Private credit is all the buzz in the insurance world these days. No sooner do you mention insurance asset allocation and the phrase pops up. But is private, or “alternative”, credit safe? Is it good for insurers, and more importantly for their customers? And is it even that new an asset class in insurer’s investment portfolio?

Matthew Smith, global head, strategic insurance group, Aberdeen Investments, shares his view on the subject, and, using a relic that is 200 years old, argues that private credit is perhaps not as novel as many might have you think.

“Alternative” credit?

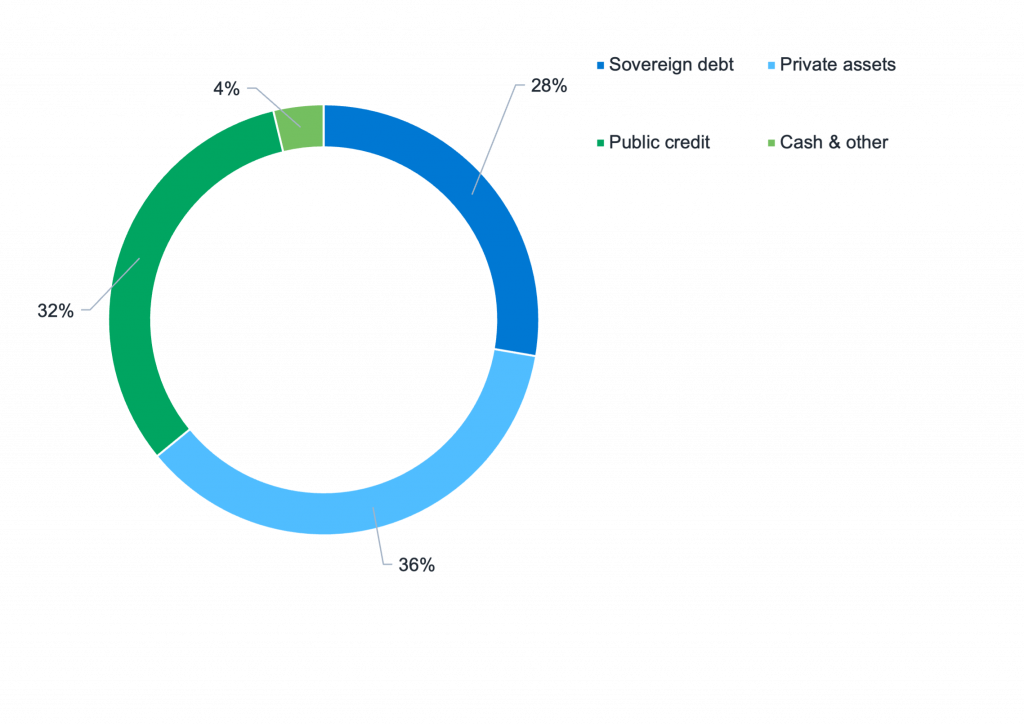

Ahead of the most recent Solvency II Wire webinar, we took a look to see how UK life assurance companies were allocating to private credit. Our definition of private credit, for the purposes of this article, is any credit instrument that’s not publicly traded.

Not so long ago, we would call this ‘alternative credit’. Based on current allocations, it’s becoming increasingly hard to describe such core and growing allocations as ‘alternative’ at all. At this point, I always like to point out that UK insurers were among the first financial institutions to invest in credit assets, during the Victorian-era boom times for the insurance industry. Back then, there was no public market for credit at all, so everything was private.

Where are private credit allocations today?

We’ll come back to history again shortly, but for now let’s go back to the present day, and our view of the allocations to private credit that we see today.

The obvious place to start is with the large annuity underwriters, particularly those actively working in the Bulk Purchase Annuity (BPA) segment, all of whom use Solvency UK’s matching adjustment (MA) framework.

SOURCE: Aberdeen & Goldman Sachs, November 2025

In simple terms, the MA allows for better capital treatment where you can demonstrate a precise match between assets and liabilities. These firms have the longest liabilities and consequently have been the most prominent in their use of private credit, with exposures averaging out just below 40% according to 2025 research from Goldman Sachs.

