Japanese insurers will soon be reporting their solvency capital ratios under the new economic value-based solvency regulation. The Economic Solvency Ratio (ESR) will replace the existing Solvency Margin Ratio (SMR) as the key indicator of the economic soundness of Japan’s insurers.

Much like the solvency ratio in Solvency II, big changes in the ESR are likely to draw the attention of market participants. Given that the SMR has been in place for over 25 years, and that the shift to the new regime will produce significantly lower ratios, it has the potential of warranting some unwanted attention.

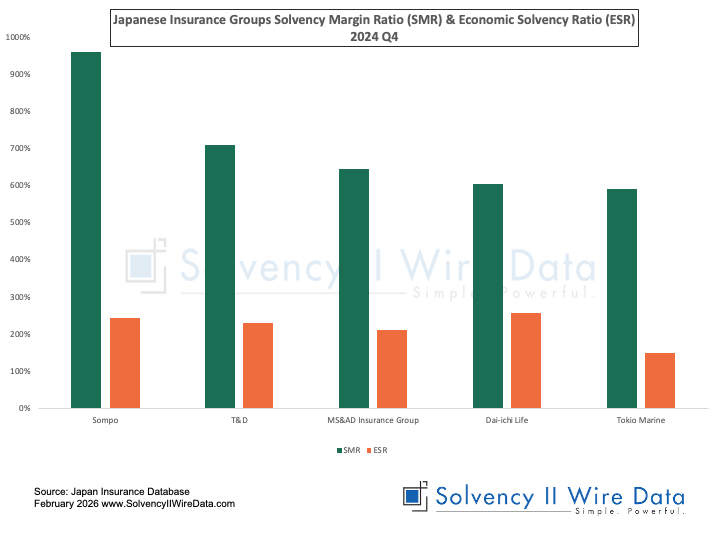

The Japan Financial Services Authority (JFSA) published results from a field test conducted in 2024 (page 4) estimating that the new ratio will shift from 933% to 219% for life insurers and from 750% to 200% for non-life.

The drop in ratio is largely due to significant changes to the method of calculation and introduction of market valuation (for a detailed discussion see ESR for life insurance companies under new Japanese solvency regulation). However, for those unfamiliar with the changes this may be cause for alarm.

A number of Japanese insurance groups have already been providing estimated calculations of their ESR. The chart below shows figures for year-end 2024 for five of Japan’s insurance groups.

The figures, collected by the Japan Insurance Database, echo the results of the JFSA field test and suggest the industry will have its work cut out for it explaining the changes.

The Japan Insurance Database is powered by Solvency II Wire Data.