Solvency II is the Basel III of the insurance world. It is the new capital adequacy regulation for the industry: ensuring insurers have sufficient funds to cover their future liabilities. Its effects could carry far beyond the specialised realm of insurance and reinsurance.

Solvency II is a bit of a nightmare, and not only because you don’t quite know which term to google: solvency two’, ‘solvency II’ or ‘solvency 2’, but because it’s demanding the industry make major changes in a short space of time. What’s more, these changes are still being defined as firms are told to be ready for implementation by January 2013.

So here is a menu du jour of some of the issues the Directive will dish-up. Broadly speaking they divide into two: the effects on individual firms and the effects on markets, with a healthy dose of crossover between the two. But first un petit aperitif, some background if you like. The FSA describes the Solvency II Framework Directive as follows (my bold):

“Solvency II will set out new, stronger EU-wide requirements on capital adequacy and risk management for insurers with the aim of increasing protection for policyholders. The strengthened regime should reduce the possibility of consumer loss or market disruption in insurance.”The Directive is about much more than capital reserves, it engages with the governance and supervisory processes as well as reporting disclosures of firms.

Looming deadlines and moving goal posts

The first of the issues affecting firms is the looming deadline and its shifting-goal-posts requirements. Between August and November 2010 firms ran Quantitative Impact Study 5 (QIS 5, pronounced quiz five). The QISs test the “financial impact and suitability” of the Directive. Findings from this latest QIS are due to be published in the coming months and will feed back to Brussels to help shape the final draft. The moving posts (QIS is only one of a number of causes) make it very difficult to know quite how much to invest and what to focus on. According to a panel of experts discussing the issue on a recent Deloitte webinar, firms face a real danger of over investing and misallocating resources in their Solvency II preparations.More data, better data

Whatever shape the final regulation takes, its scope is such that firms need to gain a better understanding of their business model and risk exposure. This means collecting more data and better quality data. Under Solvency II firms are required to use a standard capital adequacy model or an internal model (or a combination of the two). In either case the regulator will have to be satisfied that they are sufficiently robust. This is where data is critical.Are we ready?

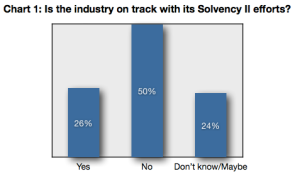

[caption id="attachment_218" align="alignright" width="300"] Source: Deloitte[/caption]

It is unclear just how prepared the industry is for the 2013 deadline. While many of the large firms already have dedicated Solvency II teams in place some evidence would suggest the industry as a whole is lagging. In a survey conducted during the Deloitte webinar only a quarter of the 142 respondents thought the industry was not on track with its Solvency II efforts.

[caption id="attachment_219" align="alignright" width="300"]

Source: Deloitte[/caption]

It is unclear just how prepared the industry is for the 2013 deadline. While many of the large firms already have dedicated Solvency II teams in place some evidence would suggest the industry as a whole is lagging. In a survey conducted during the Deloitte webinar only a quarter of the 142 respondents thought the industry was not on track with its Solvency II efforts.

[caption id="attachment_219" align="alignright" width="300"] Source: Deloitte[/caption]

More telling was the fact that 80% answered ‘no’ to the question: “Do you think that over half of your organisation understands what Solvency II means for their department?”

Still the UK is ahead of the curve compared with the rest of the continent which appears set to stick with the standard model. So issues of competitiveness and regulatory arbitrage may arise.

Source: Deloitte[/caption]

More telling was the fact that 80% answered ‘no’ to the question: “Do you think that over half of your organisation understands what Solvency II means for their department?”

Still the UK is ahead of the curve compared with the rest of the continent which appears set to stick with the standard model. So issues of competitiveness and regulatory arbitrage may arise.

Out of equities – Serengeti-style mass migration

Considering the effects on markets, Solvency II is likely to have implications beyond insurance on both bonds and equities. In its current state the Directive requires firms to hold between 30%-40% capital reserves against their equity portfolio. The capital costs could trigger a Serengeti-style mass migration out of equities by pensions funds and insurers. Given that in 2010 global pension assets were valued at $31.1 trillion, with UK alone accounting for $2.5 trillion, this could move the market. In France, for example, insurers are the largest institutional investors. Andrew Clare, professor of asset management at London’s Cass Business School, told the FT in January: “If [European insurers] start divesting their equity holdings, which represent over 80 per cent of euro-area gross domestic product, and increase their holdings of government bonds, the consequences for financial market prices in Europe could be large.”Long-short bond paradox

The Directive will also throw a curveball into some bond holdings. In response to my question on the webinar, Peter Vipond, Director of Financial Regulation and Taxation at ABI, said that under the current requirements long dated bonds will be more expensive to hold than short dated ones. We could, therefore, see a bizarre situation in which pension funds use short term bonds to cover long term liabilities.Global take-up

On a global scale there are questions about the US and Asia implementing similar measures. According to one survey insurers in Asia have shown positive signs towards introducing a similar regulatory regime. While questions remain about a Solvency II-style regime in the US. The consensus view is that Solvency II is both necessary and likely to have a positive effect on firms and the industry as a whole. But it is worth remembering that regulation, while necessary, can have unpredicted side effects. Think SOX 2002 or 401(K) in the late 1970s: a plat d’accompagnement that may not be so welcome. ..]]>

..]]>

Thank you for the contribution to the Sol II debate. You are highlighting two major issues: data quality and readiness (or lack of) – both extremely important. I am finding that insurers are not paying enough attention to data quality, nor do they focus on setting the right framework. Lani