Looking beyond the average and the Goldman Sachs paper identifies very different allocations across those BPA underwriters, with Just, Phoenix and Aviva being significantly exposed to equity release mortgages, and Rothesay significantly exposed to infrastructure debt. Corporate private placements still have a significant position in BPA private credit allocations, as does commercial real estate debt.

Less pronounced in the allocations – but definitely of increasing relevance – are other areas of the private credit universe, such as direct lending, collateralised loan obligations (CLOs) or subscription line fund finance. Although it’s a long way off the frenzy with which US insurers are exploring asset-backed finance, this very broad and somewhat amorphous category of private credit has already strongly piqued the interest of the BPA community.

Elsewhere, we’ve also seen more insurers looking to take a non-MA-friendly asset – for example a commercial property asset – and re-structure that in such a way that its cashflows become MA-eligible.

Resilience

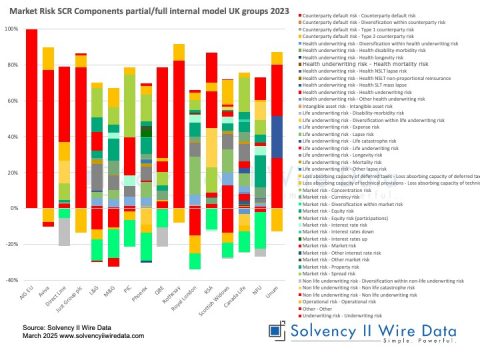

One of the things we looked at for the webinar was the resilience of UK life assurers, and one lens we placed on this was whether their investment allocations were a significantly contributing factor to fairly stable solvency ratios. In very broad terms, and allowing for the different allocations among the BPA insurers, private credit allocations undoubtedly provided a contribution to that overall aggregate resilient picture.

For insurers using the MA, the PRA is quite accommodating of internal credit ratings processes, where the insurer can assign a robustly underwritten rating to an otherwise unrated credit instrument.

Consequently, if the overwhelming majority of the private assets an insurer invests in are rated investment grade (IG), you wouldn’t necessarily see a major shift in solvency ratios. The insurer is simply rotating from a public IG credit asset to a private IG credit asset. In other words, Solvency UK doesn’t penalise you for that, just because it’s a private asset.

What about Europe?

In contrast to the UK’s life assurance community, average allocation to private credit across Europe is around 13%.

It’s a mistake to suggest that this means Europe is somehow ‘behind’ the UK. The difference is more one of market structure. The annuity market in Europe is very small compared with the UK and therefore, structurally, you don’t have that underpinning of demand that drives insurers in UK toward longer-dated private assets.

The danger with drawing conclusions based on an average across the whole of Europe is that you see it as a solitary market, when of course it isn’t.

If you look at an individual country level using 2024 data from Moody’s, you see some fairly wide dispersions. The Netherlands is the market where allocations are most similar to the UK BPA underwriters, with insurers holding on average 35% in private assets, most notably in residential mortgages. Meanwhile, France and Germany trend below 10% allocations to private credit. Again, that’s structural – the Netherlands has long-dated liabilities, whereas in France and Germany there’s more of an emphasis on insurance savings products that tend to be liquid.

