![]()

XBRL has been chosen as the reporting standard for Solvency II, thus bringing market harmonisation of the European insurance industry a step closer.

XBRL has been chosen as the reporting standard for Solvency II, thus bringing market harmonisation of the European insurance industry a step closer.

The eXtensible Business Reporting Language format, essentially a sophisticated form of text mark up, facilitates the transfer of data between financial organisations in a standardised way. This will allow regulators to make like-for-like comparisons of data from insurers across Europe.

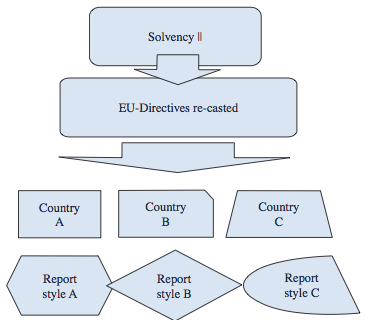

[caption id="attachment_1397" align="alignright" width="219"] XBRL reporting structure SOURCE: JFRC 2010[/caption]

XBRL reporting structure SOURCE: JFRC 2010[/caption]

A study published in the Journal of Financial Regulation and Compliance (2010)* examining the use of XBRL for Solvency II reporting notes, “Regardless of the benefits of the new regulatory frameworks, the application of the IFRS and Solvency II may increase financial risk due to their inherent technical complexities. Many of these complexities are caused by the ways that information is handled in intermediate management processes, which can lead to confusion in the information exchanged between people and systems.”

XBRL is suited for Solvency II reporting as it allows local regulators and individual firms to add extensions while maintaining the integrity of the reporting standard. It provides a common language for reports from different sources (see chart).

Because XBRL is machine readable, it can both reduce human error and increase efficiency in data handling, while its built-in internal validation process improves data accuracy. In addition, the use of a text file format to transfer the information keeps data volumes manageable.

The basics: fun with <p>s and <h>s

XBRL is a markup language, which means it uses a system of tags to define data. HTML is a simpler form of markup language that is used to create web pages, although HTML only defines the appearance of content. This web page is essentially a text file that is marked up in a particular way so your browser, be it on desktop or mobile device, knows how to ‘read’ and display the information accordingly.

Marking text with the tag <p>will define it as a paragraph</p> while marking it with <h1>defines it as a heading and displays it accordingly</h1>.

XML, the markup language used for XBRL, goes a step further by defining what the tagged data is rather than its appearance. For example, data can be defined as a date, an invoice number, or a product description. This makes it possible for different databases to merge and for companies to exchange data using a common platform.

The beauty of XML is that tags can be defined tosuite the purpose of the data, unlike HTML where tag definitions are fixed:

can only be header text at the highest level, it cannot be redefined by the user.

XML uses a taxonomy to define data for a specific purpose. The taxonomy is like a dictionary that tells the machine what each tag means and sets the rules on how the tags interact. For example, you cannot multiply two text fields.

XBRL in detail

There are a number of universally recognised XML standards and XBRL is one of them. XBRL, which is overseen by XBRL International, was specifically designed for financial reporting.

The 2010 study notes, “To facilitate the communication of business information, XBRL was created as an adaptation of XML to financial and business data with a clear objective: to “homogenize” business information and make it compatible in an environment where different entities must communicate quickly and clearly with each other but where there are no efficient programs or formats.”

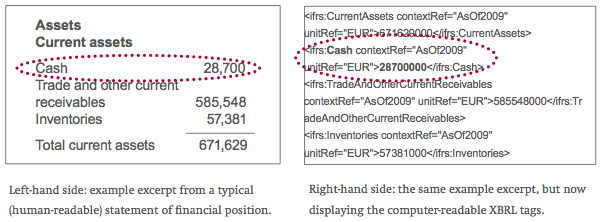

On the left-hand side excerpt, the company’s current assets are listed as six line items of text as they would appear in a statement, starting with Assets, Current assets, Cash, etc, and ending with Total current assets. The right-hand side excerpt displays the same information from the same statement. However, the formatting has been removed to reveal the computer-readable XBRL tags concealed beneath the human-readable report.The tags and definitions used in the XBRL taxonomy (which include items such as and ) are stored in a format which can then be processed according to the reporting standards needed.

IFRS produced this handy guide to using XBRL with IFRS reporting.In the example on the right, each item in the balance sheet is labelled according to the taxonomy, the tags include: , and . The balance sheet can then be displayed and formatted into different reports .

XBRL a suitable format for Solvency II

One reason why XBRL is suited for Solvency II reporting is that the taxonomies can be extended to local level. According to the study, “Once a taxonomy has been created at the European level, extensions can be added to cover the particular features of national regulatory frameworks, thus ensuring the homogeneity of the system of information while giving it the flexibility that the framework requires.”

One reason why XBRL is suited for Solvency II reporting is that the taxonomies can be extended to local level. According to the study, “Once a taxonomy has been created at the European level, extensions can be added to cover the particular features of national regulatory frameworks, thus ensuring the homogeneity of the system of information while giving it the flexibility that the framework requires.”

The study concludes, “The advantages of this project [XBRL], together with the particular characteristics of the Solvency II project, show that XBRL is an ideal technology tool that can make a valuable contribution to the reform of the regulatory framework of the insurance sector in Europe.”

*Enrique Bonsón, Virginia Cortijo, Tomas Escobar, Francisco Flores, Sergio Monreal, (2010) “Solvency II and XBRL: new rules and technologies in insurance supervision”, Journal of Financial Regulation and Compliance, Vol. 18 Iss: 2, pp.144 – 157.

Versions of the article were published on XBRL Blog Magazine and the Random Comments blog. A version of the article in Spanish can be found on the Insare website: XBsRoLvency II: Exprésalo en XBRL.]]>

3 thoughts on “XBsRoLvency II: Say it with XBRL”

Comments are closed.