Details are emerging on the thinking behind EIOPA’s interim measures and how National Competent Authorities (NCAs) may respond to them. The Guidelines on the application of the interim measures were issued in March, on a comply or explain basis, and NCAs will have to notify EIOPA if they intend to comply with the Guidelines within two months of the final draft being published. A public consultation is currently being held until 19 June and a final draft is expected to be published in September 2013 (Solvency II Wire 4 March 2013).

Dealing with missing legal framework

Much of the success of the interim measures will depend on the level of compliance with the Guidelines. One key obstacle is that in some member states the legal framework to apply the rules is not yet in place. EIOPA says it is aware of these limitations but is optimistic that a sufficient level of compliance will be achieved despite this. Patrick Hoedjes, Director of Operations at EIOPA told Solvency II Wire in an interview, “The expectation is that we will also have some explanations, not only compliance. A further expectation is that the majority of members will comply, maybe not in the first stage, but certainly in the later stage of the preparatory period.” Having to agree to take action while knowing that the legal framework to apply the Guidelines was not yet in place in all countries was a difficult decision for some members of the EIOPA Board of Supervisors (BOS). “It is not something in the DNA of a supervisor to say ‘yes’ to something at a European level which you know you cannot fully comply with at a national level,” Mr Hoedjes said. “I think they [BOS members] have been quite courageous to go in that direction. That is the only way we could issue meaningful guidelines.” Jan Parner, Deputy Director General, Danish Financial Supervisory Authority, and a current member of the EIOPA BOS said one of the reasons it was possible to go ahead with the Guidelines is that the interim measures are in effect an elaboration of the IAIS Insurance Core Principles (ICPs), already adopted by member states. Mr Parner told Solvency II Wire that on the whole, the Danish regulator viewed the Guidelines as something very positive. “Denmark will be able to comply with a good portion of the guidelines. However we currently do not have the legal framework for the reporting package proposed.” The Danish regulator will assess the requirements once the guidelines are finalized. One of the reasons the reporting requirements in the interim measures are so contentious is because they are not part of the ICPs. In the reporting Guidelines EIOPA has proposed that, “Data should be used only for the purpose of assessing and improving preparedness for Solvency II requirements.” But Mr Parner dismissed the idea. “The Danish FSA will be unable to see a reported balance sheet and not act on it if the company has breached its SCR or MCR,” he said.Picture of compliance

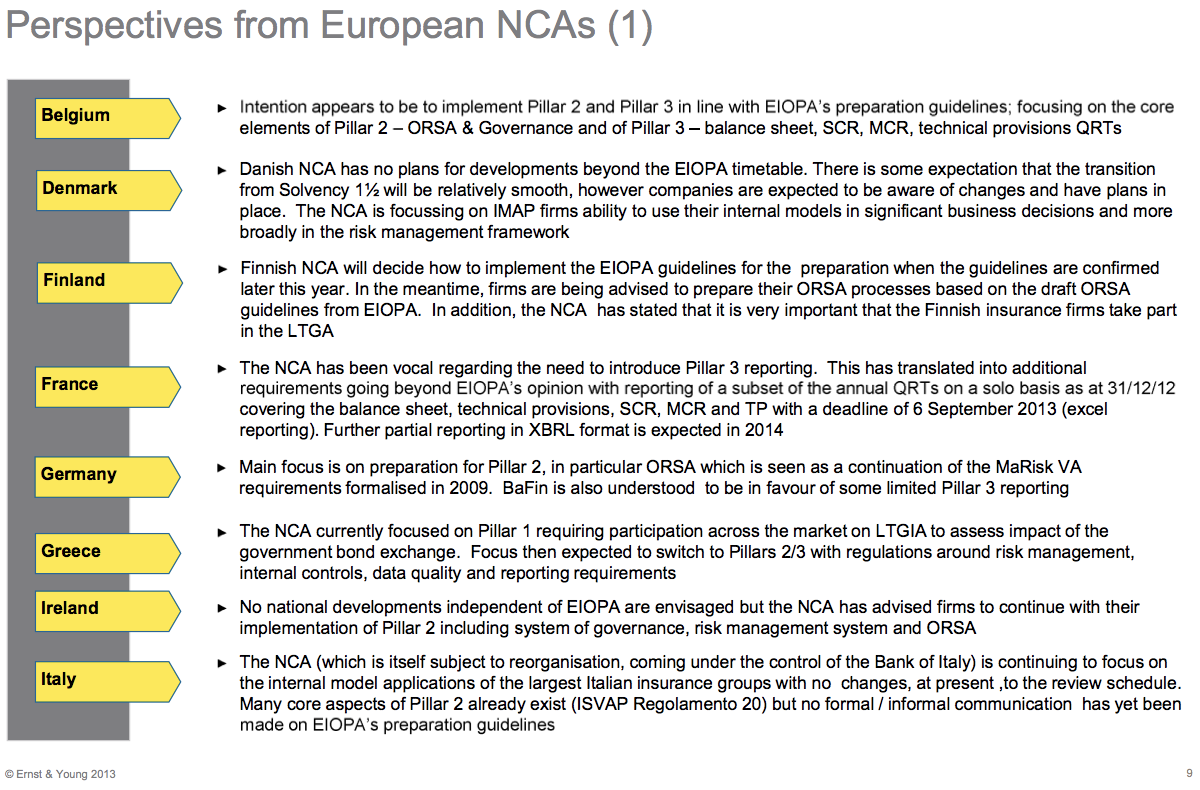

[caption id="attachment_84989" align="alignright" width="155"] Perspectives from NCAs 1 SOURCE: Ernst & Young[/caption]