Driving forces

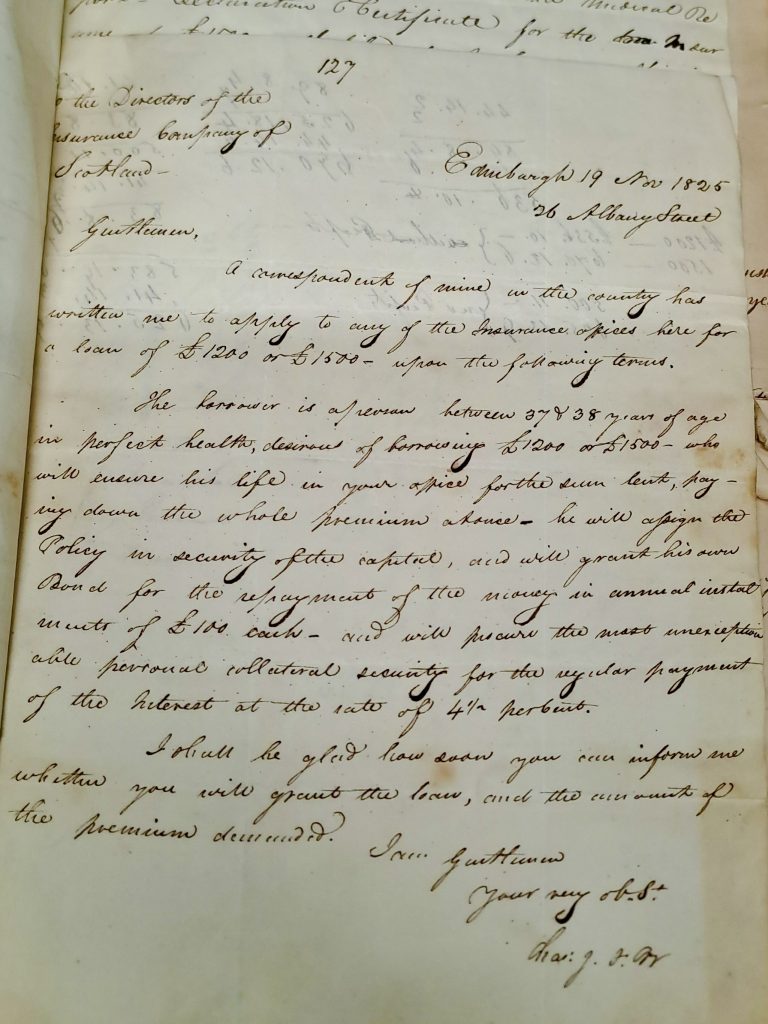

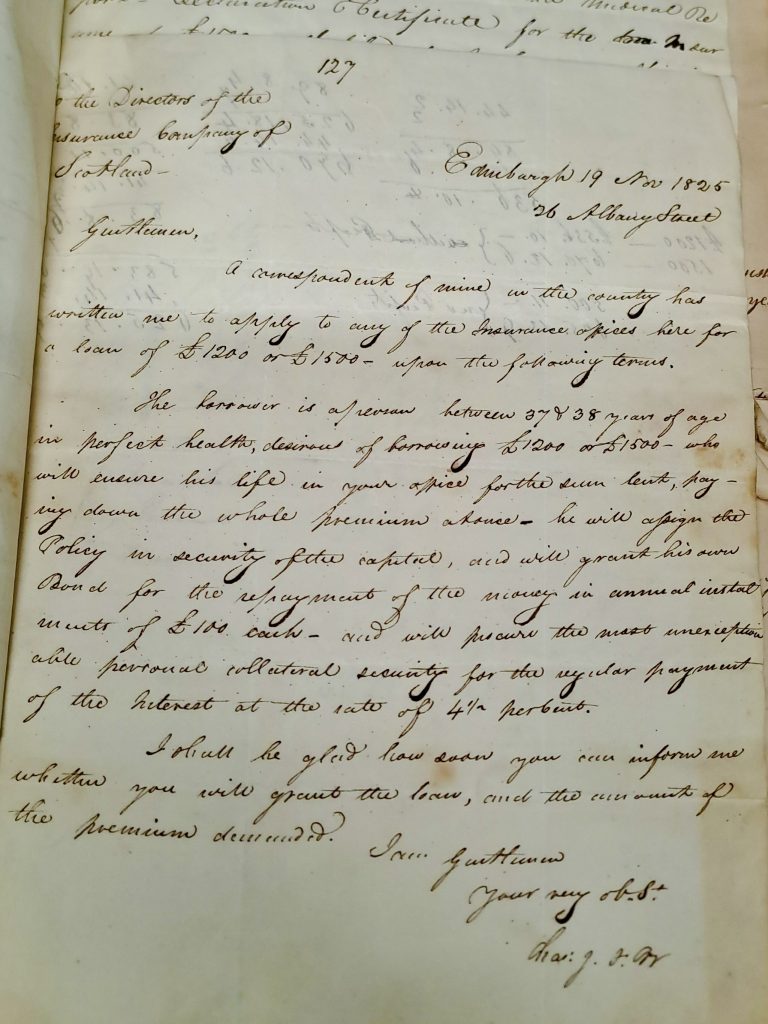

Private credit investing for insurers in the UK is nothing new. In fact, we’ve taken a look in the leather-bound records filling our own rich corporate archive and identified that we made our first direct private loan in 1825. It was a loan to a policyholder, collateralised against his insurance policy.

SOURCE: Aberdeen Investment, volume of policy proposal papers (1825-1826).

The introduction of Solvency II in 2016 wasn’t the catalyst for annuity underwriters investing in private credit assets. Long-dated liabilities meant that corporate private placements or infrastructure loans were used by annuity underwriters well before the introduction of the new, pan-European solvency rulebook.

It’s the scale that’s different now. Some of this is to do with demand for assets not matching supply in the public markets, and some of it has to do with annuity underwriters becoming overall more sophisticated in their investment strategies. It takes a while for financial institutions to fully get into the rhythm of regulation.

Where do we go from here?

During the webinar, a participant asked if we could ever imagine UK insurers allocating to the diverse array of debt instruments that we observe their US counterparts exploring, in scale. While we’ve noted a number of UK insurers – in both the life and non-life areas of the market – significantly expanding what they invest in, and even with recent Solvency UK interventions like allowances for ‘highly predictable’ cashflows or the matching adjustment accelerator, that doesn’t necessarily justify a huge pivot.

For one thing, none of these recent interventions have fundamentally altered the solid, prudential foundations of Solvency UK. Even after conservative modifications, Solvency UK still requires UK insurers to be prudent risk-takers, and the increasing weight of attestations acts as a meaningful disincentive to making significant shifts toward newer, less well-tested private credit asset types.

