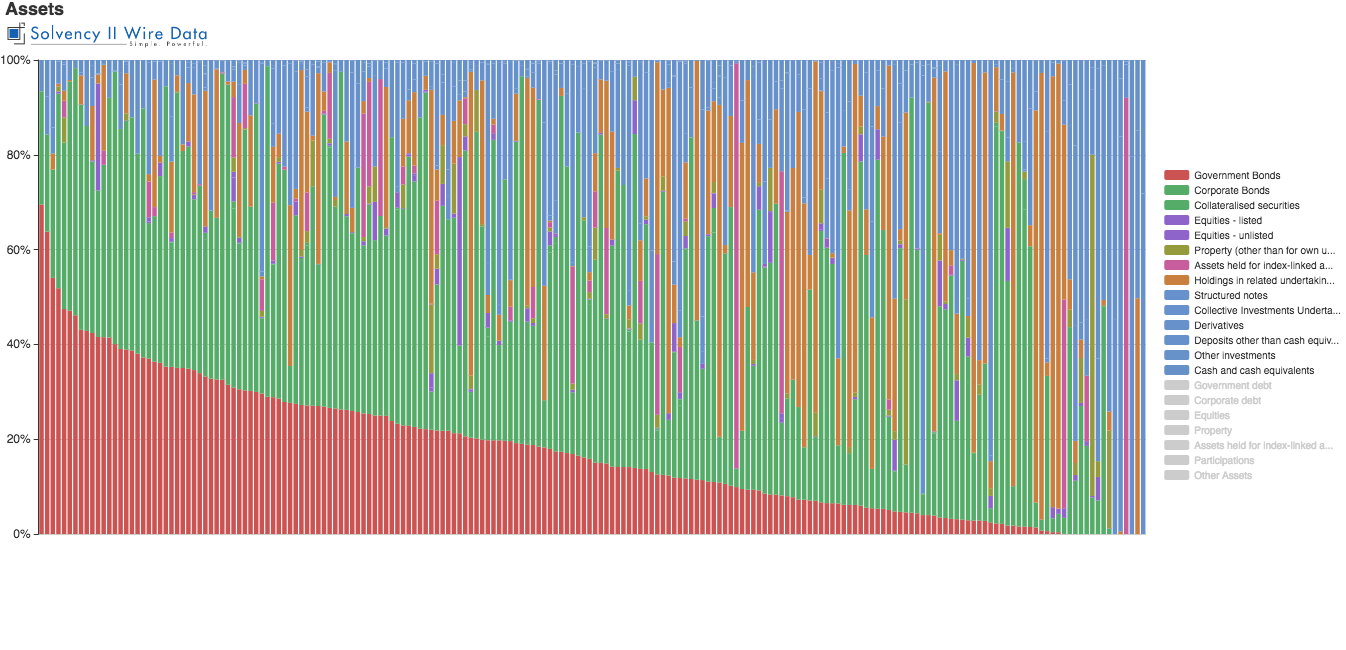

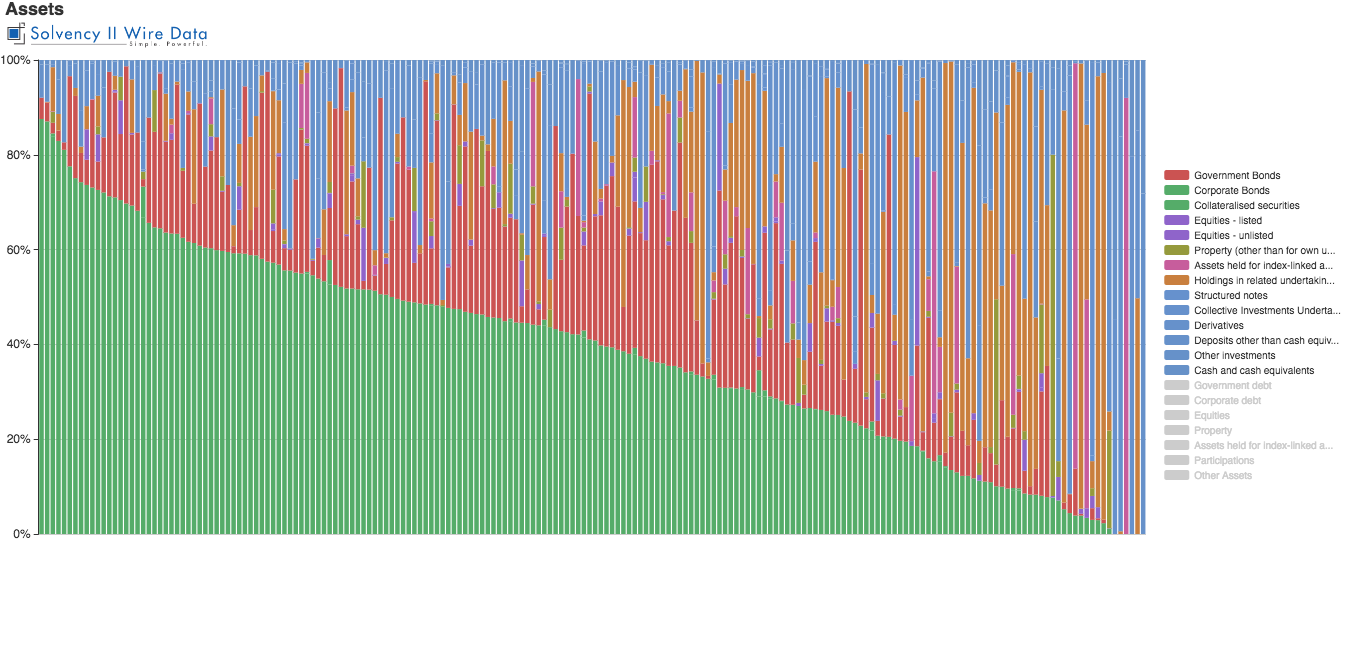

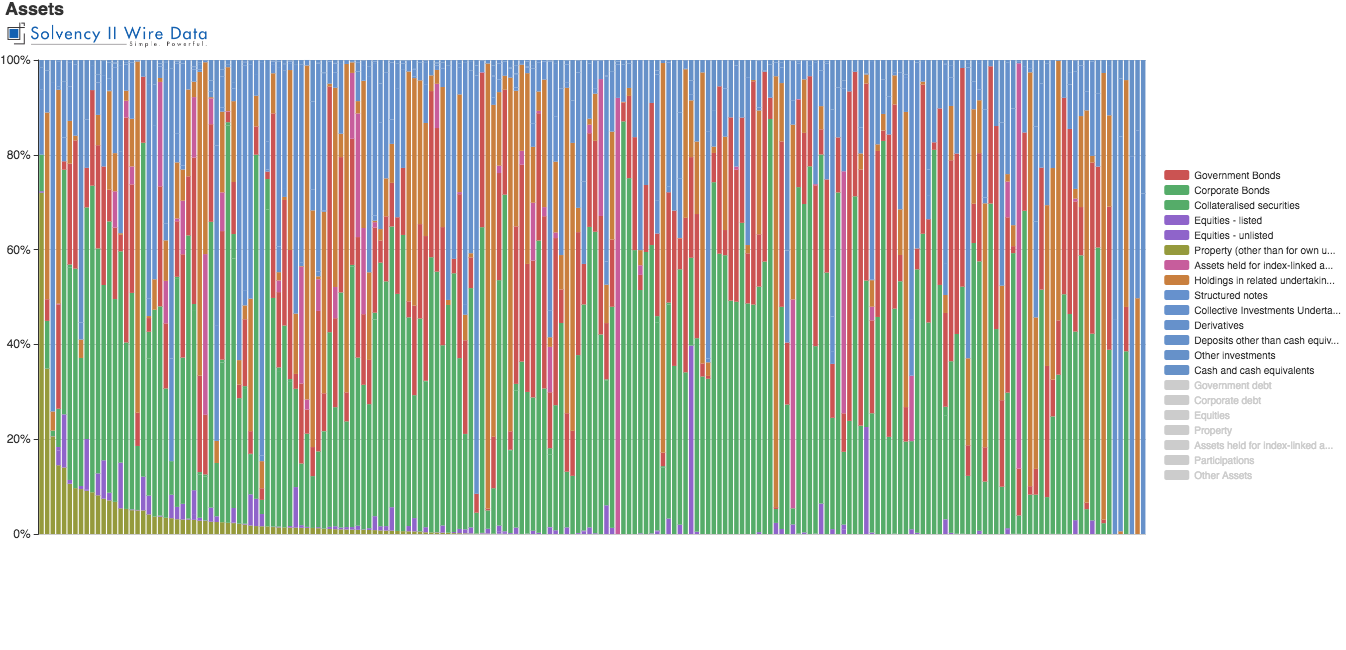

A review of the asset allocation of close to 200 life and non-life German insurers (about two thirds of firms subject to Solvency II) based on the Balance Sheet template (S.02.01.02) of the Solvency II public disclosures reveals insights into the volume of property investment and holdings in related undertakings.

A series of Solvency II Wire Data “mega charts” help to illustrate this. As expected, the balance sheet is dominated by exposure to government and corporate bonds (see charts below).

Yet, once these are stripped away, insights into the remaining asset classes can be observed.

Sorting the data by exposure to property, for example, gives an indication of just how small a portion of the overall portfolio it occupies. This may prove useful given the ongoing drive across Europe to get insurers to invest both in the real economy and infrastructure projects.