[caption id="attachment_84988" align="alignright" width="155"]

Perspectives from NCAs 1 SOURCE: Ernst & Young[/caption]

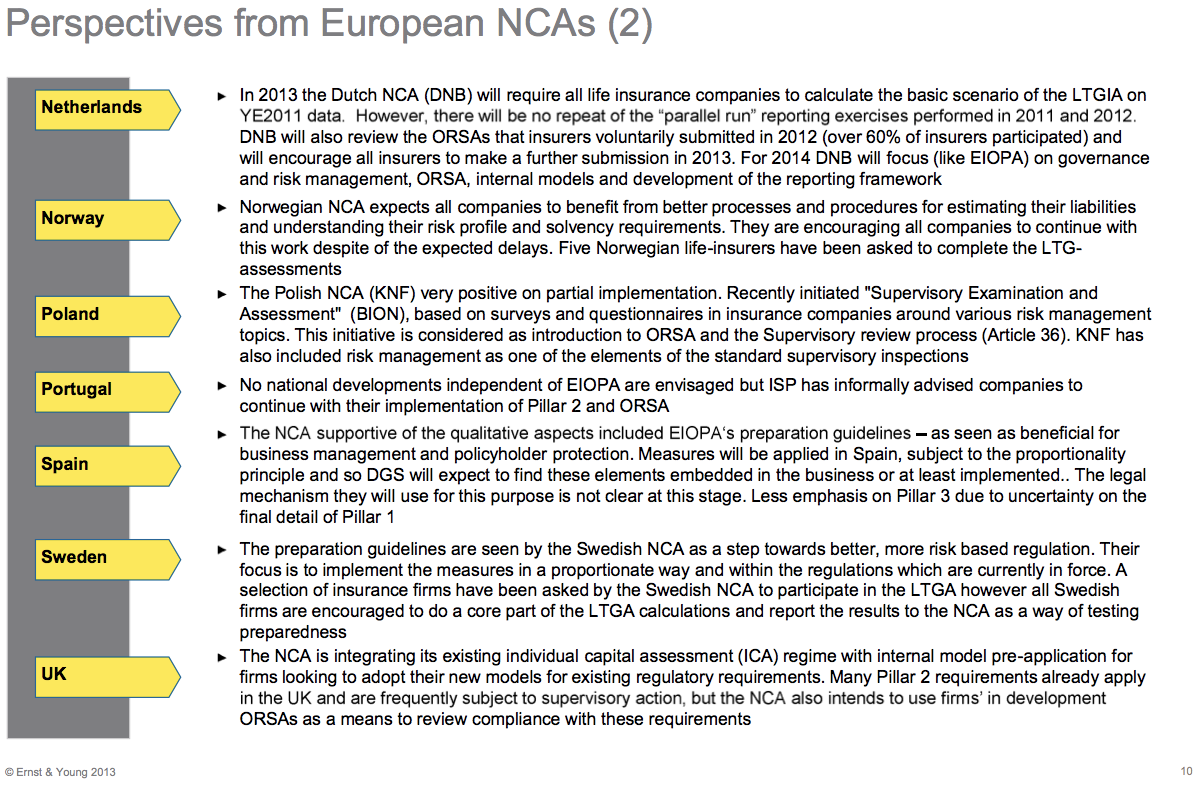

[caption id="attachment_84988" align="alignright" width="155"] Perspectives from NCAs 2 SOURCE: Ernst & Young[/caption]

A sense of the potential level of compliance by NCAs and the current gaps in the legal frameworks can be ascertained from a recent report by Ernst & Young. The report includes a useful chart (RIGHT) outlining some of the key aspects affecting each member state. Although the information is based on a range of sources and is by no means comprehensive, it gives some indication of how NCAs would approach the guidelines.

“There is clearly a danger that, given the different focus areas of the NCAs, implementation speed and methods start to diverge between member states,” Gareth Mee, Senior Manager, European Risk and Actuarial Services, Ernst & Young, said. This divergence may cause difficulties for multinational insurers simultaneously subject to similar but distinct requirements.

Mr Mee also noted the significance of reporting and operational issues to be considered. “Insurance companies are now on a glidepath to Solvency II but existing requirements are not ‘switched off’ yet and won’t be until the formal implementation. Despite this, we believe that maintenance of momentum is important and so overall we view the developments as positive for the industry.”

Perspectives from NCAs 2 SOURCE: Ernst & Young[/caption]

A sense of the potential level of compliance by NCAs and the current gaps in the legal frameworks can be ascertained from a recent report by Ernst & Young. The report includes a useful chart (RIGHT) outlining some of the key aspects affecting each member state. Although the information is based on a range of sources and is by no means comprehensive, it gives some indication of how NCAs would approach the guidelines.

“There is clearly a danger that, given the different focus areas of the NCAs, implementation speed and methods start to diverge between member states,” Gareth Mee, Senior Manager, European Risk and Actuarial Services, Ernst & Young, said. This divergence may cause difficulties for multinational insurers simultaneously subject to similar but distinct requirements.

Mr Mee also noted the significance of reporting and operational issues to be considered. “Insurance companies are now on a glidepath to Solvency II but existing requirements are not ‘switched off’ yet and won’t be until the formal implementation. Despite this, we believe that maintenance of momentum is important and so overall we view the developments as positive for the industry.”