Nevertheless, whether you’re of the view that private credit investing isn’t really that new, or whether you see it as something radical and alternative, we fully expect to see private credit continue to be a dominant allocation within UK insurance company balance sheets. That will continue to support the resiliency of the UK life assurance market and will continue to lead to greater levels of sophistication and innovation among insurers and their investment managers.

The author is Global Head, Strategic Insurance Group at Aberdeen Investments. Views expressed are the author’s own.

Click here to view a recording of the webinar UK Life Insurance Market Resilience – Trend or Anomaly?

Full Text of the Document

To the Directors of the

Insurance Company of Scotland.

Edinburgh 19 Nov 1825

26 Albany Street

Gentlemen,

A correspondent of mine in the country has written me to apply to one of the Insurance Offices here for a loan of £1200 or £1500— upon the following terms.

The borrower is a person between 37 & 38 years of age in perfect health, desirous of borrowing £1200 or £1500 who will insure his life in your office for the sum lent, paying down the whole premium at once he will assign his Policy in security of the capital, and will grant his own Bond for the repayment of the money in annual interest & annuity of £100 each and will procure the most unexceptionable personal collateral security for the regular payment of the Interest at the rate of 4½ per cent.

I shall be glad how soon you can inform me whether you will grant the loan, and the amount of the premium demanded.

I am Gentlemen

Your very obs.

Arnt. J. Tr.

Comment on the contract: In essence, the customer wants to borrow a sum of money and then take out a life policy with some of the proceeds (the premium being lower than the amount borrowed). What he wants to use the remaining amount of the loan for, and the premium he’s going to be charged, is unclear. He’s then putting the policy and his own personal collateral up as security for the loan (i.e. if he defaults, that’s how the insurer will get compensated).

It is difficult to see how any regulator would accommodate this type of practice today.