![]() France is surging ahead with preparations for Solvency II. Despite being unable to comply with the governance Guidelines, the French regulator has already set a number of initiatives in motion and is planning an intensive work programme for the next two years, embracing the EIOPA Guidelines and using them to prepare the market and testing firms’ readiness for Solvency II.

“We fully support the principle of these Guidelines and we also fully support the fact that we need to be prepared and have a very strong preparation plan with our market,” Romain Paserot, Director of Cross-functional and Specialised Supervision and Head of Solvency II Project at the Autorité de contrôle prudentiel (ACPR) told Solvency II Wire in an interview at the end of last year. “In some areas we have decided to go further than the interim Guidelines,” he added.

The ACPR will be expecting all firms affected by Solvency II to take part in the reporting exercises over the next two years, including look-through reporting on a best-effort basis. Firms are also expected to complete all three assessments of the ORSA in 2014 – not only the assessment of overall solvency needs stipulated in the FLAOR Guidelines.

France is surging ahead with preparations for Solvency II. Despite being unable to comply with the governance Guidelines, the French regulator has already set a number of initiatives in motion and is planning an intensive work programme for the next two years, embracing the EIOPA Guidelines and using them to prepare the market and testing firms’ readiness for Solvency II.

“We fully support the principle of these Guidelines and we also fully support the fact that we need to be prepared and have a very strong preparation plan with our market,” Romain Paserot, Director of Cross-functional and Specialised Supervision and Head of Solvency II Project at the Autorité de contrôle prudentiel (ACPR) told Solvency II Wire in an interview at the end of last year. “In some areas we have decided to go further than the interim Guidelines,” he added.

The ACPR will be expecting all firms affected by Solvency II to take part in the reporting exercises over the next two years, including look-through reporting on a best-effort basis. Firms are also expected to complete all three assessments of the ORSA in 2014 – not only the assessment of overall solvency needs stipulated in the FLAOR Guidelines.

Mr Paserot dismissed the idea that the Guidelines will be counter productive and create duplication of work. “I think that this rationale has disappeared with the agreement reached on Solvency II because now they [firms] have to work to be prepared for 2016. So it’s not counter-productive, it’s productive because it makes it possible for firms to get prepared for their new prudential framework.”

Mr Paserot dismissed the idea that the Guidelines will be counter productive and create duplication of work. “I think that this rationale has disappeared with the agreement reached on Solvency II because now they [firms] have to work to be prepared for 2016. So it’s not counter-productive, it’s productive because it makes it possible for firms to get prepared for their new prudential framework.”

Three principles

Three underlying principles are at the core of the French regulator’s approach: a holistic view of Solvency II, dialogue based on concrete information, and a firm belief that the interim period is as much about identifying gaps in firms’ systems as it is about preparing for implementation. The ACPR wants the market to be prepared for the full framework, which means working on all three pillars. “It is convenient to say there are three different pillars in Solvency II, but in fact the pillars are clearly connected.” To that end the regulator will expect to see progress across the board. There is also a strong emphasis on creating a dialogue between firms and the regulator (a stated objective of the Guidelines) based, as much as possible, on real information. Going beyond the EIOPA thresholds for reporting and ORSA is seen as a vital step for facilitating the process. “In our preparatory plan we would rather have people doing exercises in 2014 and 2015 – even if it’s not of a very high quality in 2014 – just to make sure that they have a dialogue with the supervisors on their preparation based on concrete elements in the year 2014 and also in 2015.”Governance: une tempête dans un verre d’eau

France caused a minor ‘tempête dans un verre d’eau’ last December when it announced non-compliance with the Guidelines on Systems of Governance (SOG) because it is waiting a change in the legislation that will only be made when the Directive is transposed into national law (by 31 March 2015). Even so, in its response to the comply and explain exercise the ACPR states that it is able to comply with five of the SOG Guidelines including those on Derivatives, Internal Control environment and Monitoring and reporting. And in line with its overall approach to the Guidelines the regulator intends to take action. “Even if we will be non-compliant on the Guidelines we will obviously conduct a close follow-up of undertakings and group preparation regarding governance so it doesn’t mean that we are not going to do anything from a preparatory point of view,” Mr Paserot explained. But the non-compliance may have a limited effect on the ground. According to Louisa Renoux, Head of Solvency II Project at Mutualité Française, a professional association representing French mutual health insurers, waiting for the change in the governance rules will have “no significant impact” on the preparation work of firms. “Our members are already mobilized. Most of them have participated in the 2013 exercise [conducted by the ACPR] and contribute actively to the various working groups organised around Solvency II.” The changes in the rules are also said to be generating a broader discussion about corporate governance in France where the management and the supervisory body must be separate.From FLAOR to ORSA

