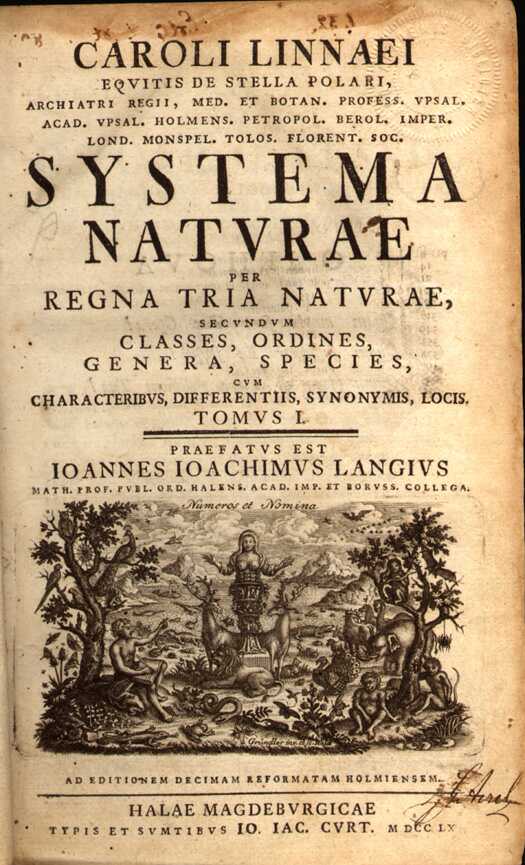

‘Systema Naturæ: Per Regna Tria Naturæ, Secundum Classes, Ordines, Genera, Species, Cum Characteribus, Differentiis, Synonymis, Locis’, was published in 1758 by the Swedish botanist Carolus Linnaeus. The book introduced a classification of the natural world into the three kingdoms, Animal, Plant and Mineral, which we still use today. It is considered to be the genesis of modern scientific taxonomy.

Firms coming to grips with the Solvency II reporting templates for asset management would be envious of such a universally accepted taxonomy. They must provide details of individual securities and their issuers for all the assets held in their portfolio.

This is proving challenging as they operate in a complex investment universe that has multiple systems of asset identification, that must, at times, seem as chaotic and random as the natural world before Linnaeus stamped his taxonomy on it.

There are 170 cells in the nine reporting templates relating to asset management in the EIOPA consultation on Pillar III reporting (CP009), published last November. It is estimated by some that as many as half could not be filled because the information is either not easily available, not currently collected in a systematic way, or simply does not exist.

Testing the templates

EIOPA received about 6,000 comments from about 60 interested parties to the entire consultation. And although the templates are yet to be tested to their full extent, some insights into how they might work in practice can be gained from a reporting dry run conducted by RSA in Autumn 2011.

The exercise was based on the templates issued for informal consultation in January 2011 and the draft Level 2 text as at February 2011. The group’s findings, especially on reporting for asset management, echo many of the concerns raised by asset managers.

“As an industry we are starting to get a coherent reporting package and I would say that we now know 80-90% of what we will have to do in the end,” David Innes, Head of Economic Capital at RSA who leads RSA’s Solvency II Programme, said.

“There aren’t huge things that are wrong with the reporting package, but there are some very practical difficulties that vary by country, firm, type of business line, and experience.”

RSA is a non-life group which has 16 EEA entities and operates across 130 countries. At the time of the dry run, the group’s asset portfolio holdings consisted of close to 80% bonds, 8% equities, 7% cash and the remainder in property, structured products and other holdings.

Inconsistencies uncovered

The dry run uncovered a number of inconsistencies in definitions and terminology across the reporting templates.

“Some forms, for example, are driven around accident year while others are driven around underwriting year,” Mr Innes said.“ This might not sound like a very big deal but if your systems are all set up to deliver accident year information, converting to underwriting year can be costly and time consuming.”

Mr Innes said they also found variations in the general glossary, although these were sometimes due to national differences. “A term might be used in one way in one form and slightly differently in another form. Or actually meaning that has been ascribed to it is not the commonly held view. Or it might be the commonly held view in say Germany but in Denmark it might be slightly different.”

For example, the group found that where RBNS (Reported But Not Settled) claims are reported these can be understood to be case reserve only or case reserve plus IBNER (Incurred But Not Enough Reported). According to Mr Innes such inconsistencies highlight the importance of having a common taxonomy and dictionary.

Reporting templates for asset management

In the reporting templates for asset management (templates Assets D1 to D6) the group found that reporting across a number of entities also contributed to the confusions.

“What one entity might call ‘Exchequer ten percent 2014’, someone else in another entity might call ‘Exchequer ten percent 14’ instead,” Mr Innes said. “So if I have ten operations in the group I might have the same asset subtly called a different name. But the situation is even worse if you then try to do it across the industry, which is one of the financial stability objectives,” he added.

The group also found that operating globally amplified the problem. According to Roni Ramdin, Solvency II Disclosures Workstream Lead at RSA, “When it came to asset data there were a lot of fields that couldn’t be populated because of the lack of uniformity between jurisdictions. We are an international group so we were also seeking information from non EEA territories.”

Asset identification

These difficulties encountered during the dry run echo observations from others across the industry and highlight the fact that there isn’t a single unified international system of asset identification and classification.

