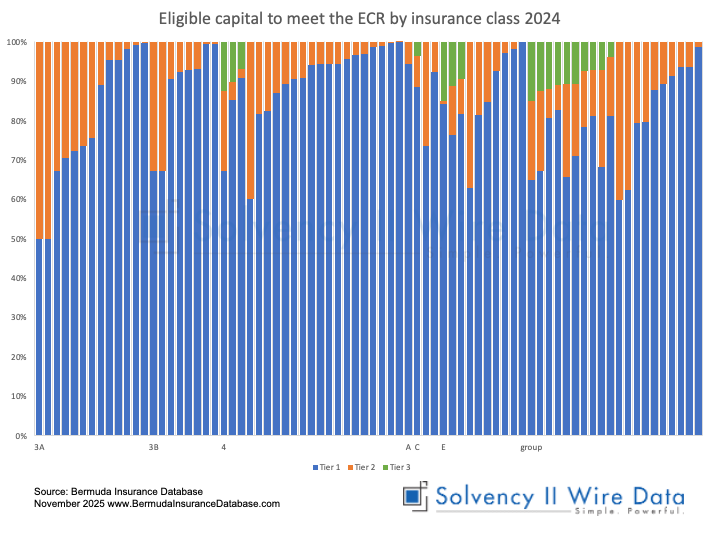

The capital is divided into three tiers, with decreasing levels of stringency. Tier 1 has the highest level of restriction and is considered the safest, and it makes up the highest proportion of capital in the market.

Analysis of the Financial Condition Reports of 168 Bermudan insurers that published capital figures in 2024 reveals that almost half only use tier 1 capital to meet their ECR.

The firms in the sample, analysed by the Bermuda Insurance Database, cover a total USD 484 billion in Eligible Own Funds to meet the ECR.

45% of the firms in the sample make use of tier 2 capital, while only 10% use tier 3 capital.

The charts below show the distribution of tier capital by line of business for solo entities and for groups, as well as distribution by insurance class.

Tier capital use in Europe under Solvency II

The use of tier capital in Europe is on the rise. In 2024 a sample of 1700 European insurers reported a total of EUR 1.44 trillion of Eligible Own Funds to meet the SCR (the Solvency II capital requirement). And while the total tier 1 restricted capital and tier 3 capital remained stable the total tier 2 capital rose from EUR 85.8 billion to EUR 93.8 billion.