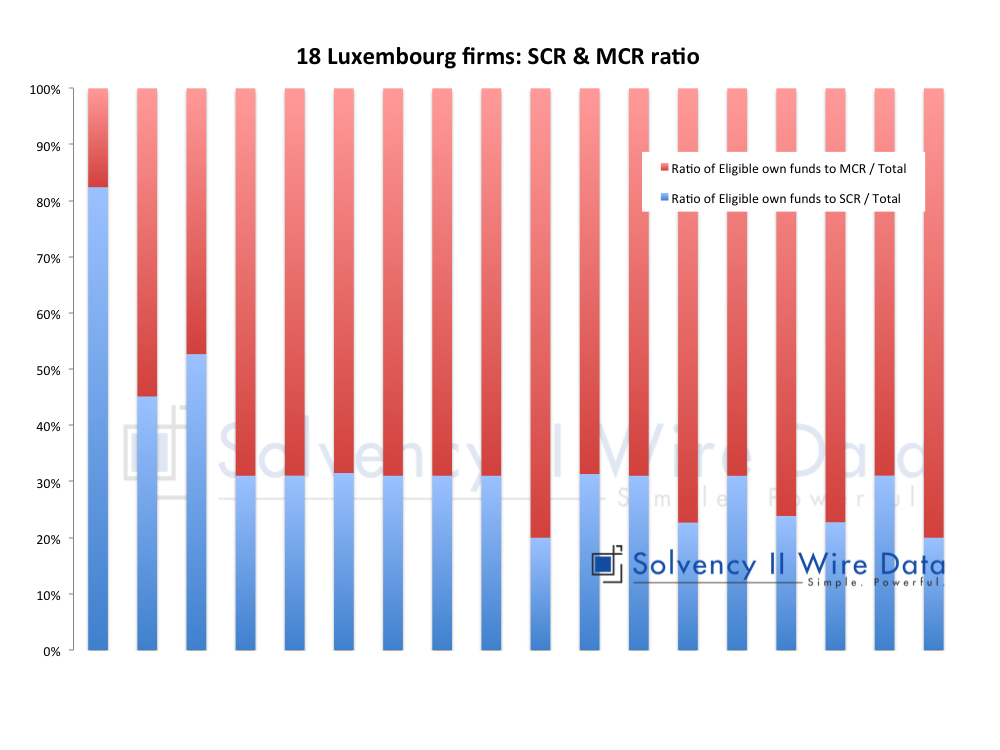

18 Luxembourg firms: SCR & MCR ratio

The first of the three charts below looks at the relationship between the SCR and MCR coverage ratios. It shows two instances in which the SCR is higher than the MCR (left side of the chart).

The range of ratios is much narrower than the sample of the German market (see Solvency II Wire 14/6/2017). The SCR ratio ranges from 130% to 892% and the MCR ratio ranges from 191% to 1379% … Article continues on Solvency II Wire Data (free to access, registration required)

The range of ratios is much narrower than the sample of the German market (see Solvency II Wire 14/6/2017). The SCR ratio ranges from 130% to 892% and the MCR ratio ranges from 191% to 1379% … Article continues on Solvency II Wire Data (free to access, registration required)

Working with SFCRs and QRTs on Solvency II Wire Data Filter to SFCR Analysis from Gideon Benari on Vimeo. SFCR Exposures Chart from Gideon Benari on Vimeo.]]>