In the absence of such a system, insurers and asset managers rely on a number of existing commercial codes such as CUSIP, ISIN or Bloomberg tickers.

What’s more, they might use an internal identification system, instead of, or alongside, one of the internationally recognised ones. No singular system covers the entire investment universe across all geographic locations, nor does it classify individual issuing entities. The templates do require filers to identify the type of ID Code used (Assets D1 – cell A4 & A5) but this does little to help resolve any inconsistencies.

Counterparty identification

The reporting templates also require the identification of the ultimate parent of the issuer and any counterparties (Assets D1 – cell A7 (list)), to help assess default and concentration risk. Here too there is no single agreed identifier.

In its response to the EIOPA consultation, the ICMA Solvency II Working Group, an industry body representing the asset management industry, stated, “Currently each data provider manages the data in isolation, which creates differences and inconsistencies across providers.”

The working group stressed the need for standard issuer data “that will allow the industry to meet the quality requirements, completeness, accuracy and appropriateness [of the reporting].”

There are a number of global industry initiatives in place to create a more uniform and consistent system of asset and counterparty identification, notably the Legal Entity Identifier (LEI) initiative, which aims to create a unique identification code for corporate entities engaged in financial transactions.

The initiative has been endorsed by the G20 Finance Ministers and Leaders, the Financial Stability Board, and has the support of many regulatory agencies and trade associations around the globe. GFMA has taken the lead in developing an industry consensus recommendation for a global LEI solution.

A test file of provisional legal entity identifiers was released in January this year. However it is unlikely to be integrated into the current Solvency II reporting, and the effort is only focused on identifying corporate entities not individual securities.

Complementary Identification Codes

EIOPA has introduced a Complementary Identification Code (CIC) table with the reporting templates. The code combines an asset’s characteristics and risk exposure, allowing supervisors to perform different aggregations and analyses by classes of securities. And it could also help overcome some of the inconsistencies in asset identification used by different filers. However it does little to help in their reporting efforts as the CIC still requires an asset ID code, such as ISIN or CUSIP.

While the CIC table is unique to EIOPA it is compatible with the classification used by the EBA. “The CIC is not to be considered as a global identifier, as it does not identify the unique asset but allows different aggregations per class of assets,” EIOPA told Solvency II Wire.

“However,” EIOPA added, “the CIC code is compatible with the one used by EBA, meaning that a transposition table between CIC and CFI (Classification of Financial instruments – ISO 10962) is possible.”

Look-through data

Both asset and issuer identification are of great importance for look-through reporting into investment funds.

Of all the reporting requirements for asset management – and possibly across the entire spectrum of Solvency II – look-through is proving to be one of the most contentious.

The ICMA Working Group raised concerns about the complexity and cost of look-through reporting on a line-by-line basis. Instead it favours reporting on an aggregate basis. “The increasing complexity of cross-border security transactions and assets management may impede timely data retrieval and consistency in data format … expected by the look-through,” it stated in its response to the consultation.

The working group also noted the difficulties associated in reporting counterparty and ultimate parent information of assets in investment funds, especially for fund-of-funds and fund-of-hedge funds.

Nelly Cotelle, co-secretary of the ICMA Solvency II working group, told Solvency II Wire, “In the case of large and disseminated portfolios, obtaining information about the ultimate parent hierarchy in order to identify all exposure is not easily possible. First, because the information might vary because of activities such as mergers and acquisitions. Second, all data vendors do not produce the same result for the same issuer hierarchy.”

“The multiplication of sources giving different results, creates inconsistencies and could prevent regulators from correctly monitoring risks,” she added.

However, Ms Cotelle, noted that as yet the working group was unaware of any research that directly links the line-by-line reporting with increased complexity and costs. “At the moment, these are issues that are being discussed among various industry groupings, such as the ICMA Working Group. Industry participants look forward to further regulatory guidance in order to shape an appropriate response.”

Collateral data

The regulator is also asking for look-through information on assets held for stock lending and collateral (Assets D6). During the RSA dry-run similar difficulties were experienced in filling in these forms, especially when assets were held with a custodian.

According to Mr Ramdin, the information available from the custodian is limited, which has meant some parts of the form could not be filled or only aggregate information could be supplied.

“We know that we have baskets of collateral equal to a percentage of what we have lent. But we don’t know the components of that basket as that changes daily. So we just have to say we have a basket of say gilts or corporate bonds equal to a certain amount. There is no way around it. And we are asking in our response to EIOPA to please confirm this is acceptable,” Mr Ramdin said.

The quest for a common identifier

The Solvency II Pillar III reporting requirements for asset management highlight the need for a unified system of identification of both assets and issuers. Given the complexity of global markets and the existence of multiple systems of identification this may be unattainable. But as global trends move towards giving regulators more information for macro-prudential supervision, perhaps it is time for a little ‘Systema Naturæ’ treatment for the investment universe.

—

To subscribe to the Solvency II Wire mailing list for free click here.

I fully agree that the above mentioned issues are the most important challenges in solvency II

However, there are other solutions than the above mentioned to adress theses issues

Best regards Niels Peter / Forca / Denamrk

Niels

Thanks for your comment. What other ways would you suggest?

Gideon