Deutsche Bank & IIF reports, EIOPA equivalence consultation & Low yield test.

Solvency II unlikely to contribute to significant asset reallocation

Solvency II and Basel III are unlikely to cause large asset reallocation in the bond market, according to a report published by Deutsche Bank this week. The report recognised the different funding incentives of the two regulations and concluded that possible unintended consequences on banks’ funding of the joint implementation of Basel III and Solvency II will likely be mitigated. The author of the report, Meta Zähres, Economist, Banking, Financial Markets, Regulation at Deutsche Bank said, “Taking a closer look at the investor base of bank bonds and the incentive structure of insurers’ investment decisions, it becomes clear that reallocations in insurers’ capital positions are possible and likely.” “However,” she added, “the loosening of a whole investor base cannot be expected. ‘Winners’ could be covered bonds as they get preferential treatment under Solvency II as well as under Basel III. Very long term corporate or bank bonds and subordinated debt may however get unattractive under Solvency II. That said, insurers have not been the main investors in these asset classes anyway.” An English version of the report, Solvency II und Basel III: Wechselwirkung beachten, is due to be published in late September.EIOPA equivalence consultation

On 17 August EIOPA launched a consultation on the equivalence of the Bermudan, Japanese and Swiss supervisory systems. All three countries were found to meet the equivalence criteria ‘with caveats‘. The consultation is open until 23 September 2011. Once the feedback is analysed EIOPA will pass its advice to the European Commission where the decision on equivalence will be made. The equivalence assessment aims to ensure the countries and their supervisory regimes “provide a similar level of policyholder/beneficiary protection as the one provided under the Solvency II Directive,” according to EIOPA. In June 2010 the European Commission asked EIOPA (then CEIOPS) to provide advice on the equivalence of the three jurisdictions. The consultation is part of the ‘first wave’ of third country assessment. According to EIOPA’s Medium-term Work Plan, published earlier this year, the second and third waves are expected in 2011-2012 and 2013-2015 respectively. The consultation is open until Friday, 23 September, 2011 at 18.00 HRS CEST. Consultation documents are available on the EIOPA website.Low yield environment test

On 19 August EIOPA launched a ‘Low Yield Environment Test’ to examine the impact of a prolonged low interest environment on insurers. The main focus of the test will be on insurers that are exposed to interest sensitive products, in particular, products with minimum guarantees or embedded policyholder options. A spokesperson for EIOPA added, “This scenario – an instantaneous shock of a downward movement of the yield curve or pronounced flattening with persistence of such a situation – could lead to material reinvestment problems and influence the ability of participating groups and undertakings to finance, for example, performance guarantees given for specific pools of insurance contracts. This, in turn, could negatively impact the capital position of insurers who are exposed to these risks.” EIOPA intends to publish the results of the test at the end of the year as part of its Autumn Financial Stability Report. Details of the test, which runs through to 16 October 2011, can be found on the Insurance Stress Test page of the EIOPA website.Report calls for more coordination between Solvency II and Basel III

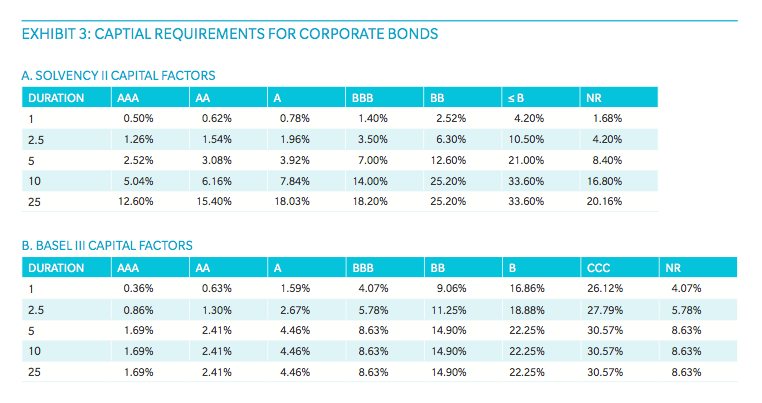

[caption id="attachment_3128" align="alignright" width="164"] Capital requirements for corporate bonds SOURCE IIF[/caption]

More cross-sectoral coordination is needed in developing regulatory reforms, according to a report by the Institute of International Finance (IIF). The Implications of Financial Regulatory Reform for the Insurance Industry, warned that lack of coordination of regulations such as Solvency II and Basel III could weaken financial stability and undermine the ability of banks and insurers to promote economic activity and recovery.

The report, published on 17 August, follows studies on the effects of regulation by the BIS and IMF.

[caption id="attachment_3121" align="alignright" width="165"]

Capital requirements for corporate bonds SOURCE IIF[/caption]

More cross-sectoral coordination is needed in developing regulatory reforms, according to a report by the Institute of International Finance (IIF). The Implications of Financial Regulatory Reform for the Insurance Industry, warned that lack of coordination of regulations such as Solvency II and Basel III could weaken financial stability and undermine the ability of banks and insurers to promote economic activity and recovery.

The report, published on 17 August, follows studies on the effects of regulation by the BIS and IMF.

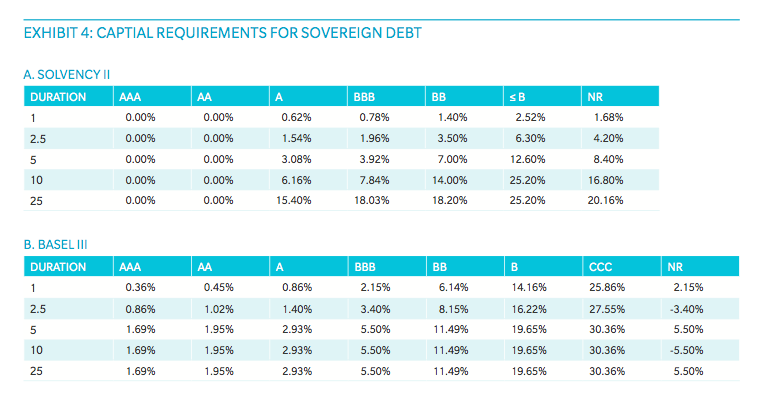

[caption id="attachment_3121" align="alignright" width="165"] Capital requirements for sovereign debt SOURCE: IIF[/caption]

Walter Kielholz, Chairman of IIF’s Insurance Working Group and a member of the IIF Board of Directors and Board Chairman of the Swiss Re Ltd. said, “At a time of important regulatory change, policy makers need to understand how the insurance and banking sectors will interact under the new regulatory regimes. The long-term investment function of insurers in the real economy needs to be preserved through appropriate regulatory incentives.”

The report also provides two handy charts showing the different treatment of corporate and government bonds under Solvency II and Basel III.

Capital requirements for sovereign debt SOURCE: IIF[/caption]

Walter Kielholz, Chairman of IIF’s Insurance Working Group and a member of the IIF Board of Directors and Board Chairman of the Swiss Re Ltd. said, “At a time of important regulatory change, policy makers need to understand how the insurance and banking sectors will interact under the new regulatory regimes. The long-term investment function of insurers in the real economy needs to be preserved through appropriate regulatory incentives.”

The report also provides two handy charts showing the different treatment of corporate and government bonds under Solvency II and Basel III.