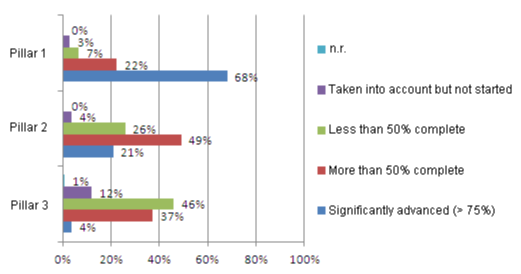

The ACPR said it intends to comply with the FLAOR Guidelines (which are based on the ORSA). The intention rather than compliance is purely technical, as at the time it had not yet communicated its plans to firms. However, the ORSA is proving to be a challenge for the French market. The 2013 ACPR Annual Preparation Survey showed little progress from the previous year. [caption id="attachment_142313" align="alignright" width="313"] Preparation levels by Pillar in 2013

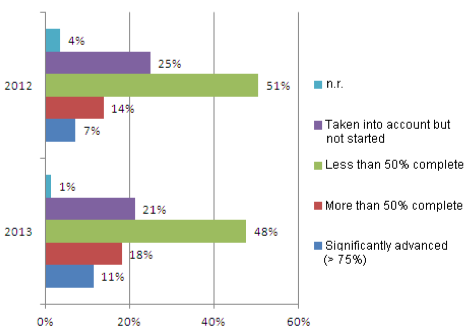

Preparation levels by Pillar in 2013SOURCE:ACPR[/caption] Over 420 of the approximately 600 firms that will be bound by Solvency II took part in the survey. Relatively little progress was made on Pillar II work compared with the previous year (see chart). And although two thirds said they were “more than 50% ready” on their Pillar II work, only 21% declared themselves “significantly advanced”. More telling is the fact that two thirds of respondents to a specific question on ORSA preparation plans said they had completed less than 50% of the work (see chart). [caption id="attachment_142315" align="alignright" width="282"]

ORSA preparation levels

ORSA preparation levelsQuestion: How far advanced are your preparation plans for the ORSA? SOURCE: ACPR[/caption] The ACPR also conducted an ORSA pilot study of ten undertakings to identify some of the key challenges prompted, in part, by the slow progress. Initial findings showed that industry concerns include questions such as the regulator’s expectations, how to define a good ORSA and the content and length of the ORSA report. The results of the study are now available on the ACPR website (in French). Ms Renoux said that as the ORSA is a new concept it has proved a challenge to adapt it to the scale and low risk profile of the association’s members. “We still have difficulties with the request anticipated by the French regulator to perform the assessment of deviations from the assumptions underlying the standard formula calculation.” To help manage the change a common approach was adopted. “As we have specific risk (on complementary health insurance) and democratic governance, we have decided to build and share a common approach on the structure of the ORSA report with an internal working group who worked also on profiles, risk appetite and scenarios,” she said.

Risk elements in place

But, while overall ORSA work is lagging, Mr Paserot noted that the results of the survey showed many firms already have the risk management elements of the ORSA in place. Most firms surveyed said they already conducted a risk mapping, and about two thirds have formalised medium and long term strategies and conducted an analysis of changes in the economic environment and market.“Be convinced and you will probably be able to convince us”

Concerns around the ORSA are one of the reasons the ACPR will go beyond the requirement of the FLAOR Guidelines and expect firms to complete all three assessments. Article 45 of the Solvency II Directive defines three assessments in the ORSA:- Overall Solvency needs, Article 45 (1) (a);

- Compliance on a continuous basis with the capital and technical provisions requirements, Article 45 (1)(b); and

- Assessment of significant deviation of the risk from the assumptions underlying the calculation of the SCR, Article 45 (1) (c).

The EIOPA Guidelines only require firms to perform the first of these in 2014 and there is a threshold on the second.

But it is not just the slow progress and market concerns that are driving the ACPR work programme. It is the belief that the ORSA is a core component of Solvency II and as such a way of assessing gaps in overall preparation. “The two other parts of the ORSA are very helpful for undertakings to think about what they will need in 2016. And should they need undertaking specific parameters, should they need transitional measures and so on, they need to think about it very soon,” Mr Paserot said.

He stressed that firms understand that the ORSA is first and foremost an exercise for them, not the regulator. “It is a very useful tool for the dialogue with your supervisor, when you can show that you have a good understanding of your risk profile, of your situation, that you have done a lot and you are pretty much convinced about your capacity to be solvent in the next year.”

