Category: SFCR Analysis

Analysis of the Solvency II public disclosures

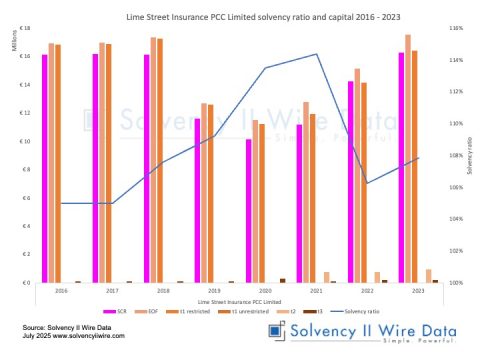

Solvency II figures signal Premier Insurance failure

October 17, 2025

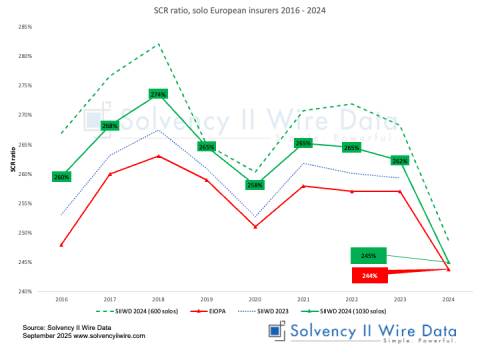

Exploring the state of the insurance market

September 7, 2025

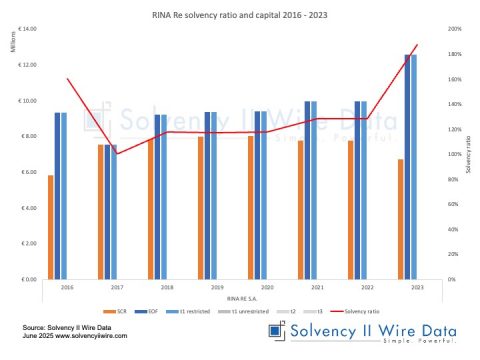

RINA Re solvency ratio and capital 2016 – 2023

June 26, 2025

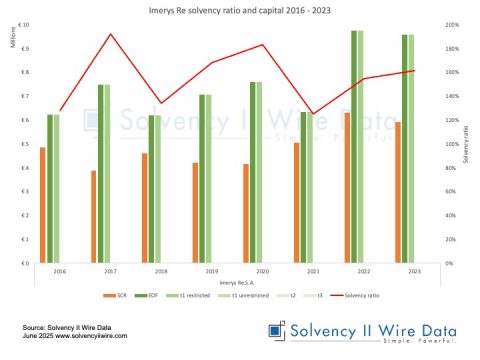

Imerys Re Solvency II disclosures 2016 – 2023

June 25, 2025

Maersk Insurance AS Solvency II figures 2023

June 23, 2025

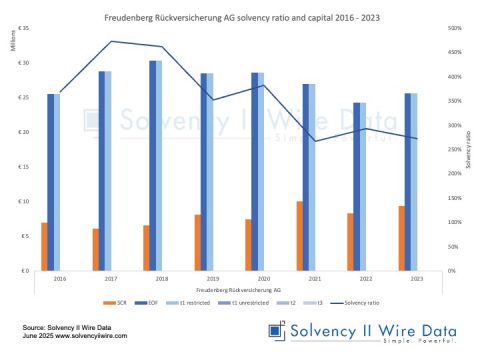

Freudenberg Rückversicherung AG SFCR 2016 – 2023

June 23, 2025

Czech Republic insurance market analysis

June 11, 2025

SFCR 2024: Solvency UK groups capital ratios

May 27, 2025

AXA 2024 SFCR: ratio down, EOF & SCR up and down 3%

May 22, 2025

Allianz 2024 SFCR: solvency ratio down, sub-debt up

May 22, 2025