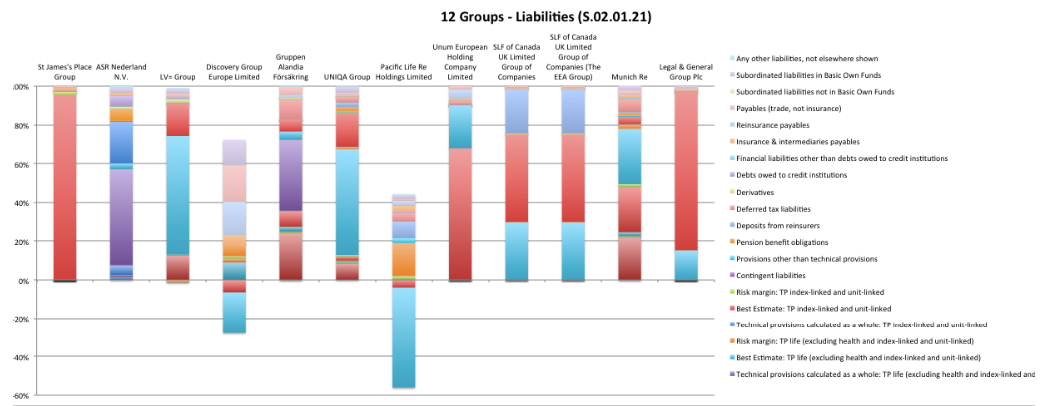

The second chart shows the breakdown of liabilities for the same sample and shows a prevalence of Best estimate Technical Provisions of index-linked and unit-linked liabilities.

The second chart shows the breakdown of liabilities for the same sample and shows a prevalence of Best estimate Technical Provisions of index-linked and unit-linked liabilities.

20+ group SFCRs and QRTs are available to premium subscribers. A further 40+ are being processed and expected to be available later this week. The full data set is available on the premium Solvency II Wire Data service. A subset of the data is also available to free subscribers to the service (register here).]]>