Sponsor’s Feature

The Solvency II implementation date is less than one year ahead. In this note Matt Cocke, Consulting Actuary, and Phil Simpson, Principal and Consulting Actuary at Milliman, take a closer look at some of the more notable milestones reached so far in the path towards implementation on 1 January 2016.

The Solvency II implementation date is less than one year ahead. In this note Matt Cocke, Consulting Actuary, and Phil Simpson, Principal and Consulting Actuary at Milliman, take a closer look at some of the more notable milestones reached so far in the path towards implementation on 1 January 2016.

Progress on Draft Delegated Acts

On 10 October 2014, the European Commission adopted the text for Delegated Acts, also known as Implementing Measures. The Delegated Acts are a Level 2 text, and as such they will be binding on national regulators and do not require transposition in local frameworks.EIOPA Publications: ITS and Guidelines

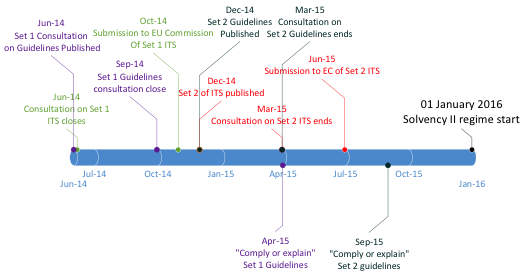

EIOPA recently published a number of Implementing Technical Standards (ITS), Regulatory Technical Standards (RTS) and Guidelines consultation papers. The ITS and RTS are the so called Level 2.5 rules in the EU’s framework: they are drafted by EIOPA and subsequently require adoption by the Commission to be enacted. Like the Delegated Acts, the ITS and RTS do not require transposition into national frameworks. The Guidelines are also drafted by EIOPA. Once finalised, national regulators do not necessarily need to comply with each guideline; however there needs to be an explanation if they do not comply (“comply or explain”). EIOPA’s timetable until 1 January 2016 is crowded, and includes multiple deliveries, as demonstrated in Figure 1. [caption id="attachment_1582695" align="alignright" width="522"] Figure 1: EIOPA timeline[/caption]

The consultation on the first set of ITS and Guidelines ended in June 2014 and they have been submitted to the Commission for adoption. The second set was published in December 2014. The consultation period ends in March 2015, and they are expected to be submitted to the Commission in June 2015.

The consultation on the first set of Guidelines ended in September 2014 and EIOPA expects to start the “comply or explain” process with national regulators in April 2015. The second set was published in December 2014, and the consultation on these closes in March 2015. The “comply or explain” process for these Guidelines is expected to start in September 2015.

Figure 1: EIOPA timeline[/caption]

The consultation on the first set of ITS and Guidelines ended in June 2014 and they have been submitted to the Commission for adoption. The second set was published in December 2014. The consultation period ends in March 2015, and they are expected to be submitted to the Commission in June 2015.

The consultation on the first set of Guidelines ended in September 2014 and EIOPA expects to start the “comply or explain” process with national regulators in April 2015. The second set was published in December 2014, and the consultation on these closes in March 2015. The “comply or explain” process for these Guidelines is expected to start in September 2015.

First set of ITS and Guidelines

The first set of ITS covers the application process for the following topics:- Internal model

- Group internal model

- Matching Adjustment

- Undertaking Specific Parameters (USP)

- Ancillary own funds

- Special Purpose Vehicles

- Contract boundaries

- Technical Provisions

- Ancillary own funds

- Classification of own funds

- Treatment of ring-fenced funds

- Treatment of related undertakings, including participations

- Look-through approach

- Basis risk

- Application of reinsurance for non-life Solvency Capital Requirement (SCR) calculations

- Various Standard Formula SCR components, such as market risk, life underwriting risk and health catastrophe risk

- Loss absorbency of deferred taxes and technical provisions

- USP

- Internal models

- Group SCR

- Equivalence

- Supervisory review process

- Pillar II including ORSA and Governance

Second set of ITS and Guidelines

The second set of ITS covers:- Regional government and local authority exposure

- Adjustment for pegged currencies

- Health equalisation and standard deviations

- Application of the equity transitional

- Transparency and accountability

- Capital add-on

- Assessing external credit rating within the risk management system

- Pillar 3 disclosure

- Index for the equity dampener

- Valuation of assets and liabilities

- Long-term guarantees and transitional measures

- Extension of the recovery period

- Methods to determine market share for exemption to supervisory reporting

- Financial stability reporting

- Reporting and disclosure

- Systematic information exchange within colleges of supervisors

- Third-party branches

Discount rate consultation

On 1 November 2014, EIOPA published a technical consultation paper on setting the risk-free discount rate. The consultation period was relatively short and ended on 21 November 2014. It was a long paper, at 110 pages, with a significant amount of technical content. There are a few items in the paper, which are particularly worthy of comment:- EIOPA have committed to use of the Smith-Wilson method for extrapolation of the yield curve beyond the Last Liquid Point (LLP).

