Insurance firms will have to conduct stress and scenario tests on a regular basis as part of their risk management process under Solvency II. These tests will include not only standard stress tests, but also reverse stress tests – effectively stress testing the business to destruction.

Regular stress tests under Solvency II

A stress test, as the name implies, tests the firm’s resilience in the face of adverse market conditions. A set of economic stresses are defined, such as a rise in interest rates or drop in markets, and the firm must then calculate if it has sufficient capital to withstand them.

At the Stress Testing and Operational Risk for Insurers event in October, speakers shared experiences and advice on conducting effective stress testing.

“The stress test is like a radar,” Dan Wilkinson, European Chief Risk Officer at Navigators, told delegates.

“It is just a quick blip showing you where something is and gives you a rough shape for the level of risk that your firm takes.” By comparison, Mr Wilkinson likened the calculation kernel, the technical model used for the quantification of capital requirements for all risk categories, to an MRI scan: giving very detailed information on specific risk exposures.

Under Solvency II, stress testing will not be a one-off event. Regulators want firms to integrate the tests into the firm’s business model, ensuring it is an integral ‘living’ part of its risk management that relates to the business plan.

Victoria Raffé, the FSA’s Head of Insurance Policy, said it was important the stress test had a material effect on the business. “Stress and scenario tests give management the confidence that its business model works and its business plan is the right business plan. If the results don’t affect your business plan or your business model then I suspect that your stresses aren’t strong enough and your management aren’t engaged enough. And I also suspect the regulators will be unhappy.”

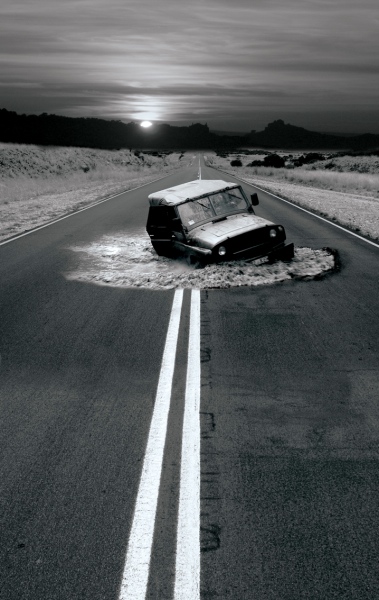

Reverse stress testing the business to destruction

Solvency II will also formalise the reporting of reverse stress tests by insurance firms. These aim to find out what will break the business – that is, make it unviable.

Neal Writer, Group Head of Risk Development at Royal London, explained the difference as follows: “In an orthodox stress test, the scenario is defined and the firm calculates whether they would have the capital necessary to avoid default. In a reverse stress test, the firm identifies scenarios which could threaten its survival, and seeks to take precautions to ensure they can withstand them.”

Mr Writer added that reverse stress tests need to be event driven, focusing on events that cause the most damage.

Solvency II will require the most severe but plausible test and it is up to individual firms to come up with scenarios that meet these criteria and will satisfy both the Board and regulators.

Kevin Borrett, UK Head of Risk at Unum, said firms should be open-minded when approaching the process. “Try to think outside the box. Remember, as you develop your reverse stress test framework you will always lean towards your own preferences.”

“Start with the big picture and think about what are the scenarios, what are the external and emerging events that concern your Board. Then once you start to define those potential scenarios, look at how they impact your business model and then look at the capital implications.”

When is the business ‘broken’?

One of the biggest challenges in developing effective reverse stress tests is defining what makes the business unviable. This, as a number of speakers pointed out, could happen well before the firm runs out of capital.

“The point at which the capital and or liquidity of the firm are exhausted may not be the only point where the business plan or business model fails,” Mr Writer said. “Agreeing what makes the business unviable is one of the most important parts of designing an effective stress test.”

Speakers pointed out that firms must look at the whole picture when considering what could make the business unviable.

“You have to ask yourself, what are the non-financial aspects that could cause the business to fail,” Mr Borrett said. “You need to think about it in the context of your customers and other stakeholders. Reputational risk is absolutely key in this respect. The challenge is how to quantify those risks.”

This message was echoed by Ms Raffe. “Please don’t stop at the financials, it is such a big mistake to do that,” she said. “I see a bit of tendency to focus on capital requirements, lilquidity, etc., but not other important aspects. Your relationship with your customers and what they are thinking about, your reputation, capital quality. It is the total picture that you need to be looking at.”

Solvency II stress testing: its a cultural thing

Lastly, Ms Raffe reiterated the importance of senior management buy-in and the need to embed risk culture in the organisation. “This is not all about process, it is a cultural thing. This culture needs to be internalised and put into practical use within the firm. As a regulator we don’t necessarily have time to see everything you do as part of this process but what we will ask is – ‘What has changed as a result?’”

—

Upcoming event: The 2011 European Solvency II Summit, 13th-14th December, Zurich (10% discount offer – Quote VIP Code: FKM62299S2AR)

Related Articles