QIS5 results earlier this month take the industry a step closer towards implementation of Solvency II. As the 2013 deadline approaches it revives questions about the complex relationship between the insurance industry and the financial crisis.

Impact on the insurance sector

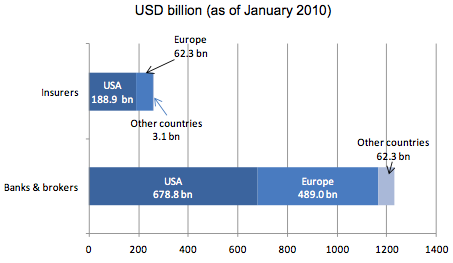

The combined write-down and credit losses from the financial crisis for both the banking and insurance sectors is reported to be $1491 billion (see Figure 1). The insurance sector reported 17.5% of that loss – $261 billion. [caption id="attachment_327" align="alignright" width="326"] Figure 1. Write-downs and credit losses in the banking and insurance sectors worldwide, Source: Bloomberg in OECD 2010[/caption]

In Europe the sector lost only 11.3% of the combined losses for the two industries. A mere $62.3 billion out of $551 billion total losses on the continent.

The figures reflect the relative resilience of the industry to financial shocks. In a 2009 report, Insurance Companies and the Financial Crisis, the OECD explains that overall the industry had a “stabilising” effect on the system:

“Insurance companies are large investors and they (especially life insurers) typically have longer-term investment horizons than several other financial institutions such as banks. They thus have the capacity to hold a relatively large part of their investments to maturity, which helps the system withstand short-term shocks. In contrast, some other types of market participants have had to sell into falling markets as a result of leverage, liquidity, regulatory and other considerations.”

Figure 1. Write-downs and credit losses in the banking and insurance sectors worldwide, Source: Bloomberg in OECD 2010[/caption]

In Europe the sector lost only 11.3% of the combined losses for the two industries. A mere $62.3 billion out of $551 billion total losses on the continent.

The figures reflect the relative resilience of the industry to financial shocks. In a 2009 report, Insurance Companies and the Financial Crisis, the OECD explains that overall the industry had a “stabilising” effect on the system:

“Insurance companies are large investors and they (especially life insurers) typically have longer-term investment horizons than several other financial institutions such as banks. They thus have the capacity to hold a relatively large part of their investments to maturity, which helps the system withstand short-term shocks. In contrast, some other types of market participants have had to sell into falling markets as a result of leverage, liquidity, regulatory and other considerations.”

Role of the insurance sector in causing the crisis

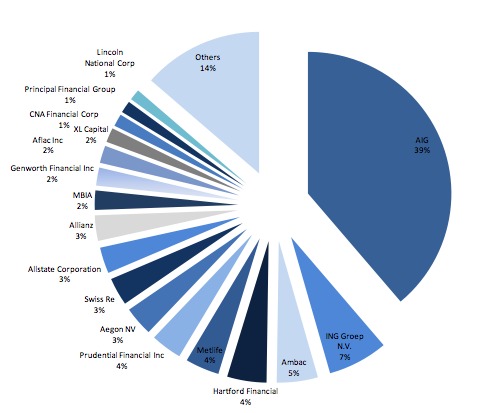

Despite this stabilising effect, certain practices within the sector contributed to the crisis. As the OECD notes in another report, the sector cannot distance itself from its negative contribution: “The insurance sector played an important supporting role in the financial crisis by virtue of the role played by financial guarantee insurance in wrapping, and elevating the credit standing of, complex structured products and thus making these products more attractive to investors and globally ubiquitous.” [caption id="attachment_329" align="alignleft" width="310"] Figure 2. Write-downs and losses at selected insurance companies, Since beginning of 2007, total of USD 261.2 billion Source: Bloomberg in OECD 2009[/caption]

Referring specifically to Credit Default Swaps (CDS), Tom Wilson, CEO of the insurer Allstate, elucidates this point. “It was, after all, an insurance product that contributed to the risk that almost brought down the global economy.”

The involvement of individual insurance firms is reflected in AIG’s share of write-down losses. A closer analysis reveals that four companies were responsible for just over half of the $261 billion worldwide loss (see Figure 2). Of these, one single company, AIG, lost 39%, that is $101.8 billion. Put another way, AIG reported losses equivalent to 6.8% of the worldwide losses from the financial crisis.

Plans to reform the regulation were already in motion before the crisis but were given a substantial impetus in its aftermath. Any criticism of the reform should be weighed up against the close relationship between the two sectors.]]>

Figure 2. Write-downs and losses at selected insurance companies, Since beginning of 2007, total of USD 261.2 billion Source: Bloomberg in OECD 2009[/caption]

Referring specifically to Credit Default Swaps (CDS), Tom Wilson, CEO of the insurer Allstate, elucidates this point. “It was, after all, an insurance product that contributed to the risk that almost brought down the global economy.”

The involvement of individual insurance firms is reflected in AIG’s share of write-down losses. A closer analysis reveals that four companies were responsible for just over half of the $261 billion worldwide loss (see Figure 2). Of these, one single company, AIG, lost 39%, that is $101.8 billion. Put another way, AIG reported losses equivalent to 6.8% of the worldwide losses from the financial crisis.

Plans to reform the regulation were already in motion before the crisis but were given a substantial impetus in its aftermath. Any criticism of the reform should be weighed up against the close relationship between the two sectors.]]>