It is also very much in the spirit of the Directive that undertakings are the first judges of the quality of their ORSA. “We will be the second judges, but you have to be the first ones. Be convinced and you will probably be able to convince us.”

The EIOPA Guidelines only require firms to perform the first of these in 2014 and there is a threshold on the second.

But it is not just the slow progress and market concerns that are driving the ACPR work programme. It is the belief that the ORSA is a core component of Solvency II and as such a way of assessing gaps in overall preparation. “The two other parts of the ORSA are very helpful for undertakings to think about what they will need in 2016. And should they need undertaking specific parameters, should they need transitional measures and so on, they need to think about it very soon,” Mr Paserot said.

He stressed that firms understand that the ORSA is first and foremost an exercise for them, not the regulator. “It is a very useful tool for the dialogue with your supervisor, when you can show that you have a good understanding of your risk profile, of your situation, that you have done a lot and you are pretty much convinced about your capacity to be solvent in the next year.”

It is also very much in the spirit of the Directive that undertakings are the first judges of the quality of their ORSA. “We will be the second judges, but you have to be the first ones. Be convinced and you will probably be able to convince us.”

Familiar trappings of the ORSA report

As in other Member States the ORSA report is a sticking point in France. Mr Paserot said that so far they have seen a number of reports that are too long, cluttered with irrelevant information and fail to clearly identify the three assessments. “We think that it is better to have a much more focused ORSA and also to have the ORSA closely reflecting the real questions that you ask yourself about your strategy, your capital adequacy, your reinsurance policy and so on. So we clearly need to have more discussions on that.”A rich profusion of reporting

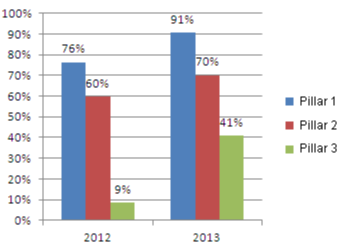

Much of the thinking applied to the ORSA is applicable to the interim reporting requirements, although here too there are specific challenges. Results of 2013 ACPR Annual Preparation Survey show that work on Pillar III is the least advanced. This, again, is in line with the experience of Solvency II work elsewhere. [caption id="attachment_142321" align="alignright" width="211"] Entities declaring themselves more than 50% ready

Entities declaring themselves more than 50% readySOURCE: ACPR[/caption] Encouragingly it is the pillar on which most progress has been made since 2012. The 41% of participants who said they were “more than 50% ready” last year compares favourably with the mere 9% reported in 2012 (see chart). The ACPR also ran a Solvency II reporting exercise in 2013, which may account for the dramatic increase in preparation work. Over 90% of the market responded to the exercise and the ACPR intends to go beyond the reporting thresholds set in the EIOPA Guidelines. “Obviously we don’t want to go back from this good result. But we will use EIOPA thresholds for the quarterly reports,” Mr Paserot said.

Look-through in 2014

In line with its conviction that dialogue should be based on concrete information, the ACPR will also require look-through reporting from 2014, albeit on a best effort basis – a further deviation from the EIOPA Guidelines. “We clearly said that you have to do that on the best effort basis for the interim period. But doing that on the best effort basis does not mean to miss your objective of 2016.”Reporting: as much about governance as it is about IT

Another reason for requesting the look-through reporting is to instil in firms the understanding that reporting is much more than just filling in the templates. Mr Paserot warned that reporting should not be treated as a tool that is tagged on at the end of the process. “You can’t just buy a reporting tool to send reports to the authorities and not ask yourself what information you need, what process you have to put in place and what is the gap between the information that you already have and the information needed to fill this report,” he said, adding that it is as much a question of governance as of IT systems.

“We see some people in the industry that just want to buy the solution in the market. And then when they implement the solution they see, ‘ah well it doesn’t work because we don’t have that data, we don’t have a way to put the data inside the solution we have just bought’.”

It is important that firms are able to deliver reports on a regular basis for all the reporting requirements, not only for look-through. Last year’s reporting exercise revealed that many firms did not have a systematic way of collecting and delivering information. “They [firms] were able to do the reporting but that doesn’t mean that they will be able to fulfil reporting requirements in the regular way under Solvency II at the time that will be required and with enough data quality. So it is very important to have people thinking about the general governance, about the processes.”

For smaller and medium size mutuals, that are currently not bound by IFRS rules and are not used to quarterly monitoring, the impact of the new reporting will be significant, according to Ms Renoux. “The workload, the frequency and the deadlines requested are very challenging. The workload for our small and medium members is such that industrialisation seems necessary.”

“You can’t just buy a reporting tool to send reports to the authorities and not ask yourself what information you need, what process you have to put in place and what is the gap between the information that you already have and the information needed to fill this report,” he said, adding that it is as much a question of governance as of IT systems.