- The paper confirms that swaps with LIBOR floating rate will be used as the starting point for determining the yield curve for the sterling, US dollar and Euro. The Bloomberg tickers for the swaps chosen are given.

- The paper confirms the Ultimate Forward Rate (UFR) as 4.2% p.a. for sterling, US dollar and Euro yield curves.

- There is some further information on the calculation of the Volatility Adjustment and Matching Adjustment.

- There is some further information on the data backing the Credit Risk Adjustment, which lowers the yield curve derived from LIBOR swap rates to compensate for the credit risk embedded within LIBOR.

- The proposed asset mix for the Volatility Adjustment for the UK featured 47.0% fixed interest, which is lower than the Euro-zone (86.9%).

PRA progress

One of the main areas of work the PRA has undertaken on Solvency II is transposition of the Level 1 Framework Directive and Omnibus II into the national framework, such as the Handbook. The PRA’s deadline for completing transposition is 31 March 2015. Another area of focus for the PRA is assessing companies’ ORSAs. Companies were expected to submit an ORSA in 2014 and will be expected to do so again 2015 to a higher standard. It appears that the PRA is closely linking the ORSA with the Standard Formula. In 2014 it started the process for reviewing the appropriateness of the Standard Formula for priority companies, which will be extended to other companies this year. The starting point for the assessment will be the ORSA. In a presentation in October 2014, the PRA stated that key areas of focus would be:- Longevity risk, where companies have unusual concentrations. For example, this could be caused by enhanced annuities.

- Equity risk, due to an active investment strategy or a concentrated equity portfolio.

- Credit risk, where the credit portfolio held may not be well represented by the Standard Formula.

- Operational risk, where companies outsource or have a range of legacy systems.

- Pensions scheme risk.

- On-going conversation and post-ORSA review action plan.

- Company-initiated action such as USP or partial internal model.

- PRA-initiated action including USP, partial internal model or capital add-on.

Standard Formula review

The PRA’s Standard Formula review process may be a significant undertaking for companies. While the analysis is not subject to the full requirements of an internal model, there are similarities. For example, companies may need to consider the make-up of their portfolio, and the completeness, accuracy or appropriateness of any backing data. As noted above, EIOPA have proposed that pension scheme risk be included in the market risk element of the SCR, which should reduce the number of companies for whom the Standard Formula is inappropriate. However, it is unclear whether any further adjustments will be required for longevity risk for pension schemes. A further area of uncertainty is the approach to volatility risk for with-profits companies.Standard Formula calibration: real life test for the Swiss Franc

It is unclear to us to what extent companies are expected to dig into the calibration of Standard Formula risks. For example, the Swiss Franc increased materially against the Euro on 15 January 2015. At one point, the Swiss Franc had increased by around 30%. This may imply that a 25% 1-year shock for currency risk, as currently specified in the Draft Delegated Acts, does not fully reflect a 1-in-200 shock.Conclusion

This is a key period in the run-up to Solvency II implementation. EIOPA’s recent publication of the Guidelines and Technical Standards is a key milestone to the expected implementation on 1 January 2016. Together with the EIOPA publications earlier in 2014, much of the final framework has now been drafted. However, the scene is not static, and further changes are expected before 2018, such as the treatment of long-term infrastructure. In our view one of the significant upcoming exercises for Standard Formula companies will be the Standard Formula review. The review could potentially be quite an onerous exercise, and the extent of the investigation required remains to be seen. — The authors are consulting actuaries at Milliman. Views expressed are the authors’ own. Further Solvency II and thought leadership articles from Milliman consultant are available here. ]]>

]]>

On the VA calibration, the 47{fe5cadadbb54208ab3a9fe6506ec07abb84961fe5f7860e6b90ac4d8e68f73da} fixed interest just seems too low, even with annuities excluded. It’s been suggested to me this was due to inclusion of unit-linked liabilities – the unit values not just the sterling reserve – in the assets taken into account. Any thoughts on this? And might EIOPA change it (of course under Solv II there isn’t such a distinction between unit liability and sterling reserve).?