On 14 October 2025 the Gibraltar-based insurer Premier Insurance Company Limited has stopped trading and was declared in default by the Financial Services Compensation Scheme (FSCS).

The FSCS notes that as a result of the defaut: “The insurer is no longer paying claims in full and FSCS is stepping in to protect the firm’s eligible UK policyholders.” Over 16,000 are expected to be affected by the default.

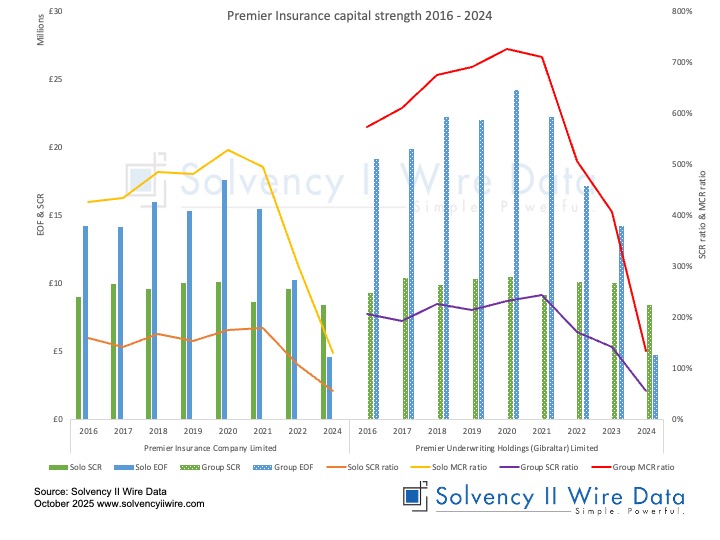

Premier Insurance Company Limited reported a Solvency II ratio of 54% in 2024, breaching its regulatory capital requirement.

In the preceding years the company was relatively well capitalised with ratios ranging between 107% to 179%.

The group holding company Premier Underwriting Holdings (Gibraltar) Limited, has been similarly well capitalised over the period.

According to the 2024 SFCR of Premier Insurance Company Limited: “Ongoing inflation in the motor market and other market challenges have resulted in an adverse actuarial review as at 31st December 2024 compared to management expectations and resulted in a further drop in available capital and a breach of the required solvency coverage at 31 December 2024.

Within no further capital available, the Company is now in run-off effective 31 December 2024. The Company and the Group have therefore not met their capital requirement throughout the period.”

However, since 2020 the ratio of both entities has been in gradual decline. A steady decline in the Eligible Own Funds to meet the SCR (EOF) has been the main driver of the decline in the ratio. The solvency ratio breach in 2024 was driven by an almost halving of the EOF of both entities.

Analysis by Solvency II Wire Data has identified a further 7 UK and Gibraltar based insurers, whose EOF has more than halved in 2024; 3 life companies and 4 non-life companies.

The extent to which a breach in the solvency ratio can signal default is discussed in detail in the artice Surviving a breach in the SCR ratio. See also further details of solvency ratio breaches in 2024.