“We see some people in the industry that just want to buy the solution in the market. And then when they implement the solution they see, ‘ah well it doesn’t work because we don’t have that data, we don’t have a way to put the data inside the solution we have just bought’.”

It is important that firms are able to deliver reports on a regular basis for all the reporting requirements, not only for look-through. Last year’s reporting exercise revealed that many firms did not have a systematic way of collecting and delivering information. “They [firms] were able to do the reporting but that doesn’t mean that they will be able to fulfil reporting requirements in the regular way under Solvency II at the time that will be required and with enough data quality. So it is very important to have people thinking about the general governance, about the processes.”

For smaller and medium size mutuals, that are currently not bound by IFRS rules and are not used to quarterly monitoring, the impact of the new reporting will be significant, according to Ms Renoux. “The workload, the frequency and the deadlines requested are very challenging. The workload for our small and medium members is such that industrialisation seems necessary.”

LTG measures in France

A question on many firms’ minds is if they can use any of the measures of the Long-Term Guarantees (LTG) package. Although the measures can be used in any Member State, Mr Paserot highlighted two points firms should bear in mind. “The first is that the LTG package is not applicable as a whole in France. For instance the Matching Adjustment will not be applicable in France because of the nature of our products. So not all the package will be applicable. And the second is that it is very important that the market has a clear view of the fact that most of the measures in the package will require approval by the supervisor.” The latter means that firms must start thinking about the measures they intend to use now in order to begin the approval process. “It is important that people are very clear on their situation now from the point of view of Pillar I calculation. They really need to make some calculations based on different scenarios and to have all these discussions with us very soon.” One of the reasons the regulator is keen for firms to assess their situation as early as possible, and hence its plans to go beyond the EIOPA Guidelines, is that any application of the measures must be viewed on a long term basis. “You have also to keep in mind that some of the measures, for instance the Volatility Balancer, it’s probably for the time being not something needed in the French market because we don’t have a situation calling for that measure. But it might be the case [in the future] so you also have to discuss the choice of the measures not only looking at your situation at one point in time but also looking forward.” Mr Paserot said that transitional measures might be used in the French market but that they would be limited to some specific portfolios. “But it’s a transitional measure,” he stressed. “That means that you have to converge, so it is not something you can just put on your balance sheet and your SCR calculation and say, ‘now I am okay with the supervisor’.”

Regardless of what measures are used they are likely to come under scrutiny by the regulator. “We will look at the choices of the undertakings and make sure that they are not using these measures to hide a problem that has to be solved.”

Mr Paserot said that transitional measures might be used in the French market but that they would be limited to some specific portfolios. “But it’s a transitional measure,” he stressed. “That means that you have to converge, so it is not something you can just put on your balance sheet and your SCR calculation and say, ‘now I am okay with the supervisor’.”

Regardless of what measures are used they are likely to come under scrutiny by the regulator. “We will look at the choices of the undertakings and make sure that they are not using these measures to hide a problem that has to be solved.”

Level 2 uncertainty is no excuse

The Parliament vote on Omnibus II on 11 March secured the legislative path of the Level 1 text of the Directive, giving further assurance to market participants that the 1 January 2016 implementation date will be kept. However considerable uncertainty remains about critical details and calibrations of the LTG measures in the Level 2 text. Not surprisingly Mr Paserot’ approach echoes his response to the arguments about duplication. “We think that is not a reason for doing nothing. One doesn’t have to wait for the full details to start working. So we encourage undertakings to do their best.” He points to the large amount of work that EIOPA did on the LTG assessment last year and that the technical specifications already available are unlikely to be completely reset in the future. Where information is not available or sufficiently clear firms can used proxies and apply proportionality and the principle of materiality. “What you have to do is based on a best current knowledge and best effort basis. And to take into account that your results include some volatility and some sensitivity.” In addition to work by firms and the regulator, the French government has been consulting with stakeholders on elements of transposition of the rules. The consultations are likely to be on going and continue until close to the final transposition deadline (31 March 2015). Solvency II Wire has learned that these discussions are proving challenging in some areas.Lopsided implementation

The French regulator is embracing the EIOPA Guidelines with such gusto. The decision to include the full set of assessments of the ORSA as well as extensive reporting requirements including some delivery in XBRL will put the preparation of French firms at the head of the pack. From EIOPA’s perspective it is unlikely to raise much concerns as these requirements are still fully in line with the final rule. But in the interim period a lopsided implementation may cause some tensions, especially for groups operating cross border. To subscribe to the Solvency II Wire mailing list for free click here. ]]>

]]>