Category: Solvency UK

Solvency UK SFCR and QRT reporting

Webinar: UK Life Insurance Market Resilience – Trend or Anomaly?

November 4, 2025

Solvency II figures signal Premier Insurance failure

October 17, 2025

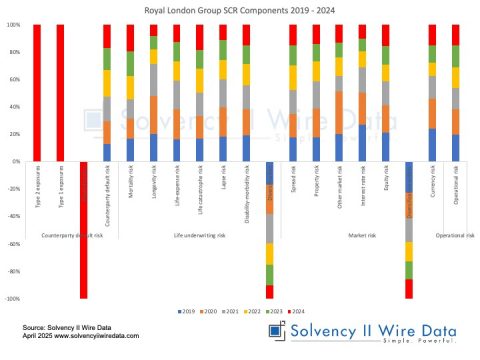

SFCR 2024: Solvency UK groups capital ratios

May 27, 2025

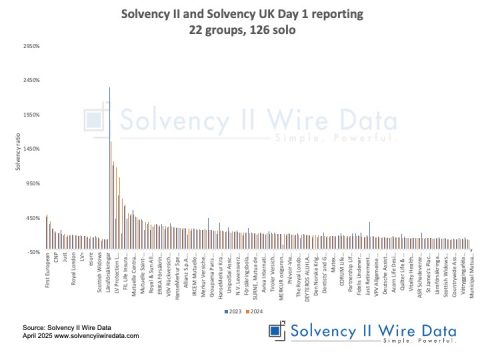

Solvency II and Solvency UK 2024 SFCR Day 1 reporting

April 9, 2025

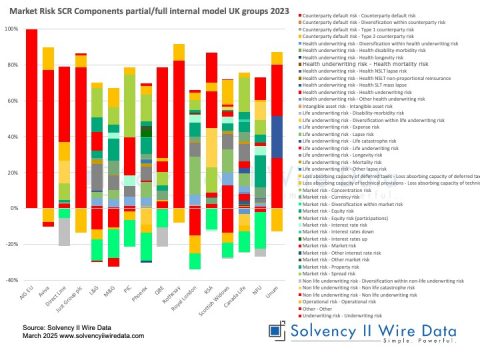

Mapping the Solvency UK public QRTs to Solvency II – webinar

March 17, 2025

A guide to the Solvency UK public disclosures

February 17, 2025